One-day loans from the central bank of the Russian Federation. Secured loans from Bank of Russia. Document flow between the Bank of Russia and credit institutions

During the first year of activity, the newly created commercial Bank does not have the right to attract loans from the Bank of Russia. In the future, he can take out the following types of Bank of Russia loans:

- one-day settlement loans;

- loans secured by government valuable papers(intraday, overnight, pawnshop).

One-day settlement loans

One-day settlement loans are provided in foreign currency Russian Federation for one business day within the total volume of loans issued by the Central Bank within the framework of a single state.

Providing a one-day overdraft to a bank means that payments are made from the bank despite a temporary absence or insufficiency in the account Money. Lending to the bank's correspondent account is carried out within the established limit on the basis of an agreement. The interest rate on an overdraft loan is established by the Board of Directors of the Bank of Russia and is specified in the agreement.

A one-day settlement loan is provided at the end of the current operating day for one operating day and is not subject to extension. It is not allowed to receive an overdraft loan within two consecutive working days.

For non-fulfillment (improper fulfillment) by the bank of its obligations to repay the overdraft loan and pay interest, a penalty in the form of a penalty in the amount of 0.5 of the refinancing rate for each day of delay until the day of repayment of the entire principal amount is collected.

To receive an overnight overdraft loan, a commercial bank must meet the following requirements:

- timely and fully comply with mandatory reserve requirements;

- not have overdue debt on loans from the Bank of Russia and interest on them, as well as on mandatory payments established by law;

- the total need for additional funds to pay for all settlement documents due before the end of the current day should not exceed the lending limit established by the bank by more than 1.5 times;

- timely and in full transfer the fee for the right to use a one-day overdraft loan.

Interest for using a one-day overdraft loan is paid simultaneously with the repayment of the loan. In case of delay, interest is repaid first, then the amount of the overdue principal debt and, lastly, the amount of penalties due.

Loans secured by government securities

Loans secured by government securities are issued to resident banks of the Russian Federation in the currency of the Russian Federation in order to maintain and regulate the liquidity of the banking system within the limits of the total volume of issued loans, determined by the Bank of Russia in accordance with the adopted guidelines of state monetary policy. The loan is secured by collateral (blocking) of government securities included in the Lombard List of the Bank of Russia.

At the time of granting a loan secured by government securities, a commercial bank must meet the following requirements:

- have sufficient collateral for the loan;

- fully comply with mandatory reserve requirements;

- not have overdue debt on loans previously provided by the Bank of Russia, and interest on them, as well as other overdue obligations to the Central Bank of the Russian Federation.

Repayment of Bank of Russia loans by borrowing banks and payment of interest on them are made within the established time limits; changing the repayment terms of loans is not allowed.

The Bank of Russia can set different interest rates for different types loans, taking into account the term and frequency of loan provision.

The bank chooses what types of loans from the Central Bank of the Russian Federation it will use and enters into an agreement with the Bank of Russia general loan agreement. An additional agreement is also drawn up to the correspondent account agreement of a commercial bank, which secures the right of the Central Bank of the Russian Federation to write off funds in the amount of outstanding claims of the Bank of Russia for loans provided, as well as amounts for the right to use intraday and loans without an order from the bank that owns the correspondent account.

A commercial bank must have custody account in the authorized depositories, with whom he must enter into an additional agreement to open the “Blocked by the Bank of Russia” section on his custody account.

Loans from the Central Bank of the Russian Federation are provided subject to the preliminary blocking by the bank of government securities owned by it by right of ownership. These securities must have a maturity date no earlier than 10 calendar days after the maturity date of the provided loan from the Bank of Russia. The Bank independently determines the number and issues of government securities subject to preliminary blocking.

The maximum possible loan amount (including accrued interest) that a bank can receive is the market value of government securities, adjusted by the Bank of Russia adjustment factor.

Lombard loans from the Bank of Russia are provided in the following ways:

- according to bank applications for a pawn loan: a pawn loan is provided on any business day at a fixed interest rate established by the Bank of Russia;

- based on the results of a pawnshop credit auction: pawnshop loans are provided after an auction is held by the Bank of Russia at an interest rate determined based on the results of the auction and published in the official statement on the results of the auction.

