How to get a property deduction for an individual entrepreneur. When buying an apartment, can an individual entrepreneur (IP) receive a property tax deduction and how to apply for it according to the law? Conditions for receiving an individual entrepreneur deduction

BLITZ!

An individual entrepreneur can receive a tax deduction after purchasing real estate!

But this requires the use of OSNO, or the payment of personal income tax on income from work combined with entrepreneurial activity. If the individual entrepreneur is on a simplified basis, unified agricultural tax, patent or UTII, filing a tax refund is trivial out of nowhere.

Now more details.

From the moment of registration with the state, individual entrepreneurs automatically become subjects of taxation, that is, they have an obligation to pay taxes. The amount and types of taxes vary between different tax schemes, although the total tax collections are in any case quite large. It is precisely in order to reduce the tax burden that the Tax Code of the Russian Federation has developed such a concept as “tax deduction”. In essence, a tax deduction is the right and opportunity for a taxpayer to reimburse part of the taxes paid through some other payments or to be completely exempt from paying them.

Individual entrepreneur real estate and tax deduction

With regard to real estate, entrepreneurs can apply the deduction when purchasing not only apartments, but also country houses and land plots. The legislation also provides for the opportunity to receive a deduction for the construction of country cottages, but only if all costs for paying workers, purchasing materials, etc. can be documented, therefore all receipts, sales and cash receipts, contracts must be collected and stored. When purchasing newly built housing (primary market), the tax deduction can be extended to funds spent on repairs and decoration of the purchased apartment.

Conditions for tax deduction refund: general rules

When developing and explaining the concept of “tax deduction,” legislators identified several basic rules for obtaining it. In particular, the following conditions must be met:

- The largest amount by law for using a tax deduction is 2 million rubles. If an apartment or some other piece of real estate costs more, then everything above 2 million rubles. will not be taken into account;

- The personal income tax is 13%, so it is easy to calculate that the maximum tax deduction (that is, from 2 million rubles) will be equal to 260 thousand rubles. It is worth noting that the amount of the tax deduction can be returned at any time period - in this case there are no restrictions;

- Since the beginning of 2014, a rule has been in force according to which it is possible to receive a tax deduction not from just one apartment, but from several apartments or any other real estate at once. The main thing is to comply with the requirement that their price does not exceed 2 million rubles.

- You can include in the deductible the cost of repairs and finishing of a new apartment if the purchase and sale agreement states that the housing is purchased without finishing;

- if real estate is purchased from close relatives (parents, brothers or sisters, own children), the right to a tax deduction for its acquisition is lost, since in this case the partners in the transaction are recognized as interdependent individuals (clause 1 of Article 105.1 of the Tax Code of the Russian Federation);

- If the property was purchased with a mortgage, then a tax deduction is also made from the interest paid on the mortgage loan. Moreover, in this case, taking into account interest, a deduction can be made from an amount of 3 million rubles. This norm was developed as a measure of additional support for the development of the Russian mortgage market.

The above rules apply not only to individual entrepreneurs, but equally to all other citizens of the Russian Federation.

Story: Until 2014, a tax deduction could only be applied to one piece of real estate; now this restriction has been removed. The main thing is that the total cost of the acquired real estate should not exceed 2 million rubles.

Thus, it is obvious that the tax deduction is an excellent help to support those citizens who are employees and receive a “white” salary. In this sense, it is somewhat more difficult for individual entrepreneurs: they cannot always return taxes paid to the state.

Who is entitled to a tax deduction?

As already mentioned, not all individual entrepreneurs can apply for a tax deduction after purchasing real estate. In order to receive it, individual entrepreneurs must meet a number of parameters.

- An individual entrepreneur must apply the general taxation regime, since only it implies the payment of personal income tax, which means that the entrepreneur is obliged to keep strict records of tax reporting and accounting, maintain a Book of Income and Expenses, pay VAT and perform all other procedures required by OSNO. Special tax regimes, as well as the Patent system, do not provide the opportunity to make a tax deduction from the purchase of real estate, since businessmen subject to these types of taxation are exempt from paying personal income tax. But there are also exceptions here: they apply to those individual entrepreneurs who, in addition to income under a special tax system, have income subject to personal income tax at a rate of 13% (for example, if a businessman combines tax regimes with OSNO).

