Write-off of losses from previous years. The procedure for writing off losses of previous years (nuances) Loss of previous years

One of the tax innovations for 2017 is the introduction of restrictions on the recognition of losses generated in previous tax periods. As a kind of compensation for the “inconveniences,” the legislator simultaneously abolished the 10-year limit on the transfer of losses to the future. That is, now losses can be written off until they are completely exhausted, which was not possible under the previous procedure. However, in reality everything turned out to be not so simple.

Back in 2016, organizations had every right to completely reset their income tax base using losses from previous years. Since the beginning of 2017, the legislator has seriously limited taxpayers in this regard. Law No. 401-FZ of November 30, 2017 introduced a limit on the write-off of past losses - old losses can reduce the income tax base of the current period by no more than 50 percent (clause 2.1 of Article 283 of the Tax Code). It must be said that it was initially planned to set the limit at 30 percent of the tax base of the current period. However, apparently, the legislators recognized that this would be too much.

Obviously, the introduction of restrictions on writing off past losses increases the tax burden on enterprises. Moreover, the problem can even be widespread. After all, given the economic situation in the country, in past years many companies operated in the red. And now, when they are just getting back on their feet, if they wrote off losses in the same way, the budget again would not “see” anything.

To some extent, this, of course, contradicts the moratorium on increasing the tax burden introduced in the Russian Federation. Apparently in order to smooth out such unfavorable consequences, Law N 401-FZ abolished the current 10-year limit on the transfer of losses.

Important Details

When applying the new procedure, the following important points must be taken into account:

1) the restriction on the recognition of past losses is temporary - it is valid from 2017 to 2020. That is, from 2021 it will again be possible to recognize accumulated losses in full;

2) a restriction has also been introduced on the amount of recognized losses received by the CTG participants. It will also amount to 50% of the consolidated tax base of the consolidated group of taxpayers of the current reporting (tax) period. At the same time, it is necessary to make changes to the accounting policy for the purposes of taxation of consolidated groups of taxpayers and provide for the procedure for calculating and recalculating the amount of transferred losses that arose when calculating the consolidated tax base, taking into account the 50% limit that is applied by the responsible participant of the consolidated group of taxpayers (clause 6 of Article 283 of the Tax Code as amended . Law N 401-FZ);

3) the abolition of the 10-year limit on the transfer of losses applies only to those that arose in 2007 and later (subclause 16 of Article 13 of Law No. 401-FZ);

4) the rule has been retained according to which losses are recognized, as they say, one by one. That is, if a company has incurred losses in more than one tax period, such losses are carried forward to the future in the order in which they were incurred;

5) as before, documents confirming the amount of the loss incurred must be kept for the entire period of transfer of the loss plus another four years after the end of the year in which the loss was completely written off.

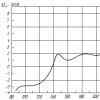

On the numbers

Let's see how the new rules work in practice.

Example. At the end of 2015, Romashka LLC received a loss of 500,000 rubles. At the same time, 2016 also brought a loss in the amount of 300,000 rubles.

In turn, 2017 turned out to be profitable for the company. The cumulative total profit was:

- for the first quarter of 2017 - 350,000 rubles;

- for the first half of 2017 - 500,000 rubles;

- for 9 months of 2017 - 700,000 rubles;

- for 2017 - 800,000 rubles.

When determining the income tax base in 2017, Romashka LLC has the right to take into account:

- for the first quarter of 2017 - part of the loss for 2015 in the amount of RUB 175,000. (RUB 350,000: 2);

- for the first half of 2017 - half of the loss for 2015 - 250,000 rubles. (RUB 500,000: 2);

- for 9 months of 2017 - part of the loss for 2015 in the amount of RUB 350,000. (RUB 700,000: 2);

- for 2017 - part of the loss for 2015 in the amount of 400,000 rubles. (RUB 800,000: 2).

The old fashioned way

For comparison, we present the calculation of the amount of loss carried forward to the future according to the old rules under the same circumstances (financial results).

When determining the income tax base in 2017, Romashka LLC, according to the old rules, could take into account:

- for the first quarter of 2017 - part of the loss for 2015 in the amount of RUB 350,000;

- for the first half of 2017 - a complete loss for 2015 in the amount of RUB 500,000;

- for 9 months of 2017 - full loss for 2015 in the amount of 500,000 rubles. and part of the loss for 2016 in the amount of RUB 200,000;

- for 2017 - complete loss for 2015 and 2016 in the amount of 800,000 rubles.

Thus, according to the old rules, Romashka LLC had the opportunity to fully take into account the losses received for 2015 and 2016. Moreover, in the example under consideration, the company would not have to pay advance payments for income tax in 2017 and tax for this year, since the income tax base was completely zeroed out.

According to the new rules, Romashka LLC will take into account only half of the losses for 2015 and 2016. At the same time, the company retains the obligation to pay advance payments for income tax and tax for 2017, since the income tax base is no longer zero. Romashka LLC will take into account the remainder of the “past” losses in the following periods without any time limit.

Losses under the simplified tax system

In conclusion, we note that the “simplified” ones with the object of taxation “income minus expenses” also have the opportunity to take into account “past” losses. At the same time, what is interesting is that in 2017 such losses are recognized under the old procedure under the simplified tax system. The legislator did not make any changes to paragraph 7 of Article 346.18 of the Code. This means that the amount of the transferred loss to the simplified tax system, as before, is not limited and can be written off only within 10 years following the tax period in which this loss was received.

The fall of 2016 ended with the signing of a large-scale package of documents amending tax legislation. Let us note the most significant changes in tax legislation that are strategically important for business.

Corporate income tax

Tax accounting reserves are formed voluntarily. Not only as a safety net, but also to legally reduce income tax liabilities (by increasing the cost of contributions to reserves).The most popular provision is the provision for doubtful debts. It allows you to protect the company from late payments for delivered goods (work, services). Any reserve, and the reserve for doubtful debts is no exception, requires equal accounting of certain costs in expenses. If accounts receivable are not repaid on time and there are doubts that payments will be received at all, the taxpayer has the right to minimize his risks through the created “nest egg” - a reserve.

During a crisis, the tendency to increase accounts receivable and payable is obvious. Often, counterparties, in collusion, artificially “inflate” mutual debt. Then the tax authorities draw conclusions about the presence of an unjustified tax benefit. However, for a long time the question remained controversial whether to include in the reserve the amount of receivables or the difference between receivables and payables in the presence of counter-obligations. The controllers insisted on the difference, the courts did not have a clear position, but often took the side of the taxpayer.