Lombard credit auctions are held by the Bank of Russia (venue: Moscow) as interest-based competitions for banks' applications to participate in a pawn credit auction. The basis for holding an auction is the official message of the Bank of Russia about the holding of a pawnshop credit auction, which establishes: the method of conducting the auction; the period for which the loan is provided; the size of the maximum share of non-competitive applications for participation in a pawnshop credit auction (as a percentage of the total volume of applications submitted by the bank) and, if necessary, other conditions for the auction. The official statement is published in the Bank of Russia Bulletin and other media. The Bank of Russia has the right to set restrictions on the number of applications accepted for an auction from one bank. The restrictions established by the Bank of Russia are indicated in the official message of the Bank of Russia on the holding of a pawnshop credit auction.

Competitive bids from banks accepted for the auction are ranked according to the level of interest rate offered by banks, starting with the maximum. If the volume of loans put up for auction is exhausted, the Bank of Russia has the right to proportionally reduce the amount of each competitive bid, which indicates the interest rate accepted by the Bank of Russia as the cut-off rate, in the list of satisfied competitive bids. At the same time, competitive requests from banks may be partially satisfied.

Non-competitive bids from banks accepted for the auction are satisfied at the weighted average rate established as a result of the pawnshop credit auction. In this case, the calculation of the weighted average rate is carried out by the Bank of Russia based on competitive bids of banks satisfied/partially satisfied following the results of the auction.

Lombard credit auctions are conducted in one of the following ways:

- according to the “American” method: competitive bids included in the list of satisfied competitive bids are satisfied at interest rates offered by banks in these bids, which are equal to or higher than the cut-off rate established by the Bank of Russia based on the results of the auction;

- according to the “Dutch” method: competitive bids included in the list of satisfied competitive bids are satisfied at the minimum interest rate that will be included in the list of satisfied competitive bids of banks (i.e., at the cut-off rate established by the Bank of Russia based on the results of the auction).

If the bank fails to fulfill (improper fulfillment) its obligations to repay the loan and pay interest on it, the Bank of Russia begins procedure for the sale of pledged securities (collateral).

Proceeds from the sale of pledged government securities are used in the following order:

- expenses of the Bank of Russia associated with its implementation are reimbursed;

- the bank's interest debt and the bank's loan debt (in the amount of the principal debt) are repaid;

- the amounts of penalties (penalties) due for payment are repaid.

If the amount of proceeds from the sale of collateral is higher than the amount of existing liabilities, the excess is transferred to the bank's correspondent account. If the proceeds are insufficient to repay all obligations, the Bank of Russia writes off the missing amount from the bank's correspondent account.

Legal basis

It includes the following fragments from banking laws, as well as the following main regulations Bank of Russia:

Regulations “On the procedure for the Bank of Russia to provide loans to banks secured by collateral and guarantees” dated October 3, 2000 No. 122-P;

Regulations “On the procedure for the Bank of Russia to provide loans to credit institutions secured by collateral (blocking) of securities” dated August 4, 2003 No. 236-P;

Directive “On the list of securities included in the Lombard list of the Bank of Russia” dated July 28, 2004 No. 1482-U;

Letters “On the inclusion of securities in the Lombard list of the Bank of Russia” dated September 16, 2004 No. 110-T, dated December 6, 2004 No. 140-T and dated April 20, 2005 No. 63-T;

Order “On calculating the cost of collateral for loans from the Bank of Russia” dated September 22, 2004 No. OD-682;

Orders “On adjustment coefficients of the Bank of Russia” dated December 6, 2004 No. OD-848, dated December 31, 2004 No. OD-906 and dated April 20, 2005 No. OD-263.

From the Law “On Central Bank RF"

Art. 4. The Bank of Russia performs the following functions:

3) is the lender of last resort for credit institutions, organizes a system for their refinancing;

Art. 36. The Bank of Russia regulates the total volume of loans it issues in accordance with the accepted guidelines for the unified state monetary policy.

Art. 37. The Bank of Russia may set one or more interest rates for various types of transactions or pursue an interest rate policy without fixing the interest rate.

The Bank of Russia uses interest rate policy to influence market interest rates.

Art. 40. Refinancing means lending by the Bank of Russia to credit institutions.

The forms, procedure and conditions of refinancing are established by the Bank of Russia.

Art. 43. Direct quantitative restrictions of the Bank of Russia mean the establishment of limits on the refinancing of credit institutions and the conduct of certain banking operations by credit institutions.

The Bank of Russia has the right to apply direct quantitative restrictions, equally affecting all credit institutions, in exceptional cases in order to implement a unified state monetary policy only after consultations with the Government of the Russian Federation.