- An individual entrepreneur must have a profit with which he can pay personal income tax at a 13% rate. In this case, an exception is made for income received as part of dividends and participation in the share of a legal entity.

- Individual entrepreneurs paying personal income tax are required to submit a declaration in form 3-NDFL to tax specialists at their place of residence by April 30 (inclusive) of the year following the reporting year. It must indicate information about the accrued tax and the amount of deduction that the individual entrepreneur expects. If a businessman also has income for which he must provide the tax authorities with a 2-NDFL certificate, then in order to receive a deduction he must transfer this to the tax service (most often this applies to entrepreneurs who rent out property as individuals and individual entrepreneurs who additionally work under employment contracts).

- An individual entrepreneur must have on hand a complete list of documents proving the fact of purchasing housing (certificate, agreement, deed, etc.).

- And finally, the last condition that must be fulfilled in order to receive a tax deduction: the purchased apartment or other real estate must be registered either in the name of the individual entrepreneur himself, or in the name of one of his children, or in the name of his spouse.

Thus, only if all of the above conditions are met, an individual entrepreneur receives the right to a tax deduction.

Attention! Individual entrepreneurs have the opportunity to receive the desired deduction even if they plan to use the purchased apartment for commercial purposes. That is, for the purposes of tax deduction, the reason for purchasing the property does not matter.

FYI. If an individual entrepreneur is married and his other half has income from which personal income tax is paid in the amount of 13%, then when purchasing real estate, the husband or wife of the individual entrepreneur can receive a full tax deduction. The reason for this is that according to the law of the Russian Federation, spouses have common property, as well as equal rights and obligations.

When can you ask for a deduction on real estate?

An individual entrepreneur has just purchased an apartment. Can he immediately prepare documents for the tax office to provide a deduction? No, he needs to wait until next year. Having received the documents on property rights, you can ask for a tax deduction only in the coming reporting year.

What if the purchased apartment is sold again?

A situation may arise when an individual entrepreneur purchases real estate, submits documents for a tax deduction, and then sells the apartment. It's not illegal. Moreover, even if this action was taken before the deduction amount was exhausted, it is legal. Everything that its owner does with real estate after purchase no longer concerns tax payments. The deduction will be provided until the amount is completely exhausted.

Based on the information above, we can summarize that an individual entrepreneur, in principle, can receive a tax deduction. However, for this it is necessary that it meet certain parameters, the main one of which is the businessman’s payment of personal income tax (13%). To do this, you can use two options: either apply the general taxation system in your activities, or find a part-time job that will generate additional income subject to personal income tax.

Can a sole proprietor return the 13 percent income tax? This is possible in the following cases:

- at the time of purchasing housing for cash (Article 220 of the Tax Code of the Russian Federation);

- when purchasing housing under a targeted loan agreement (Article 220 of the Tax Code of the Russian Federation).

Important! When registering a property deduction under a targeted loan agreement, an individual entrepreneur can return the interest on the mortgage.

Conditions for this

In order to exercise his right to receive a preferential refund, the taxpayer must comply with a number of conditions:

If all of the above conditions are met, the entrepreneur is guaranteed to receive the opportunity to obtain a property deduction. We talked in more detail about what a tax deduction is when buying and selling an apartment.

In the event that it is impossible to obtain compensation for the purchase of an apartment, the entrepreneur has the right to arrange payment through his spouse subject to her official employment and the further possibility of providing the tax authority with a certificate of income in form 2-NDFL. This will confirm the existence of income on which income tax is paid in the amount of 13%. You can find out about the possibility of receiving a tax deduction for non-working citizens or pensioners.

When is the 13% refund not possible?

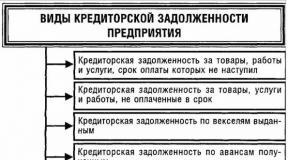

Reference. Not all entrepreneurs can receive compensation, and this directly depends on the form of taxation chosen for doing business.

Thus, individual entrepreneurs who use:

- simplified tax system(simplified taxation system);

- UTII(single tax on imputed income);

- patent business(when a patent is acquired for a certain type of business);

- ESNH(special taxation system for agricultural producers).

The listed tax systems reduce the payment burden for an entrepreneur in the course of his activities, but at the same time deprive him of the opportunity to receive a property deduction.