From 2017, doubtful debt in the presence of counter-obligations will be recognized as “debt to the taxpayer in the part that exceeds the specified payables of the taxpayer to this counterparty (paragraph 1, clause 1, article 266 of the Tax Code of the Russian Federation). If there are no counter obligations, then the reserve is formed as before (except for the right to choose a limit).

It is clear that the amendment is aimed at increasing tax revenues to the budget. However, the Code says “before this counterparty.” The concept of “counterparty” is not disclosed in the Code. It can be assumed that the parent organization is one counterparty, and the subsidiary or branch is another counterparty. If so, then in general the methodology for creating a reserve for doubtful debts has not changed, and the interest of organizations in expanding the pool of counterparties is obvious.

Before the introduction of the amendment to paragraph 1 of Article 266 of the Tax Code of the Russian Federation, the courts did not have compelling reasons to resolve the dispute not in favor of the taxpayer (that is, recognizing only the difference in the presence of counter-obligations). After January 1, 2017, it is enough for an organization to acquire an extensive network of counterparties to reduce the risks of claims regarding unjustified tax benefits.

Carry forward of losses

The risk of receiving a loss at the end of the tax period during a crisis increases sharply. The consequences for the budget are obvious - not all organizations take part in replenishing the piggy bank without paying income tax. The reason is simple - the transfer of losses from previous years made it possible to reduce the tax base of the current period, sometimes to zero. Unprofitable commissions no longer scare taxpayers. Many have learned to defend their losses. Legislators found a way out of the situation from the experience of going through past crises.The approach is simple: everyone must pay taxes, including unprofitable companies. But shouldn’t we directly introduce a “tax on losses”, as was the case in the first stages of the formation of the tax system of the Russian Federation? Everything is simpler: clause 2.1 was added to Article 283 of the Tax Code of the Russian Federation. What's the point? According to current legislation, losses from previous years can be carried forward to subsequent tax periods, but not more than for 10 years. Since 2017 it has been removed temporarily O There is no restriction on the timing of the transfer, but a restriction is introduced on reducing the tax base - no more than 50%.

We quote: “In the reporting (tax) periods from January 1, 2017 to December 31, 2020, the tax base for the tax for the current reporting (tax) period, ... cannot be reduced by the amount of losses received in previous tax periods by more than 50 percent".

In fact, the norm will come into force in 2018, but you can try to increase the base quarterly and begin to carry forward losses over the reporting periods of 2017. True, the risk of recalculation based on year-end results cannot be ruled out. Something else is more important. If you do not have time to take into account losses for 2006 and 2007 in reducing the tax base for 2016 (this is the last, tenth year for carrying forward losses), then from 2018 to 2021 the probability of paying income tax if there are losses is very high.

What to expect after 2020? It is far from certain that a new series of amendments to the Tax Code of the Russian Federation will appear. Thus, legislators did not lift restrictions for unprofitable companies, but, on the contrary, introduced an even stricter standard. Do not miss an important point: for the entire period of transfer of losses and the period when these losses were received, you need to keep all tax accounting documents for income tax.

Explanations on VAT returns

The rules for providing explanations to tax authorities during desk audits have changed. Amendments to Article 88 of the Tax Code of the Russian Federation have completely confused taxpayers, which can lead to unreasonable fines, and then it’s not far from blocking the account.Let's start with fines. You have received a request to explain the contradictions between the information in the submitted documents. Or about the discrepancy between the information provided by you and the data of the tax authority. If you fail to provide explanations in a timely manner, you may pay a fine under Art. 129.1 of the Tax Code of the Russian Federation, namely:

- 5,000 rub. for the first violation;

- 20,000 rub. for each subsequent violation.

If an organization has VAT benefits, then from June 2, 2016, tax authorities have the right to demand explanations (and not documents on benefits, as was the case before this date) for preferential transactions (clause 6 of Article 88 of the Tax Code of the Russian Federation).

The concept of “benefit” is not in Chapter 21 “VAT” of the Tax Code of the Russian Federation. Or rather, there is no separate article that would stipulate which transactions are preferential and which are exempt from taxation. The general definition of benefits is presented in Art. 56 Tax Code of the Russian Federation. And in relation to VAT, an explanation of benefits is available in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 (clause 14).

Thus, the Supreme Arbitration Court of the Russian Federation mentions benefits for canteens of educational and medical organizations (subclause 5, clause 2, article 149 of the Tax Code of the Russian Federation), religious organizations (subclause 1, clause 3, article 149 of the Tax Code of the Russian Federation), public organizations of disabled people (subclause 2, clause 3, Article 149 of the Tax Code of the Russian Federation), in relation to bar associations, law bureaus and chambers of lawyers (subclause 14, paragraph 3, Article 149 of the Tax Code of the Russian Federation). The judges considered it unacceptable to demand documents (explanations - as amended by the Tax Code of the Russian Federation from June 2, 2016) on transactions that are not taxed or exempt from taxation under Article 149 of the Tax Code of the Russian Federation. Tax exemption is not provided in order to give advantages to a certain category of payers over others performing the same transactions, but represents special rules for taxation of relevant transactions. If so, then the tax office has no right to demand an explanation, even if the company reflects such an operation in section 7 of the declaration.

From January 1, 2017, companies that report under the TKS provide explanations in electronic form, in the form and format approved by the Federal Tax Service of Russia (at the time of publication the format was not approved). This rule is contained in the new paragraph 4 of paragraph 3 of Art. 88 Tax Code of the Russian Federation. Explanations are provided in the cases listed in the closed list in Article 88 of the Tax Code of the Russian Federation (clause 3):

- errors were identified in the tax return (calculation) and (or) contradictions between the information in the submitted documents;

- discrepancies were identified between the information provided by the taxpayer and the information available to the tax authority;

- in the updated declaration, the amount of tax payable to the budget is reduced in comparison with the previously submitted tax return (calculation);

- the amount of loss received in the corresponding reporting (tax) period is declared.

A person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount. If the person who violated the right received income as a result, the person whose right was violated has the right to demand compensation, along with other damages, for lost profits in an amount not less than such income.

Losses caused to a citizen or legal entity as a result of illegal

Actions (inaction) of state bodies, local government bodies or officials of these bodies, including the issuance of an act of a state body or local government body that does not comply with the law or other legal act, are subject to compensation by the Russian Federation, the relevant subject of the Russian Federation or a municipal entity.