Art. 46. The Bank of Russia has the right to carry out the following banking operations and transactions with Russian and foreign credit organizations, the Government of the Russian Federation to achieve the goals provided for in this... Law:

1) provide loans for a period of no more than one year secured by securities and other assets, unless otherwise established in the federal law on the federal budget;

Art. 47. Bank of Russia loans can be secured by:

Gold and other precious metals in standard and measured bars;

Foreign currency;

Bills of exchange denominated in Russian and foreign currencies;

Government securities.

Lists of bills and government securities suitable for securing loans from the Bank of Russia are determined by... The Board of Directors.

In cases established in the decision of the Board of Directors, loans from the Bank of Russia may be secured by other valuables, as well as sureties and bank guarantees.

From Art. 28 of the Law “On Banks and Banking Activities”

If there is a lack of funds for... lending to clients and fulfilling its obligations, a credit institution can apply for loans from the Bank of Russia on the terms determined by it.

Loans that the Central Bank can issue and their main characteristics

The issue is being considered on the basis of the above-mentioned Regulation No. 236, which is the basic document of the Bank of Russia for this area of its activity.

General provisions

1. The Bank of Russia can issue loans on the terms of security, urgency, repayment and payment. Collateral for Bank of Russia loans is usually considered to be a pledge (blocking) of government securities included in the Lombard list approved by the Board of Directors of the Central Bank. In exceptional cases, securities not included in the specified list may be accepted as collateral for loans (Regulation No. 236 does not say anything about this).

2. The Bank of Russia (represented by its authorized institution or division) may issue the following types of loans to commercial banks:

Intraday;

One-day settlement (overnight loans);

Pawn shops 1.

With sufficient collateral and compliance with a number of conditions, the bank can receive several types of loans in one day, including several pawn loans for different or the same terms and/or several intraday loans.

The Bank of Russia does not issue loans to bank branches (however, in some cases it may credit the amount of the loan issued to the bank to the correspondent sub-account of its branch).

This does not cover special types of loans that the Central Bank also has the right to issue:

Stabilization (aimed at bringing the bank out of a crisis situation);

Rehabilitation, which can be issued to a bank that undertakes the financial rehabilitation of another bank that is in critical condition (see Central Bank Regulation No. 38 of June 25, 1998);

General conditions for the provision and repayment of loans from the Bank of Russia

The Bank of Russia may issue loans to the bank in the following cases. 1. If the bank has concluded with him:

General loan agreement (see Appendix 2 to Regulation No. 236) - when concluding it, the bank independently chooses what types of Central Bank loans it will use; there is a limitation here: the conclusion of a general agreement for receiving intraday loans requires the simultaneous conclusion of a general agreement for obtaining overnight loans, and vice versa,

Lombard is a loan that is secured by securities. Taking this into account, all Bank of Russia loans considered here are actually pawnshop loans.

the conclusion of a general agreement for obtaining overnight loans requires the simultaneous conclusion of a general agreement for obtaining intraday loans;

Additional agreement to the agreement on a correspondent account opened in a division of the Central Bank: on granting the Bank of Russia the right to directly write off from the specified correspondent account of the bank the amounts of fees for the use of intraday loans (if the general agreement provides for the bank to receive intraday loans) 1 ; about debiting money from the specified account according to payment documents in excess of the funds available on it.

In order to obtain intraday loans and overnight loans, a potential borrower bank can enter into this additional agreement not with the Bank of Russia, but with an authorized RNKO.

An authorized RNCO is a settlement NPO that has entered into an agreement with the Bank of Russia on interaction when carrying out operations in accordance with Regulation No. 236 and meets the requirements of the Bank of Russia (these requirements are set out in Appendix 1 to the Regulations). In fact, this means an exchange that organizes trading in securities included in the Lombard list of the Central Bank.

2. If the bank has a securities account with the depository. In this case, depositories can have different statuses: authorized depositories, which serve dealer banks in the GKO-OFZ market (now this is the non-profit partnership “National Depository Center”); dealer banks in the GKO-OFZ market, which provide services to other banks; other professional participants in the securities market holding licenses for depository activities.

3. If the bank has concluded an additional agreement (agreements) to the depository agreement with the depositary (and issued the corresponding power of attorney to the Bank of Russia): on opening a section (sections) “Blocked by the Bank of Russia” on its securities account and on the right of the Bank of Russia to assign a full number to this section; on the right of the Bank of Russia to open sections of the bank’s securities account necessary for lending and assign numbers to them; on the appointment of the Bank of Russia as the operator of such sections of the bank's securities account; on the right of the Bank of Russia to close the specified sections of the bank's securities account.