How to make an income tax refund?

Required documents

At the end of the year An individual entrepreneur applying for compensation must prepare a standard package of documents.

The collected package of documents must be accompanied by an application for income tax refund, tips for filling out and a sample of which you will find in.

Where and when to submit?

The listed package of documents, together with the 3-NDFL declaration, must be submitted to the tax authority at the place of registration of the individual entrepreneur. You can start applying for benefits at any time, even immediately after purchasing the property.

The transfer of the requested payment (if the municipal body makes a positive decision) will be made only at the end of the tax period). To obtain a deduction, information for the three previous years is taken into account.

Sum

As for individuals, the procedure and amounts for personal income tax refunds for individual entrepreneurs are identical. So, when registering ownership of an apartment, the maximum amount for payment is 2 million rubles regardless of the actual purchase price. In this case, the maximum amount of property deduction will be 260 thousand rubles.

In the case of mortgage lending to individual entrepreneurs, the amount of preferential calculation will be increased to 3 million rubles.

Important! Since 2014, property deductions have been possible for several pieces of property, up to the exhaustion of the return limit.

Self-calculation

As stated earlier, a refund of the property deduction is possible within 13% of the cost of the purchased housing.

With mortgage lending, the buyer can count on a refund of the following amounts:

With mortgage lending, the buyer can count on a refund of the following amounts:

- 2 million rubles (cost of purchasing living space);

- 3 million rubles (the amount of mortgage interest paid).

The first option for calculations can be applied to several properties, until the final selection of the amount of the deduction is reached (that is, until the property return reaches the maximum possible level of 260,000 rubles). If, when purchasing an apartment, the deduction amount is less than the maximum possible, the right to the benefit is retained for subsequent purchases.

For example: the apartment was purchased for 1,560,000 rubles. The calculation of the property deduction that the owner can claim is carried out as follows:

1,560,000*13% = 202,800 rubles.

He can request payment of the missing amount of compensation in the amount of 57,200 (260,000 – 202,800) rubles upon the next purchase of real estate.

An example of a calculation when purchasing an apartment with a mortgage:

2,000,000*13% + 3,000,000=13% = 260 thousand + 390 thousand = 650 thousand rubles.

Payment terms

In accordance with paragraph 6 of Article 78 of the tax legislation, the amount of the claimed deduction must be returned to the applicant within 30 days from the moment of registration of the application for deduction. But at the same time, Article 88 somewhat contradicts it, indicating the return of the property deduction only after the end of the desk audit (which, as is known, lasts at least 3 months).

In addition, it is not indicated anywhere whether we are talking about full months, because the taxpayer can submit an application in the last days. At the same time, Federal Tax Service employees allow the possibility of returning the deduction within 30 days. It turns out that the expected period for returning the property deduction is at least 4 months.

The following reasons for delayed payments may arise:

- lack of some documents;

- detection of facts of inconsistency prohibiting the owner from receiving a property deduction;

- errors, human factor.

Reference. If the requested refund is not received within the maximum possible period, it is necessary to contact the head of the tax authority with a written complaint (drawn up in duplicate, with marks of acceptance by the tax authority). allows in such cases to go to court.

Conclusions

The main requirement for the return of a property deduction is the presence of income, thanks to which taxes are paid to the budget. At its core, a property deduction is a means of returning previously paid taxes. Consequently, in the absence of payment to the budget, receiving a property deduction will be denied.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Dear reader, if you are interested in the tax deduction in 2019. for individual entrepreneurs or not, then this material is for you. We will consider whether the benefit is provided in principle, whether there are any special conditions for appointment, and whether the process of its implementation differs from the standard.

The article will be useful to those who want to realize all possible benefits. Some compensation is due for rent, medical services and other social expenses. And it can also be assigned to an individual entrepreneur in certain situations. Let's figure out which ones exactly.

Can an individual entrepreneur receive a deduction in 2019?

A tax refund for an apartment, among other things, is provided under certain conditions. The main one is the applicant’s payment of income tax to the budget. It is from these funds that subsequent reimbursement occurs. A citizen pays personal income tax taxes on his income, and the state returns them to him in specified cases.