The debtor is obliged to compensate the creditor for losses caused by non-fulfillment or improper fulfillment of the obligation. Unless otherwise provided by law, other legal acts or contract, when determining damages, the prices that existed in the place where the obligation was to be fulfilled on the day the debtor voluntarily satisfied the creditor’s claim are taken into account, and if the demand was not voluntarily satisfied - on day of filing the claim. Based on the circumstances, the court may satisfy the claim for damages, taking into account the prices existing on the day of the decision.

When determining lost profits, the measures taken by the creditor to obtain it and the preparations made for this purpose are taken into account.

If a penalty is established for non-fulfillment or improper fulfillment of an obligation, then the losses are compensated in the part not covered by the penalty.

The debtor is obliged to compensate the creditor for losses caused by non-fulfillment or improper fulfillment of the obligation. Unless otherwise provided by law or contract, a person who fails to fulfill or improperly fulfills an obligation when carrying out business activities is liable unless he proves that proper fulfillment was impossible due to force majeure, that is, extraordinary and unavoidable circumstances under the given conditions.

Such circumstances do not include violation of obligations on the part of the debtor's counterparties, the lack of goods on the market necessary for execution, or the debtor's lack of necessary funds.

The norms of civil legislation define the institution of force majeure by establishing criteria and characteristics, without directly indicating exactly what circumstances it covers.

The creditor's fault

If the failure to fulfill or improper fulfillment of an obligation was due to the fault of both parties, the court accordingly reduces the amount of liability of the debtor. The court also has the right to reduce the amount of liability of the debtor if the creditor intentionally or negligently contributed to an increase in the amount of losses caused by non-performance or improper performance, or did not take reasonable measures to reduce them.

Carry forward of losses in 2017

Before 2017, enterprises could carry forward losses for 10 years following the tax period in which these losses were incurred. On January 1, 2017, amendments were made to Article 283 and to paragraph 22 of Article 280 of the Tax Code of the Russian Federation introduced by Federal Law No. 401-FZ of November 30, 2016.The 10-year limitation on carrying forward losses from previous years has now been removed. From 2017, the amount of loss can be carried forward to all subsequent years, and not to 10 years. Now losses can be written off until full repayment for as long as possible. This innovation can be applied to losses incurred for tax periods starting from January 1, 2007. The changes are provided for by Federal Law No. 401-FZ of November 30, 2016.

The remaining rules for carrying forward losses in 2017 remained the same. As before, losses can be carried forward in 2017 not only at the end of the tax period, but also at the end of each reporting period for income tax. Although this should be done by those who operate with sustainable profits. Indeed, in the case when during the year the company operated with a profit and reduced advance payments due to losses of previous years, but ended the financial year with a loss, the written-off amounts will have to be restored.

The requirement to store documents confirming the formation of losses has not changed. They must be preserved as long as the loss will participate in the formation of the tax base for the tax. Plus another four years. So the shelf life of this “primary” will need to be monitored more carefully.

Profit tax due to losses from previous years cannot be completely zeroed out

But, in exchange for the removal of one restriction, another appeared.

During the reporting and tax periods from January 1, 2017 to December 31, 2020, the base cannot be reduced by the amount of losses from previous periods by more than 50% (clause 2.1 of Article 283 of the Tax Code of the Russian Federation). The changes apply to losses incurred for tax periods beginning on January 1, 2007. The changes are provided for by Federal Law No. 401-FZ of November 30, 2016 and included in Article 283 of the Tax Code.

This change does not affect the basis to which certain special income tax rates apply. For example, rates for organizations participating in regional investment projects. The limit does not apply to residents of the technology-innovation special economic zone, participants in regional investment projects and some other categories of “beneficiaries”.

A similar rule was introduced for the carry forward of losses in 2017 from transactions with non-traded securities and non-traded derivative financial instruments. From January 2017, the base from such operations in the current period can be reduced by losses from previous years, but not by more than 50%.

New procedure for accounting for losses by a consolidated group of taxpayers

On January 1, 2017, the changes made to paragraph 1 of Article 278.1 and paragraph 5 of Article 321.2 of the Tax Code of the Russian Federation came into force (Federal Law dated November 30, 2016 No. 401-FZ).

According to the previously applicable rules, each of the participants in the consolidated group did not determine its own taxable base for profits. Instead, companies transmitted information to the responsible participant, and he, in turn, considered the base for the group as a whole. The consolidated basis was the arithmetic sum of the income of all participants minus the arithmetic sum of the expenses of all participants. A negative value between income and expenses was recognized as a group loss. They could be taken into account when determining the consolidated base of the next period.

Since January 2017, the procedure for determining the base and accounting for losses has changed. Now the base for each private owner of the consolidated group is determined separately according to the rules established for “ordinary” taxpayers. The bases are then added up to form a consolidated base. The losses received by each of the group members are also summed up. The amount of losses can be taken into account when forming a consolidated base in an amount not exceeding 50% of the consolidated tax base of the current reporting (tax) period.

If the losses of any of the group members remain unaccounted for when determining the consolidated basis, such a participant can take them into account in the “normal” manner, that is, as if he was not part of the group, but acted independently.

In the event that in the reporting (tax) period losses were incurred simultaneously by all members of the group, the consolidated base is taken equal to zero.

Profit and loss report 2017

The modern form used for reporting for 2017 (Clause 1, Article 14 of the Federal Law “On Accounting” No. 402-FZ) is called a statement of financial results. Although there are changes to the text of Order No. 66n of the Ministry of Finance of Russia, which approved this form (Order of the Ministry of Finance of Russia No. 57n).This renaming, in fact, became the only (not counting a number of manipulations with the word “for reference” in the 2nd table of the report) change in the content of the profit and loss statement form since its approval by Order No. 66n. At the same time, the signature of the chief accountant disappeared from the signatures under it.

A similar form that was previously in force was introduced by order of the Ministry of Finance of Russia No. 67n. It was also called the income statement. Form 2 was included in the list of accounting forms. Since the essence of the report has changed little when the form is re-approved, it often continues to be called the profit and loss statement (or Form 2 for short). We will also use these names.

The overall total figures in the income statement for a certain period show how and from what the financial result of the organization was formed. These figures are compared with the same period of at least 1 previous year. Thus, the profit and loss statement makes it possible to analyze indicators not only at the reporting date, but also over time.