Loans are provided subject to the bank's prior blocking of securities (included in the Lombard list) in the "Blocked by the Bank of Russia" section of the bank's securities account at the depository. Banks independently determine the number and issues of securities that they are going to offer as collateral (block) in order to obtain loans from the Bank of Russia. Such securities must meet the following requirements: be included in the Lombard list; accounted for in the bank's securities account at the depository; belong to the bank by right of ownership and not be encumbered by other obligations; have a repayment period no earlier than ten calendar days after the maturity date of the Bank of Russia loan.

In accordance with the Central Bank Directive No. 1170-U dated June 24, 2002, and then the Directive No. 1430-U dated May 25, 2004, the fee for the right to use intraday loans is set equal to zero.

The first Lombard list of the Bank of Russia (dated March 13, 1996) included government short-term zero-coupon bonds (GKOs), issued in accordance with Decree of the Government of the Russian Federation dated February 8, 1993 No. 107 and federal loan bonds with a variable coupon income (OFZ), issued in accordance with Decree of the Government of the Russian Federation of May 15, 1995 No. 458.

Starting from April 1999, the list included: GKOs issued for circulation after December 14, 1998; federal loan bonds with constant coupon yield (OFZ-PD) with maturities after December 31, 1999; federal loan bonds with fixed coupon income (OFZ-FD).

Even earlier, in September 1998, the pawnshop list was replenished with bonds from the Bank of Russia itself, which it began to issue in accordance with Central Bank Regulation No. 52-P dated August 28, 1998.

Since mid-2001, the pawnshop list included;

GKOs, issued in accordance with Decree of the Government of the Russian Federation dated October 16, 2000 No. 790 and the terms of issue and circulation of these bonds, approved by order of the Minister of Finance of the Russian Federation dated November 24, 2000 No. YuZn;

OFZ with a fixed coupon income, issued in accordance with Decree of the Government of the Russian Federation dated May 15, 1995 No. 458 and the conditions of their issue approved by order of the Minister of Finance of the Russian Federation dated August 18, 1998 No. 37n;

Bonds of the Bank of Russia.

At the end of 2001 the list was expanded to include:

OFZ with debt amortization (OFZ-AD), issued in accordance with Decree of the Government of the Russian Federation dated May 15, 1995 No. 458 and the conditions of their issue and circulation approved by order of the Ministry of Finance of the Russian Federation dated April 27, 2002 No. 37n;

OFZ with variable coupon yield (OFZ-PK), issued in accordance with Decree of the Government of the Russian Federation dated May 15, 1995 No. 458 and the conditions of their issue and circulation approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2000 No. 112n, sold by the Bank of Russia from its portfolio with a repurchase obligation.

Since the beginning of 2004, the Lombard list of the Bank of Russia included the following securities (see the now canceled Directive of the Central Bank of January 9, 2004 No. 1368-U):

GKOs issued in accordance with Decree of the Government of the Russian Federation dated October 16, 2000 No. 790 and the conditions of their issue and circulation approved by order of the Ministry of Finance of the Russian Federation dated November 24, 2000 No. YuZn;

OFZ with a constant coupon yield, issued in accordance with the Decree of the Government of the Russian Federation dated May 15, 1995 No. 458 and the conditions of their issue and circulation approved by Order of the Ministry of Finance of the Russian Federation dated August 16, 2001 No. 65n;

OFZ with a fixed coupon income, issued in accordance with Decree of the Government of the Russian Federation dated May 15, 1995 No. 458 and the conditions of their issue approved by Order of the Ministry of Finance of the Russian Federation dated August 18, 1998 No. 37n;

OFZ-AD, issued in accordance with Decree of the Government of the Russian Federation dated May 15, 1995 No. 458 and the conditions of their issue and circulation approved by Order of the Ministry of Finance of the Russian Federation dated April 27, 2002 No. 37n;

OFZ with variable coupon yield, issued in accordance with Decree of the Government of the Russian Federation dated May 15, 1995 No. 458 and the conditions of their issue and circulation approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2000 No. 112n;

Bonds of external bonded loans of the Russian Federation (OVOZ), issued in accordance with Decree of the Government of the Russian Federation of January 23, 1997 No. 71;

OVZ issued in accordance with Decree of the Government of the Russian Federation of March 14, 1998 No. 302;

OVOZ issued in accordance with the Decree of the Government of the Russian Federation “On Debt Settlement former USSR before foreign commercial banks and financial institutions united in the London Club of Creditors" dated June 23, 2000 No. 478 and the conditions of their issue and circulation approved by order of the Ministry of Finance of the Russian Federation dated July 18, 2000 No. 71n;