Consequently, individual entrepreneurs can count on a refund, but subject to working according to the general tax base. Simplified legislation does not make it possible to cover this type of relief, since there are no corresponding contributions to the budget. This means there will be no return help.

Letter of the Ministry of Finance No. 03-11-11/21776 of the Russian Federation, as amended on April 16, 2015, stipulates the right of an entrepreneur to use real estate purchased with deductions in business activities.

Example: Dolmatov S.P., a leading business under the general system, bought in 2017 for 1,900,000 rubles and paid a fee of 43,750 rubles. The amount is within the limit, which means he can receive compensation in the amount of 247,000 rubles. At the beginning of 2019, the applicant filed a declaration, declaring the right to a refund.

The amount of compensation is within the framework of the personal income tax tariff paid earlier, therefore, in 2019, citizen Dolmatov was assigned 43,750 rubles. And the repayable balance as of 2020 will be 203,250. How much he will be paid from this amount will directly depend on the level of income and mandatory payments paid to the budget.

Note! Taxes paid by a person under the general tax system cover 13% of personal income tax, which is the basis for assigning him a deduction for certain expenses.

simplified tax system, unified agricultural tax and UTII and the right to benefits

Special taxation systems, including the simplified tax system, unified agricultural tax and UTII exempt a businessman from paying personal income tax. What does Article 346 of the Tax Code say? At the same time, Article 21 clearly states that only payers of the 13% income rate are remunerated with the deduction.

Based on the above, we can summarize that participants of the simplified tax system, unified agricultural tax and UTII in the standard position cannot take advantage of the benefit. But in any rule, there is an exception. It exists in our case too.

Exceptions to the rules

The basis for exceptional cases is the fact of payment of income tax. Consequently, a property tax deduction for a mortgage, when purchasing real estate with one’s own funds, for an individual entrepreneur may occur in the following situations:

- Activities under labor and civil contracts.

- Profit from renting out real estate.

- Pension from non-state funds.

- Lottery winnings.

- Income from the sale of inheritance, donated and purchased property that was owned for less than 5 years.

Each of the above-described options for generating income requires the businessman to pay mandatory payments. To do this, a declaration must be filed and the fee must be paid within the allowed time frame.

Attention! The tax must be paid at the end of the reporting period. The year is ending, in the new period you need to submit a report by April 30 and make payments by June 15.

Example situation: Gorikova O.V. In 2018, she worked under the UTII scheme. During the same period, she purchased an apartment worth 822,000 rubles. Consequently, I could get 106,860 rubles back from them. For this purpose, she contacted the tax service in January 2019. She was denied compensation.

The situation changes for her in 2019, since in 2019 there were contributions to the budget. Gorikova O.V. Officially, according to the contract, I rented out a new apartment and received a profit of 20,000 monthly. For 12 months, the amount of income amounted to 240,000 rubles, of which 31,200 rubles went to the budget as personal income tax. Consequently, Gorikova O.V. it becomes possible to receive a refund in the amount of 31,200 rubles.

Benefits for self-employed citizens

For self-employed persons in order to make a profit, the Tax Code determines a complete exemption from paying personal income tax. This means that persons working under the patent system are also exempt from deductions. But when purchasing real estate in joint ownership, there is a chance to correct the situation.

Art. 346 in terms of paragraph 43 exempts persons submitting PSN as reporting from income payments.

For example, a businessman buys a house. In case of a legal marriage, all types of real estate acquired by him are distributed between him and his wife in proportion to the existing shares in the family, standard 50 to 50%. If his wife is officially employed and receives other official income subject to personal income tax, then she can claim a refund.

How can an individual entrepreneur apply for a deduction?

A businessman who fulfills the conditions shown for receiving a deduction is guaranteed the right to assign such a relief. But it is not detected automatically. The person must state his claim. This can be done at the end of the reporting period (year).

To receive reimbursement for expenses in 2019, you must submit a 3-NDFL format declaration before April 30, 2020. In addition to the report, an application is submitted with the bank details of the account to which the funds are expected to be credited. Other documents will also be required, a list of which will be discussed below. For now, let's denote the order:

- Submitting a declaration and package of documents.

- Processing an application to the Federal Tax Service.

- Work on documents, correcting inaccuracies and providing additional papers (if required).

- Making a decision.