Annual reporting is mandatory and intended for submission to regulatory authorities (IFTS, State Statistics Committee). Its integral part is Form 2, which, together with the balance sheet, is filled out by all legal entities without exception.

However, a profit and loss statement is very often required for interim reporting dates (that is, it must be compiled taking into account data based on the results of the closing of the next month of the year).

You may need it:

Economic Service;

managers;

founders;

banks;

investors;

counterparties.

The structure of the profit and loss statement for 2017 corresponds to the previous one. It still highlights the following to be filled out:

The header part of the report, which indicates the period for which it was compiled, the date of compilation, all the main statistical codes (with their text interpretation) and the TIN of the legal entity are given, as well as the order of the unit of measurement in which the figures are entered into the report;

the main table containing the calculation of the financial result itself;

lookup table;

manager's signature and date of signing.

In the form of the profit and loss statement given in Order No. 66n, the main table consists of 4 columns:

Explanations that are filled out if there are deviations from the lines proposed by the form or if there are numbers in the report that require more detailed disclosure;

unified names of indicators (rows of the table in which the financial result of the work for the period specified in the title is calculated sequentially from the amount of revenue received before taking into account IT and ONA that affect income tax);

digital values for each line corresponding to the reporting period;

digital values for each line corresponding to the same period of the previous year.

Reporting lines submitted to Goskomstat must be encoded. The codes required for this are given in Appendix 4 to Order No. 66n. In order not to adjust the reporting submitted to different authorities, it is more convenient to initially prepare it in a form containing the “Code” column between the 2nd and 3rd columns of the form recommended by the Ministry of Finance. Moreover, during current work with reports, it is often preferable to indicate the line numbers of the form rather than their names.

The 2nd table in the income statement contains background information divided into 2 parts:

On income that increases the profit received by directly attributing it to capital (for example, amounts of additional valuation of fixed assets and intangible assets falling directly into additional capital) indicating the amount of the final profit of the period adjusted for these incomes;

about profit (loss) per 1 share (this data is needed for JSC).

The profit and loss report is filled out according to the following rules:

Cumulatively throughout the year, changing the calculation data and the overall financial result monthly. For official reporting, the reporting period will be one year. For the legal entity’s own purposes, it can be done in any way.

According to accounting data, comparing the figures calculated from the report with similar turnovers or results for the corresponding accounting accounts.

Amounts that have a negative (or opposite to the original, such as for SHE or IT) sign are shown in parentheses.

Columns along the lines of missing indicators are crossed out.

When filling out a profit and loss statement, information is entered using turnover data from accounting accounts:

90 (for core activities) and 91 (for other income and expenses). VAT and excise taxes are excluded from revenue. The result obtained from the profit and loss statement in terms of the amount of profit (loss) before tax must coincide with the similar result of account 99.

09 and 77 (according to ONA and ONO) for legal entities using PBU 18/02. The values of income tax and net profit generated using them in the report should give, respectively, the amount of tax received according to the declaration and the amount of the final profit (loss) that arose in accounting.

83 (for income not included in net profit) when entering data into the reference table.

How to write a report using a simplified form

SMEs can prepare an income statement using a simplified form. This is directly stated in Order No. 66n, and Appendix 5 to it contains this form. There is no reference table in it, and the main one is built in the same way as in the full form of the report, but the rows are combined (enlarged). It is also convenient to enter an additional “Code” column into it. The peculiarity of specifying the code in the lines of the combined indicators will be the choice for them of the code for which the data predominates in the line.

Losses from previous years since 2017

On January 1, 2017, the new Federal Law of November 30, 2016 No. 401-FZ came into force, which regulates the rules for transferring losses to the future, changed from the new year.The new law determines that it is now possible to carry forward losses from previous years in accounting only in an amount not exceeding 50% of the tax base of the current tax period. Also, the new law has removed the ten-year restrictive period for transferring losses that existed previously. It is worth noting that a 50% limit on the amount of loss carryover has been determined by legislators for the period until the end of 2020.

In accounting, to reflect transactions for the transfer of losses to the future, one should be guided by the provisions and norms prescribed in PBU 18/02 “Accounting for calculations of corporate income tax.” Accounting for losses should be indicated by a debit to account 68 and a credit to account 09.

Rules for storing documentation confirming losses from previous years

Accountants have quite a lot of questions about what and how exactly the company should store documents that will confirm the losses incurred. It should be noted that losses from previous years are grounds for reducing the tax base of the current reporting period by the amount of previously received losses, in accordance with the provisions of clause 4 of Art. 283 of the Tax Code of the Russian Federation, which means that documents about them must be kept. In tax legislation, however, there is no specificity about what exactly these documents should be. But the tax authorities themselves argue that, at a minimum, this should be the primary tax for the tax period in which the loss was incurred.

Thus, primary documentation for losses from previous years should include invoices, reconciliation acts, invoices, statements, cash and sales receipts, and others. It is important to note that these are not tax registers or accounting cards, but primary records, where there is written confirmation of the amount of loss. On this issue, the Ministry of Finance of the Russian Federation also agrees with the tax authorities, which is confirmed, for example, by letter of the Ministry of Finance of Russia No. 03-03-06/1/278.

Thus, until a loss is written off to reduce the tax base until it is completely written off, documentation about it should be kept permanently.

In addition, paragraph 1 of Article 23 of the Tax Code of the Russian Federation determines the storage period for tax and accounting documents, which is 4 years. During this period, the taxpayer is obliged to ensure the safety of documentation that can confirm the calculation and payment of taxes, as well as the company’s income and expenses.

It turns out that even after repayment of losses from previous periods, documents about this fact must be kept for another four years. This nuance is spelled out in the letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/278, and is also defined in paragraphs. 8 clause 1 art. 23, paragraph 4, art. 283 Tax Code of the Russian Federation.

Write-off of losses in 2017

Write-off of losses from previous years is carried out based on the decision of the founders or shareholders and is regulated by the norms of accounting and tax legislation. Let's consider a step-by-step algorithm of actions for correctly writing off losses incurred in the past.Any company is created for the purpose of making a profit. But in current market conditions, some of them make losses at the end of the year. Loss is the minus difference between the income and expenses of an enterprise for a certain period.

Most often, such losses are covered by profits not distributed among participants (shareholders) or by reserve and additional funds. But if losses exceed income, then the negative balance can be transferred to later periods, but not more than 10 years (clause 2 of Article 283 of the Tax Code of the Russian Federation).