OVOZ, issued in accordance with resolutions of the Government of the Russian Federation dated June 23, 2000 No. 478, dated December 29, 2001 No. 931 and the conditions for their additional issue and circulation approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 113n;

Bonds of the state currency bond loan of 1999, issued in accordance with the Decree of the Government of the Russian Federation dated November 29, 1999 No. 1306 and the conditions of their issue and circulation approved by order of the Ministry of Finance of the Russian Federation dated January 28, 2000 No. 13n;

Bonds of the Bank of Russia.

In mid-2004, the list also included bonds of constituent entities of the Russian Federation that met certain criteria.

Then, by Directive No. 1482-U dated July 28, 2004, the list was again adjusted: four types of OFZs were excluded and three other types of bonds were added.

The market value of the listed securities, adjusted by the adjustment coefficient of the Bank of Russia and taking into account the interest due, is considered the maximum possible amount of the loan (loans) that the bank can receive from the Bank of Russia.

Adjustment factor - a numerical multiplier (in the range from 0 to 1), calculated based on possible changes in the prices of securities on the organized securities market (OSM), by which the market value of these securities is adjusted; used by the Bank of Russia to reduce its risks associated with possible depreciation of securities accepted as collateral for loans; its size is established by the Board of Directors.

At the end of 2004 - beginning of 2005, the values of the adjustment coefficients used to adjust the market value of securities accepted as collateral for loans from the Central Bank ranged from 0.5 (bonds of the Housing Mortgage Lending Agency and the Moscow Mortgage Agency Bank) to 0.98 (Bank of Russia bonds).

In accordance with Regulation No. 236, a bank applying for loans from the Central Bank must satisfy a number of conditions, including the following:

1) in terms of its financial condition, the bank must belong to the 1st classification group (based on the criteria established in the Central Bank Directive No. 766 dated March 31, 2000), i.e. be considered a bank “without shortcomings in its activities” (previously, banks “with certain shortcomings in its activities” could also count on loans);

2) to carefully comply with reserve requirements at the time of granting the loan; did not have any overdue monetary obligations to the Bank of Russia, and had sufficient collateral for the loan.

Loan collateral is considered sufficient if the market value of the securities previously blocked by the bank, adjusted by the correction factor, is greater than or equal to the amount of the requested loan (including interest for the expected period of using the loan). Adequacy of collateral

loans are calculated in accordance with the procedure prescribed in Appendix 3 to Regulation No. 236.

Changing the repayment terms of Bank of Russia loans is not allowed.

An exception can be made only in the following cases: 1) seizure of securities pledged as collateral for a Central Bank loan. In such a situation, the bank is obliged to replace the loan collateral with appropriate collateral within five working days, but if this requirement is not met, the Bank of Russia has the right to unilaterally demand early repayment of the loan by sending a corresponding request to the bank; 2) if during the period of using the pawn loan the borrower bank ceases to belong to the 1st classification group in terms of its financial condition. In this situation, the Bank of Russia will have the right to unilaterally demand early repayment of the loan.

Features of granting and repaying pawn loans

Lombard loans are provided by authorized institutions and authorized divisions of the Bank of Russia.

The authorized institution of the Bank of Russia is the TU of the Bank of Russia, a division of the settlement network of the Bank of Russia, the First Operational Directorate under the Bank of Russia (OPERU-1), which, by an administrative act of the management of the Central Bank, is given the right to conduct operations in accordance with Regulation No. 236. The authorized division of the Bank of Russia is a division of the central of the Central Bank apparatus, appointed by an administrative act of the leadership of the Central Bank.

Lombard loans are provided in two ways:

According to banks, loans are provided in principle on any working day at a fixed interest rate; the loan term is determined in the bank’s application;

Based on the results of a pawnshop credit auction - loans are issued after the auction at a rate determined by the results of the auction; The loan term is determined by the Bank of Russia.

The bank's application for a pawn loan is reviewed (with the necessary checks) within one business day.