Note! Any result of an application processed for deduction is sent to the applicant in writing. If there is a refusal, it requires legislative justification.

Required papers:

- Z-NDFL form;

- return application (free form, taking into account the required information);

- apartment contract + certificate of owner (if secondary housing);

- DD acceptance certificate (if the apartment is from a new building);

- payment papers.

If the return is on a mortgage, then you will additionally need:

- loan agreement;

- payment schedule;

- statement of the balance of the debt;

- certificate of the amount of interest paid.

In case of joint ownership, they will also require:

- application for determination of shares;

- marriage certificate;

- children's testimonies.

If the refund for expenses aimed at construction:

- receipts, acceptance certificates (for purchased goods);

- copies of contracts (if work or services were paid for).

Along with the copies, you must submit the originals to the inspector for verification. Without certification, they will accept copies that have a notary visa. If the entrepreneur acts not personally, but through a representative, a power of attorney will be required.

Deduction for online purchases

A reduction in the tax base with the purchase of an online cash register is guaranteed to all entrepreneurs on UTII and PSN. The condition applies to its timely registration with the Federal Tax Service and amounts to up to 18,000 rubles in compensation for each device.

Federal Law No. 349, as amended on November 27, 2017, guarantees entrepreneurs on UTII and PSN the opportunity to partially compensate for the cost of an online cash register.

The tax deduction takes into account:

- CCP costs;

- cost of fiscal storage;

- cost of setting up and upgrading the device.

The relaxation is valid under the following conditions:

- The device must be entered into the register of the Federal Tax Service;

- The cash register is registered.

Note! You can receive up to 18,000 refunds for each cash register.

It is better to register it immediately after purchasing a cash register. Until the data is entered into the register, the basis for a return does not apply. If UTII and PSN are combined, then compensation can be paid according to one of the modes. If it is not possible to repay the entire amount during the year, the balance is carried over to the next period.

Individual entrepreneurs, under the PSN, UTII system, who work in the retail business, provide catering services and have hired staff, will be able to count on reimbursement provided they are registered before July 1, 2019. All other participants have until July 1, 2020.

Questions and answers

Question: In 2018, the Federal Tax Service informed me that individual entrepreneurs cannot claim a deduction when purchasing real estate. Then I was on the simplified tax system and became the owner of the apartment. From the beginning of 2019, it switched to a general taxation system. In this case, I acquire the right, but do the deadlines allow me to apply for a refund?

Answer: The statute of limitations for property type deductions is 3 years. In 2020, you can safely submit a declaration and count on a refund in the amount of personal income tax you paid for 2019.

Question: I am an individual entrepreneur, working under the simplified tax system. I regularly pay personal income tax for my hired employees. Do I have grounds for a deduction?

Answer: You are not, but your employees are. You make transfers not for yourself, but for hired workers. You yourself, working under the simplified tax system, receive an exemption from paying the corresponding tax, and therefore a deductible refund.

Individual entrepreneurs may not always receive a tax deduction when purchasing an apartment.

There are nuances in this issue related to the individual entrepreneur taxation model. Let's consider the situations in which a business owner is entitled and the nuances associated with receiving it.

Legislative regulation of the issue

The tax system in Russia has been regulated Tax Code of the Russian Federation: part one - Federal Law No. 146 of 07/31/98, part two - Federal Law No. 117 of 08/05/00.

The provision of property deductions reflects the provisions articles 217-220 of the second part document, as well as instructions and explanations from the Federal Tax Service.

Business status

An individual entrepreneur is a citizen officially registered in this status to conduct commercial activities without forming a legal entity.

The Civil Code of the Russian Federation does not consider individual entrepreneurs subjects of ownership real estate. Therefore, apartments purchased by this category are registered in the ownership of individuals without taking into account their status as individual entrepreneurs. This circumstance gives rise to questions about the possibility of providing individual entrepreneurs with a tax deduction for the purchase of apartments.

The answer lies in the essence of the benefit. In its meaning, a property deduction is nothing more than refund of part of what was paid to the treasury of income tax () by its payers, and these are citizens. Since an individual entrepreneur combines the legal characteristics of an individual, he can claim a tax refund in this capacity if a number of conditions are met.