You can write off the entire amount at once, or in parts during the current or any of the next 9 years. If, based on the results of several periods, negative results are obtained, then they must be transferred to the future in chronological order based on the fact of formation.

Losses must be confirmed by primary documentation (letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/206). Such papers must be kept during the entire period of repayment of losses incurred (clause 4 of Article 283 of the Tax Code of the Russian Federation).

If the primary document was lost, but the amount of losses was confirmed by a tax audit report, then it is unlikely to be transferred to the future (letter of the Ministry of Finance No. 03-03-06/1/278). Please note that court decisions on this issue are mixed.

If a taxpayer suffered losses using the simplified tax system or unified agricultural tax, and then switched to OSNO, then he does not have the right to take into account losses under the new regime (letter of the Ministry of Finance of Russia No. 03-03-06/1/617).

If a negative result is obtained in the reporting period, then the basis for calculating profit is equal to 0 (clause 8 of Article 274 of the Tax Code of the Russian Federation). Accordingly, there is no tax.

If a company applies the simplified tax system of 15%, then upon receiving a loss it must calculate and pay the minimum tax, which is 1% of the income received. Moreover, these expenses can be taken into account in the next 10 years (clause 6 of Article 346.18 of the Tax Code of the Russian Federation).

All income and expenses received in the current period are accumulated in account 99. At the end of the year, it is closed in account 84 (82, 83). And if the profit in the current period is not enough to cover losses, then the balance of account 99 is transferred to account 97.

Example:

At the end of 2015, Alpha LLC received losses in the amount of RUB 373,580. The founders decided to cover losses using additional and reserve capital. As of 01/01/2017, their amount is 140,330 rubles. and 175,830 rub. respectively. And the difference is 57,420 rubles. (373,580 – 140,330 – 175,830) decided to write off against the profits of the following years.

Postings:

31.12.2015

Dt 84 Kt 99 - 316,160 rub. - part of the losses is written off to the current result.

Dt 97 Kt 99 - 57,420 rub. - negative financial results are attributed to future expenses.

01.01.2016

Dt 83 Kt 84 - 175,830 rub. - part of the losses was repaid from additional capital.

Dt 82 Kt 84 - 140,330 rub. - compensation for losses from the reserve fund.

At the end of 2016, a profit of RUB 27,775 was received.

31.12.2016

Dt 99 Kt 84 - 27,775 rub. - profit at the end of the year.

01.01.2017

Dt 84 Kt 97 - 27,775 rub. - last year's loss is repaid in the current period.

Losses resulting from business activities from previous periods are written off against current or subsequent profits. In tax accounting, such losses are reflected in the income tax return. At the same time, losses incurred by the company are checked by tax authorities with particular passion.

Accounting for losses in 2017

One of the tax innovations for 2017 is the introduction of restrictions on the recognition of losses generated in previous tax periods. As a kind of compensation for the “inconveniences,” the legislator simultaneously abolished the 10-year limit on the transfer of losses to the future. That is, now losses can be written off until they are completely exhausted, which was not possible under the previous procedure. However, in reality everything turned out to be not so simple.Back in 2016, organizations had every right to completely reset their income tax base using losses from previous years. Since the beginning of 2017, the legislator has seriously limited taxpayers in this regard. Law No. 401-FZ of November 30, 2017 introduced a limit on the write-off of past losses - old losses can reduce the income tax base of the current period by no more than 50 percent (clause 2.1 of Article 283 of the Tax Code). It must be said that it was initially planned to set the limit at 30 percent of the tax base of the current period. However, apparently, the legislators recognized that this would be too much.

Obviously, the introduction of restrictions on writing off past losses increases the tax burden on enterprises. Moreover, the problem can even be widespread. After all, given the economic situation in the country, in past years many companies operated in the red. And now, when they are just getting back on their feet, if they wrote off losses in the same way, the budget again would not “see” anything.

To some extent, this, of course, contradicts the moratorium on increasing the tax burden introduced in the Russian Federation. Apparently in order to smooth out such unfavorable consequences, Law N 401-FZ abolished the current 10-year limit on the transfer of losses.

When applying the new procedure, the following important points must be taken into account:

1) the restriction on the recognition of past losses is temporary - it is valid from 2017 to 2020. That is, from 2021 it will again be possible to recognize accumulated losses in full;

2) a restriction has also been introduced on the amount of recognized losses received by the CTG participants. It will also amount to 50% of the consolidated tax base of the consolidated group of taxpayers of the current reporting (tax) period. At the same time, it is necessary to make changes to the accounting policy for the purposes of taxation of consolidated groups of taxpayers and provide for the procedure for calculating and recalculating the amount of transferred losses that arose when calculating the consolidated tax base, taking into account the 50% limit that is applied by the responsible participant of the consolidated group of taxpayers (clause 6 of Article 283 of the Tax Code as amended . Law N 401-FZ);

3) the abolition of the 10-year limit on the transfer of losses applies only to those that arose in 2007 and later (subclause 16 of Article 13 of Law No. 401-FZ);

4) the rule has been retained according to which losses are recognized, as they say, one by one. That is, if a company has incurred losses in more than one tax period, such losses are carried forward to the future in the order in which they were incurred;

5) as before, documents confirming the amount of the loss incurred must be kept for the entire period of transfer of the loss plus another four years after the end of the year in which the loss was completely written off.

Let's see how the new rules will work in practice:

Example. At the end of 2015, Romashka LLC received a loss of 500,000 rubles. At the same time, 2016 also brought a loss in the amount of 300,000 rubles.

In turn, 2017 turned out to be profitable for the company. The cumulative total profit was:

For the first quarter of 2017 - 350,000 rubles;

- for the first half of 2017 - 500,000 rubles;

- for 9 months of 2017 - 700,000 rubles;

- for 2017 - 800,000 rubles.

When determining the income tax base in 2017, Romashka LLC has the right to take into account:

For the first quarter of 2017 - part of the loss for 2015 in the amount of RUB 175,000. (RUB 350,000: 2);

- for the first half of 2017 - half of the loss for 2015 - 250,000 rubles. (RUB 500,000: 2);

- for 9 months of 2017 - part of the loss for 2015 in the amount of RUB 350,000. (RUB 700,000: 2);

- for 2017 - part of the loss for 2015 in the amount of 400,000 rubles. (RUB 800,000: 2).

For comparison, we present the calculation of the amount of loss carried forward to the future according to the old rules under the same circumstances (financial results).