Objects, from which an individual entrepreneur can receive a deduction:

Objects, from which an individual entrepreneur can receive a deduction:

- apartments in multi-apartment buildings;

- private housing construction projects put into operation;

- unfinished construction projects;

- land plots;

- construction of a country house after providing documentary evidence of expenses;

- expenses for repairs of purchased real estate - since 2017, such costs must be reflected in the purchase, sale or agreement of sale.

Returns possible with one-time payment apartments, upon registration, as well as within the framework of shared participation in construction. The entrepreneur also claims a deduction for credit interest.

Terms and conditions of provision

After registration, an individual entrepreneur acquires a gloomy addition to brilliant professional prospects: the obligation to pay a number of taxes. You have to study the Tax Code and the orders of the Federal Tax Service in order to choose the appropriate taxation system. The types of taxes, their amounts, and possible benefits depend on this circumstance.

When a refund is not allowed

Many businessmen prefer special schemes:

Needless to say, working under “simplified” or “imputation” reduces the payment burden and makes accounting easier. But, at the same time, it deprives the entrepreneur of property tax benefits.

Using the example popular schemes, we’ll explain why.

When to use simplified tax system , as tax base one of the options is:

- total income of the enterprise with a tax rate of 6%;

- “net” income, when business expenses are subtracted from the amount of income - the rate in this case will be from 5 to 15%.

In any case, the subject pays 13% personal income tax in relation to hired personnel, but the businessman does not make income payments to the budget for himself.

UTII possible with certain types of activities. In these cases, the tax rate is determined by a formula using a coefficient depending on the type of business. An entrepreneur makes mandatory contributions for his employees (to the Pension Fund of the Russian Federation, the Social Insurance Fund, the Federal Migration Service), however, the businessman is also exempt from his own income tax.

Since there is no income subject to income tax in both options, there is no property refund from the purchase of an apartment. For the same reason, other special regimes will not allow you to take advantage of the deduction.

Requirements

Some entrepreneurs without a legal entity have the opportunity to receive a deduction for the purchased apartment.

These faces meet the following requirements law:

Additional condition

Let's assume that the individual entrepreneur did not transfer personal income tax during the tax period. But he is in a registered marriage, and the “other half” regularly pays 13%. There will be a deduction in this option as well, but calculations are carried out based on the payer’s base.

Does the further purpose of the apartment matter? Since 2015 – no. According to the April clarification of the Ministry of Finance numbered 03-11-11/21776, a deduction for a purchased apartment is provided to individual entrepreneurs even in cases where this object is used in the main activity of the applicant for the benefit.

Registration procedure

The entrepreneur applies to the Federal Tax Service department at the location of the real estate, in the area where the purchase/sale transaction is registered, or at the place of temporary residence.

Provided:

When can I start applying for benefits? Yes, even immediately after buying an apartment. But, in case of a positive decision, the transfer is made at the end of the tax period. In 2018, the deduction is received for the three previous periods.

Refund limit

Financial personal income tax return framework identical to the conditions for individuals:

- when purchasing an apartment, the estimated maximum will be 2 million rubles. from the cost of housing with a maximum return of 260,000 rubles;

- if there is an interest return on the mortgage, the amount of preferential calculation is increased to 3 million.

Since 2014, preference has been granted to several real estate properties until the maximum is exhausted.

The rules for obtaining a refund of previously paid personal income tax when purchasing real estate are described in the following video:

Any citizen who has his own business and has the status of an individual entrepreneur is obliged to pay a set percentage of the total amount of his profit - tax - to the state treasury. Its size directly depends on the adopted tax collection system. There is a legally established procedure that allows an individual entrepreneur to legally receive back part of the money that he transferred to the state as tax. In order to implement it correctly, individual entrepreneurs should become familiar with a number of aspects and nuances of this process.

Any citizen who has his own business and has the status of an individual entrepreneur is obliged to pay a set percentage of the total amount of his profit - tax - to the state treasury. Its size directly depends on the adopted tax collection system. There is a legally established procedure that allows an individual entrepreneur to legally receive back part of the money that he transferred to the state as tax. In order to implement it correctly, individual entrepreneurs should become familiar with a number of aspects and nuances of this process.

The concept of tax deduction for individual entrepreneurs in the legislative framework of the Russian Federation

According to current legislation, the opportunity to carry out the process of returning money in the form of a tax deduction is provided only to those individuals who are recognized as residents of the Russian Federation. The main condition is the availability of employment with an officially concluded contract and a document certifying that the person regularly contributes to the treasury an amount equal to 13% of his labor income.

Not only a citizen of the Russian Federation can be considered a resident of the Russian Federation. This may also be a person who is not such, but has a residence permit in the Russian Federation and has been in the country for more than six months. At the same time, citizens of the Russian Federation who are on the territory of another state and have issued documents for a residence permit there are not considered residents.

A tax deduction will help individual entrepreneurs save some of their money. In fact, this is the main legal way to reduce the amount of tax required to be paid. However, it only relates to , which is levied on the individual’s total earnings. Therefore, individual entrepreneurs do not have the right to save money in the form of a tax deduction, since they do not pay personal income tax.

What types of tax deductions can an individual entrepreneur claim?

There are officially 5 types of tax deductions, each of which has its own conditions for application and method of calculation:

- standard;

- social;

- property;

- professional;

- investment.

The standard type involves deductions for special categories of citizens who have certain benefits, including for children. To confirm the availability of benefits, you must contact the territorial tax office and obtain the appropriate certificate there.

The Tax Code of the Russian Federation (Article 218) specifies certain amounts that, depending on the status of a person, an individual entrepreneur can claim for each month of the tax period in order to reduce the tax burden:

- 500 rubles – provided for citizens awarded the title of Hero of the USSR and the Russian Federation, as well as those nominated to receive the highest state awards, etc.;

- 1,400 rubles - for the birth of the first and second children, even if they have different fathers;

- 3,000 rubles - for parents (or guardians) of large families with three or more children, participants in the Second World War, participants in the Chechen War and children of deceased servicemen, as well as liquidators of the Chernobyl explosion;

- 6000-12000 rubles - to persons responsible for students in educational institutions and disabled children under the age of 24 years.

The social type includes those amounts that a person donated to the budget of charitable organizations, however, they should not exceed the level of 25% of his total income. Payment under the contract for personal training or training of your children is also taken into account. Organizations in which a resident studies must have an official license, but the amount of the deduction cannot exceed the level established in the Tax Code. To receive a deduction, a person must contact the territorial tax office at the place of registration and fulfill a number of conditions:

- pay personal income tax;

- provide a copy of a document confirming receipt of education on a paid basis;

- attach a receipt for payment of the amount indicating personal information.

The amount of reimbursed funds spent on commercial education cannot exceed the amount of 120,000 rubles. Based on calculations, if a student is officially registered as an entrepreneur, he can profitably save about 15,600 rubles over 10 months of the academic year.

It is also possible to get back part of the money spent both on your own treatment and on medical services provided to your family members. They mean:

To carry out such an operation, you should also contact the tax service.

Property deduction implies the return of funds spent on any purchase and sale transactions (land, house, apartment, shares in companies or societies), including through a mortgage loan.

Thus, the main types of tax deductions allow individual entrepreneurs to make transactions more profitably and return a certain part of the money spent on them. On the part of the state, granting the right to a tax deduction is a response step to an entrepreneur who pays taxes (personal income tax and VAT) to the treasury on time and in full.

The state can grant an individual entrepreneur the right to take advantage of a property tax deduction more than once, but within a limit of 2 million rubles, provided that the owner bought the property and spent, say, only 1 million rubles. At the same time, he officially has the right to dispose of the other part of the funds when carrying out a transaction with other property (letter of the Federal Tax Service of Russia dated September 18, 2013 No. BS-4-11/16779@, letter of the Ministry of Finance of Russia dated September 13, 2013 No. 03-04-07/ 37870).

To obtain consent to apply a property tax deduction, an individual entrepreneur must fill out form 3-NDFL and also provide a number of the following documents:

- declaration 2-NDFL;

- original document of purchase and sale of real estate;

- a receipt indicating timely payment under the concluded agreement;

- registration extract from the relevant registration authority;

- written application for deduction.

Professional deductions include those that constitute documented expenses under certain contracts. Individual entrepreneurs are entitled to them, as well as to the previous ones, if they regularly pay 13% of their total earnings. To properly process the deduction, you must provide documents that confirm the transparency of your accounting. These could be:

- receipts;

- checks;

- acts on completed transactions;

- invoices;

- invoices, etc.