When determining the income tax base in 2017, Romashka LLC, according to the old rules, could take into account:

For the first quarter of 2017 - part of the loss for 2015 in the amount of RUB 350,000;

- for the first half of 2017 - a complete loss for 2015 in the amount of RUB 500,000;

- for 9 months of 2017 - full loss for 2015 in the amount of 500,000 rubles. and part of the loss for 2016 in the amount of RUB 200,000;

- for 2017 - complete loss for 2015 and 2016 in the amount of 800,000 rubles.

Thus, according to the old rules, Romashka LLC had the opportunity to fully take into account the losses received for 2015 and 2016. Moreover, in the example under consideration, the company would not have to pay advance payments for income tax in 2017 and tax for this year, since the income tax base was completely zeroed out.

According to the new rules, Romashka LLC will take into account only half of the losses for 2015 and 2016. At the same time, the company retains the obligation to pay advance payments for income tax and tax for 2017, since the income tax base is no longer zero. Romashka LLC will take into account the remainder of the “past” losses in the following periods without any time limit.

Losses under the simplified tax system

In conclusion, we note that the “simplified” ones with the object of taxation “income minus expenses” also have the opportunity to take into account “past” losses. At the same time, what is interesting is that in 2017 such losses are recognized under the old procedure under the simplified tax system. The legislator did not make any changes to paragraph 7 of Article 346.18 of the Code. This means that the amount of the transferred loss to the simplified tax system, as before, is not limited and can be written off only within 10 years following the tax period in which this loss was received.

Form of profit and loss report 2017

Accounting reporting falls on the shoulders of all business entities. Since reporting documents must be submitted annually. The main accounting document is the balance sheet. As for the profit and loss statement, this is rather an additional document, but it also applies to large and small business entities.When preparing a profit and loss statement, you can safely take the “title” of the balance sheet as a sample of the title part. Since the information provided in this part will be the same. Each line of the OKUD 0710002 form is filled in with total indicators.

The profit and loss statement form requires line-by-line completion, as in the balance sheet, but the order of completion is slightly different, which is best seen in several examples:

2110 it is necessary to calculate the difference between the total revenue of a given enterprise received from the sale of goods or services and the amount of VAT paid, the data for this line is taken from sales account 90;

2120 shows the cost price after excluding all costs, data for this item is taken from the Debit of account 90;

2100 – this line is intended to determine gross profit and is found as the difference in the lines indicated above;

2210 – line is intended to show commercial costs, the values of which are taken from Debit 44. Cost amounts are also included here;

2220 – before filling out the income statement, this value is taken from Debit 44.

The profit and loss statement of an enterprise contains the amounts of income of a given object, by which one can judge how efficiently the given object operates, how profitable it is, and also view the growth of profit for it. This document is compiled using the incremental method, which allows you to view the dynamics of growth or decrease in income from activities.

This document is sometimes also called a “financial profit statement” or a “financial performance statement,” but no matter what you call it, it plays a key role in forming an idea of the activity of a given entity and the benefit of its founders.

The profit and loss report is compiled on the basis of parameters for profits, losses, results of sales and non-sales processes, company costs for sales and production, other costs, as well as taxes incurred, etc.

The profit and loss statement is submitted in Form 2 (OKUD 0710002), as required by law. The data entered into this form forms a document that is close in importance to a balance sheet. Also, using this form, it is established how profitable a given enterprise and individual components of the entrepreneurial process are, which is very important when conducting an analysis of the operation of the facility.

The profit and loss statement must fully characterize the profit of a given enterprise. That is, how it was obtained, shares by type of activity, all costs of carrying out the business process, as well as net profit after paying these costs.

In order to correctly assess the development trend of a business entity, it is necessary to carry out a comprehensive analysis of the profit and loss statement. It is this procedure that helps determine how effective the business model of a given business entity is. This matters not only for those who manage the company, but also for investors and creditors.

Settlement of losses in 2017

Firms that apply the simplification and pay a single tax on the difference between income and expenses can include losses from previous years in calculating the tax base. Write it off at the end of the year. Based on the results of the reporting periods, losses cannot be written off.Recognize the loss of previous years in the tax base, observing the following rules:

The amount of the transferred loss should not exceed 30 percent of the annual tax base for the single tax;

the amount of the loss can be carried forward to the future, but no more than 10 years in advance (i.e. if the loss was incurred in 2007, then the last year for its write-off is 2017);

the size of the loss and its amount, which reduces the tax base in each tax period, must be documented (for example, primary documentation (acts, invoices, etc.), copies of tax returns, a book of income and expenses).

Do not accept losses incurred when applying other taxation regimes when calculating the single tax. On the contrary, do not recognize a loss incurred during the period of application of the simplified tax regime if the company has switched to other taxation regimes.

This procedure is established in paragraph 7 of Article 346.18 of the Tax Code of the Russian Federation.

According to the Russian Ministry of Finance, if a company did not include last year’s loss in the calculation of the tax base this year, then it cannot be carried forward to the future (letter No. 03-11-04/2/233). This conclusion is based on the provisions of paragraph 7 of Article 346.18 of the Tax Code of the Russian Federation.

The text of this norm differs from the rules for writing off losses of previous years, provided for in relation to income tax in Article 268 of the Tax Code of the Russian Federation. Thus, paragraph 7 of Article 346.18 of the Tax Code of the Russian Federation does not directly say that a loss not taken into account in the year closest to the unprofitable year can be transferred in whole (or in part) to the next year out of the next nine years.

However, in paragraph 7 of Article 346.18 of the Tax Code of the Russian Federation there are no restrictions given by the Ministry of Finance of Russia. It says that simplified companies with the object of taxation of income minus expenses have the right, but not the obligation, to include losses from previous years in the calculation of the tax base. At the same time, in which year this can be done - in the closest to the unprofitable year or after several years, paragraph 7 of Article 346.18 of the Tax Code of the Russian Federation is not specified.

Despite the ambiguity of this position, tax inspectors will most likely be guided by the position of the Russian Ministry of Finance. To reduce the risks during the audit, in the tax period following the loss-making year, include a small part of the loss in the calculation of the single tax during simplification. Clause 7 of Article 346.18 of the Tax Code of the Russian Federation provides only for the maximum allowable amount of loss (30 percent) that can be taken into account for the year. There are no restrictions on the minimum amount of loss.

If at the end of the year the company’s expenses exceeded taxable income, then instead of a single tax, the minimum tax must be transferred to the budget. It is 1 percent of taxable income for the year.