In the case of documented income received, an individual entrepreneur can receive a deduction in the full amount of expenses associated with this income.

An individual entrepreneur can take advantage of a deduction of 20% of his entire earned income if he is unable to provide papers with the specified expenses. , such a rule does not apply to those individuals who are not officially registered in the register of individual entrepreneurs, but carry out their own business activities.

When investing long-term, selling assets (securities), or transferring funds to a personal account, an investment tax deduction system is used, which also has its own restrictions established by the articles of the Tax Code of the Russian Federation. In order to qualify for such a reduction in the tax base, an individual entrepreneur must perform one of the following operations:

- complete a real estate purchase transaction;

- rebuild the house, taking into account funds allocated for the purchase of building materials;

- transfer a plot of land to the state for its subsequent exploitation;

- carry out a loan transaction at the bank.

Tax legislation provides for an amount of 3,000,000 rubles, which is the maximum for tax reduction. Similar to the property deduction, the state can grant an individual entrepreneur the right to take advantage of the tax deduction several times.

Features of tax deductions for individual entrepreneurs

In relation to an individual registered as an individual entrepreneur, there is a list of nuances according to which he will not be able to return the funds spent.

This happens if the individual entrepreneur’s business belongs to a preferential category, which a priori implies a tax reduction.

However, he can still get his money back if:

- its activities do not require tax contributions or fall under a special, more simplified scheme of contributions to the treasury;

- There is legal confirmation that the individual entrepreneur regularly pays personal income tax at a rate of 13%.

Tax deduction for individual entrepreneurs on UTII

Despite the above idea that an individual entrepreneur on UTII cannot receive a deduction in general cases, there is an exception to this rule. An individual entrepreneur can receive a tax deduction if he receives additional funds from which personal income tax is withheld.

An individual entrepreneur who wishes to keep records under the UTII scheme must submit a corresponding petition to the territorial tax office at his place of residence.

An application in the UTII-2 form is submitted within the first five days from the moment the individual entrepreneur began to carry out its activities.

The main documents also provided by the citizen to the tax service are as follows:

- passport;

- originals of acts of registration of individual entrepreneurs certified by a notary in the territorial body of the unified registration center.

If an individual entrepreneur has already completed the registration procedure with a given tax office for another matter, he must still register when switching to UTII.

There is a penalty according to which an individual entrepreneur who has not sent his documents to the tax service within the established period may be brought to administrative responsibility and punished by paying a fine in the amount of 10% of the amount of earnings for a given period. Such a fine must be at least 40,000 rubles.

Conditions for obtaining a property tax deduction for individual entrepreneurs

Tax legislation separately identifies the main conditions under which an individual entrepreneur has the right to claim a property deduction:

There is an additional way for an entrepreneur to receive a full tax deduction when purchasing housing. To do this, you must submit documents to the Tax Service confirming that the husband/wife of the individual entrepreneur pays personal income tax in the amount of 13% of his salary. The largest deduction amount is 2,000,000 rubles. That is, an individual entrepreneur can save 260,000 rubles.

If the transaction was completed after 2014, he can go through this procedure an unlimited number of times, but within the limit of 260,000 rubles.

The procedure for registration and necessary documents to obtain a tax deduction for individual entrepreneurs

Obtaining a tax deduction is possible on the basis of the documents that the individual entrepreneur submitted for consideration. The package of papers required by tax officials must include the following documents:

- passport;

- declaration 2-NDFL;

- receipts indicating the timeliness and completeness of payment of funds under the concluded transaction;

- act of extract from the Unified State Register of Individual Entrepreneurs;

- originals of acts of registration of individual entrepreneurs certified by a notary in the territorial body of the unified registration center (SRC);

- original document of the property purchase and sale transaction;

- expense declaration;

- indication of the individual bank account to which the received deduction will be transferred;

- certificate 3-NDFL.

Main mistakes when receiving a tax deduction

Often, citizens make several key mistakes that lead to them not being allowed to receive a tax deduction. Among them:

- papers confirming the origin of income have not been provided;

- the expenses were paid by another person (and not by the taxpayer personally);

- payments for the provision of medical or other services were transferred to institutions that do not have an official state license.