If you receive a loss, the amount of minimum tax paid can be written off as expenses next year. This rule also applies if the company again ends the next year with a negative financial result. In this case, a new loss will be formed, carried forward to the future.

This is provided for in paragraph 6 of Article 346.18 of the Tax Code of the Russian Federation.

Calculate the amount of loss carried forward into the future in Section III of the book of accounting for income and expenses of companies using a simplified procedure approved by Order No. 167n of the Ministry of Finance of Russia.

In the tax return for a single tax, the offset of losses from previous years is reflected as follows.

Indicate the amount of taxable income for the current year on line 010 of section 2 of the declaration approved by order of the Ministry of Finance of Russia No. 7n. The amount of taxable expenses is on line 020 of the same section. In line 030 of section 2 of the declaration, enter the difference (if any) between the amount of the minimum tax paid and the calculated single tax for the previous year. If a loss was incurred last year, this difference will be equal to the amount of the minimum tax paid (since the amount of the calculated single tax will be zero).

Calculate the total amount of income (line 040) or loss (line 041) of the current year as the difference between lines 010, 020 and 030. If you get a positive difference (income), reduce it by the amount of loss from previous years (but not more than 30 percent) . Reflect the loss on line 050 of section 2 of the declaration. If there is a negative difference (loss), do not accept the loss of previous years as a reduction in the tax base.

This follows from Section IV of the Procedure, approved by Order No. 7n of the Ministry of Finance of Russia.

Write-off of losses from previous yearsis carried out on the basis of a decision of the founders or shareholders and is regulated by the norms of accounting and tax legislation. Let's consider a step-by-step algorithm of actions for correctly writing off losses incurred in the past.

Step 1: determine the amount to carry forward losses

Any company is created for the purpose of making a profit. But in current market conditions, some of them make losses at the end of the year. Loss is the minus difference between the income and expenses of an enterprise for a certain period.

IMPORTANT! A loss in accounting and taxation is formed according to different rules, therefore, most likely, the amount of loss in accounting and tax accounting will differ.

In accounting, such losses are covered by profits not distributed among participants (shareholders) or reserve and additional funds.

In tax accounting, if losses exceed income, then the negative balance can be carried forward to later periods. But for 2017-2020 there is a restriction: the tax base cannot be reduced by the amount of losses received in previous periods by more than 50% (clauses 2, 2.1 of Article 283 of the Tax Code of the Russian Federation).

How to reflect received losses in your income tax return, read the material.

Step 2: take into account the features of paying off last year’s losses

- Losses must be confirmed with primary documentation (letter of the Ministry of Finance of the Russian Federation dated January 19, 2018 No. 03-03-06/1/2598). Such papers must be kept during the entire period of repayment of losses incurred (clause 4 of Article 283 of the Tax Code of the Russian Federation).

IMPORTANT! If the primary document was lost, but the amount of losses is confirmed by a tax audit report, then it is unlikely that it will be possible to transfer it to the future (letter of the Ministry of Finance dated May 25, 2012 No. 03-03-06/1/278, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 24, 2012 No. 3546/12 in case No. A40-9620/11-140-41, the Central District Arbitration Court dated May 22, 2013 in case No. A14-10046/2012 (determined by the Supreme Arbitration Court of the Russian Federation dated August 9, 2013 No. VAS -10478/13 refused to transfer case No. A14-10046/2012 to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the order of supervision of this resolution)).

- If a taxpayer suffered losses using the simplified tax system or unified agricultural tax, and then switched to OSNO, then he does not have the right to take into account losses under the new regime (clause 5 of article 346.6, clause 7 of article 346.18 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 25, 2009 No. 03-03-06/1/617).

- If a negative result is obtained in the reporting period, then the basis for calculating profit is equal to 0 (clause 8 of Article 274 of the Tax Code of the Russian Federation). Accordingly, there is no tax.

- If a company applies the simplified tax system of 15%, then upon receiving a loss it must calculate and pay the minimum tax, which is 1% of the income received. In this case, the resulting loss can be taken into account in expenses over the next 10 years (clause 6 of Article 346.18 of the Tax Code of the Russian Federation).

- When applying the unified agricultural tax, the resulting loss can also be taken into account in expenses over the next 10 years (clause 5 of article 346.6 of the Tax Code of the Russian Federation).

For information on how to explain a loss to tax authorities, see the material .

Step 3: record the write-off of losses from previous years in accounting

In accounting, all income and expenses received in the current period are accumulated in account 99. At the end of the year, it is closed in account 84 (82, 83).

Example

At the end of 2017, Alpha LLC received losses in the amount of RUB 373,580. At the meeting on May 21, 2018, the founders decided to cover losses using additional and reserve capital. As of 01/01/2018, their amount is 140,330 rubles. and 175,830 rub. respectively. And the difference is 57,420 rubles. (373,580 - 140,330 - 175,830) decided to write off against the profits of the following years.

Postings

31.12.2017:

- Dt 84 Kt 99 — RUB 373,580. — an uncovered loss for 2017 has been formed.

21.05.2018:

- Dt 83 Kt 84 — 175,830 rub. — part of the losses was repaid from additional capital.

- Dt 82 Kt 84 — 140,330 rub. — compensation for losses from the reserve fund.

For more information on recording losses in accounting, read also in the article.

Results

Losses resulting from business activities from previous periods are written off against current or subsequent profits. Under OSNO tax accounting, such losses are reflected in the income tax return. At the same time, losses incurred by the company are checked by tax authorities with particular passion.

In our article we will look at the procedure for transferring losses from previous periods in the general taxation system, the algorithm of actions, transferring losses to future periods, writing off losses, as well as some features.

Lesion– these are losses expressed in monetary form, a decrease in material and monetary resources as a result of the excess of expenses over income. Any organization can suffer a loss. If costs exceed revenues, the organization incurs losses, i.e. negative financial result. In this case, it is necessary to recognize the loss and reflect it in accounting and reporting. But the organization has the right to write off losses received as a result of the tax period to reduce the tax base in the following tax periods. A right, but not an obligation (Article 283 of the Tax Code of the Russian Federation “Carrying forward losses to the future”, letter of the Federal Tax Service No. SD-4-3/539 dated January 16, 2018). Please note that the mechanism for carrying forward losses received in previous tax periods was changed from January 1, 2017.

Limitations on carrying forward losses from previous years

The tax base for income tax can be reduced by the amount of losses incurred in previous tax periods. Before 2017, losses could be carried forward for 10 years, now there is no time limit and losses received from January 1, 2017 can be carried forward until the resulting loss for all previous years is completely written off (clause 2 of Article 283 of the Tax Code RF). If losses were incurred in several tax periods, then they must be transferred sequentially, starting from the first tax period in which the loss was incurred (clause 3 of Article 283 of the Tax Code of the Russian Federation).

An organization has the right to reduce the tax base for the tax for the current reporting period by a loss of no more than 50% of profit (clause 2.1 of Article 283 of the Tax Code of the Russian Federation). There are categories of taxpayers to which this restriction does not apply, these are taxpayers with a special status (Article 284 of the Tax Code of the Russian Federation):

- participants of the free economic zone;

- participants in regional investment projects;

- residents of the special economic zone in the Kaliningrad region, etc.

The tax base can be reduced by the amount of the loss only if a profit was generated in the current reporting period.

IMPORTANT! If you decide to exercise the right to transfer losses, you are obliged to keep all primary documents that confirm its occurrence until the end of the transfer and another 4 years after - " The taxpayer is obliged to keep documents confirming the amount of losses incurred during the entire period when he reduces the tax base of the current tax period by the amounts of previously received losses... ensure the safety of accounting and tax data for four years... ". (Article 283 of the Tax Code of the Russian Federation and Article 23 of the Tax Code of the Russian Federation).

Algorithm for transferring losses in the accounting database

Currently there is no automatic transfer of losses in the programs. Therefore, we will transfer the loss using manual entries. Please note that the manual loss carry forward operation is carried out on December 31, after the close of the tax period, but before the balance sheet reformation.

1. We close the tax period in which the loss was incurred

- We will forward the documents for December;

- We close the month, but skip the “balance sheet reform” operation. D 99.01 – K 90.09 The program must generate the posting independently.

- We create a manual loss transfer operation:

D 97.21 – K 99.01 – the amount of loss carried forward to future periods.

97.21 “Other deferred expenses”

99.01 “Profits and losses from activities with the main tax system” - For account D 97.21, we create the subaccount “Loss ... year” and configure this subaccount correctly.

Amount - Amount of loss

Write-off period - from XX.XX.XXXX

2. We carry out the “balance sheet reform” document

D 84.02 – K 99.01

D 90.01 – K 90.09

The program must generate the postings independently. The transfer of losses is carried out after the regulatory operation “Calculation of income tax”.

3. Write-off of losses from previous years

Now, in the new tax period, starting from the date specified in Subconto, if an organization makes a profit in tax accounting, it will automatically be reduced by part of the loss of the previous period or the entire amount. The write-off will take place monthly until the entire loss is written off. The operation can be seen in Menu – Closing the month – Write-off of losses from previous years.

D 99.01 – K 97.21 – the amount of the written off part of the loss.

4. We reflect the transferred loss in the income tax return

On Sheet 02 of Appendix 4, you must indicate the year from which we are transferring the loss and the amount of the loss Total; the amount of the tax base; the amount of loss, but not more than 50% of the profit; balance of unwritten loss.

We go to Sheet 02, the amount of the transferred loss should be automatically transferred to page 110.

--

Loss transfer as an example

When calculating income tax for 2017, Mega LLC received a loss of 350,000 rubles.

This loss can be carried forward to the future, forming from December 31, 2017. manual wiring operation D 97.21 – K 99.01 = 350,000 rub.

In the 1st quarter of 2018, when calculating income tax for Mega LLC:

Income 1,200,000 rubles,

Expenses 1,000,000 rub.

The tax base was 200,000 rubles. (1,200,000 – 1,000,000), we can reduce it by the amount of loss, but not more than 50% of the profit.

In our case, we reduce by 100,000 rubles.

In the income tax return on Sheet 02, Appendix 4, we indicate:

- the year from which we transfer the loss = 2017;

- amount of loss Total = 350,000 rubles;

- tax base amount = 200,000 rubles;

- amount of loss, but not more than 50% of profit = 100,000 rubles;

- balance of unwritten loss = 250,000 rubles (350,000 – 100,000)

5. Deferred loss carryforward

There are situations when organizations do not want to reduce the tax base for losses from previous years in the current tax period, because carrying forward losses to the future is a right. But then a situation may arise when management needs to reduce the tax base, thereby reducing the tax.

Important!

- If you do not apply PBU 18/02 and are sure that you will never carry forward the resulting loss, then you do not have to create a manual “Loss Transfer” operation at the end of the year.

- If you apply PBU 18/02, then this operation will have to be created, otherwise the program will not allow you to close the first month of the next year.

How to do it:

In the manual operation of transferring a loss, for account 97.21 we create the subaccount “Loss ... year”

Type for NU - Losses of previous years

Type of asset in the balance sheet - Other current assets

Amount - Amount of loss

Recognition of expenses - In a special order

Write-off period - LEAVE THE LINE BLANK

Later, when you decide to reduce your tax base by the amount of the loss, you will need to indicate in the “write-off period” field the first date of the tax period from which you want to start writing off.

6. We suspend the write-off of losses for a while

It happens that an organization has written off a loss over a certain period of time, but this year does not want to reduce the tax profit for the loss of previous years and needs to stop writing off the loss for a while.

In this case, you need to create a transaction entered manually with the posting:

D 97.21 (sub-account “Remaining loss 2017”) - K 97.21 (sub-account “Loss 2017”) - the amount of the balance of the loss not transferred.

We set up the subconto “Remaining loss 2017” as described above, i.e. We leave the dates of the write-off period blank.

Then, when write-off is required again, it will be necessary to post back:

D 97.21 (sub-account “Loss 2017”) - K 97.21 (sub-account “Balance of loss 2017”) - the amount of the balance of the loss not transferred.

conclusions

Any organization is created for the purpose of making a profit. But in market conditions, some make losses at the end of the year. Often such losses are covered by profits not distributed among participants or by reserve and additional funds. If losses exceed income, then the negative balance can be carried forward to later periods. You can reduce the tax base for income tax by the amount of losses that were received in previous tax periods. There is no time limit; losses can be carried forward until the resulting loss for all previous years is completely written off. Losses must be transferred in chronological order based on the fact of occurrence. It must be remembered that before reducing the tax base of the current year by the amount of losses from previous years, check the availability of documents that confirm the amount and period of occurrence of losses.

Firmmaker, April 2018

Anastasia Chizhova (Konatova)

When using the material, a link is required

If you notice an error, select a piece of text and press Ctrl+Enter