Lombard credit auctions are held as interest-based competitions for banks' applications for loans (these auctions are conducted by an authorized division of the Central Bank). The bank's application can be competitive (if it is satisfied, then exactly at the interest rate specified in it) or non-competitive (see below). Competitive bids from banks accepted for the auction are ranked according to the level of interest rates they offer, starting with the maximum. The final decision on the cut-off rate and the volume of loans provided based on the results of the auction is made by the Bank of Russia after analyzing applications. Non-competitive bids from banks accepted for the auction are satisfied at the weighted average rate established at the end of the auction. At the same time, the Bank of Russia calculates the weighted average rate based on competitive bids from banks that are satisfied/partially satisfied at the end of the auction. In modern conditions, the auctions in question are held weekly, and the corresponding loans are issued only for two weeks.

Such credit auctions are conducted in one of the following ways:

1) “American” method - competitive bids (included in the list of satisfied ones) are satisfied at the interest rates proposed in the bids by the banks themselves, but only if these rates are equal to or exceed the cut-off rate established by the Bank of Russia based on the results of the auction;

2) “Dutch” method - all competitive applications (included in the list of satisfied applications) are satisfied at the last (minimum) interest rate, which will be included in the list of satisfied applications (i.e., at the cut-off rate).

The entire technology of pawn lending is spelled out in detail in the relevant Regulations (Appendix 6 to Regulation No. 236).

The conditions for pawn lending that the Bank of Russia applied in 1997-1998 are presented in table. 17.2.

Table 17.2 Terms of pawn lending, % per annum

|

Loan terms ________________________ |

|

|

Since October 6, 1997 |

|

|

for a period of 3 to 7 days -^ 15 |

|

|

for a period of 8 to 14 days - 18 |

|

|

for a period of 15 to 30 days - 21 |

|

|

Since November 11, 1997 |

Fixed rate loans: |

|

for a period of 3 to 7 days - 22 |

|

|

for a period of 8 to 14 days - 25 |

|

|

for a period of 15 to 30 days - 28 |

|

|

Since December 1, 1997 |

Loans at a fixed rate regardless of terms - 36 |

|

Since 02.02.1998 |

Loans at a fixed rate regardless of terms - 42 |

|

From 02/17/1998 |

Loans at a fixed rate regardless of terms - 39 |

|

From 03/16/1998 |

Loans at a fixed rate regardless of terms - 30 |

|

From 05/18/1998 |

Fixed rate loans: |

|

for a period of 3 to 14 days - 36 |

|

|

for a period of 15 to 30 days - 40 |

|

|

Since May 19, 1998 |

Loans at a fixed rate regardless of terms - 50 |

|

Since May 27, 1998 |

Loans at a fixed rate for periods from 1 to 20 days - 150 |

|

Since June 5, 1998 |

Loans at a fixed rate for a period from 1 to 20 days - 60 |

|

Since June 29, 1998 |

Loans at a fixed rate for a period from 3 to 20 days - 80_________| |

From August 8, 1998, pawnshop loans began to be provided only for periods of up to seven calendar days and only through credit auctions (starting from July 27, 1998, they could be carried out 2 times a week according to the “American” method). This procedure was canceled by Central Bank Directive No. 1168-U dated June 24, 2002.

After August 1998, this channel for bank refinancing practically ceased to function. Only at the end of 2003 did the Bank of Russia decide to again begin to revive the institution of refinancing commercial banks (see below).

Features of providing and repaying intraday loans and overnight loans

These loans are also allowed to be issued only within the refinancing limits set daily for each bank individually. The amount of such a limit is fixed in the general agreement. The maximum intraday allowed debit balance on a bank's correspondent account should not exceed either the refinancing limit established for it or the market value of the securities blocked by it, adjusted by the adjustment factor. At the same time, it is not necessary to submit an application to the Bank of Russia for an intraday loan or an overnight loan.

The procedure for granting and repaying these loans is defined in detail in the previously mentioned Regulations.

Intraday loans can be issued to the bank during the operating day by debiting funds from the bank's correspondent account in a division of the Central Bank/authorized RNKO according to payment documents if there are no or insufficient funds on it. This type of loan is repaid using current receipts to the bank’s correspondent account (in an amount covering the intraday authorized debit balance allowed by the bank) or is reissued at the end of the day as an overnight loan.

Overnight loans are provided if at the end of the day (at the end of the time of acceptance and processing of settlement documents presented to the bank accounts of clients of the Bank of Russia/authorized RNKO) there is an outstanding intraday loan from the Bank of Russia. Lending method - writing off funds according to payment documents from the bank's correspondent account in the absence or insufficiency of funds in the specified account. Such loans are issued so that the respective banks can complete the necessary settlements (payments) at the end of the business day. The loan is credited to the bank's correspondent account and is valid for one business day.

This shows that an overnight loan is issued at a time when financial markets are no longer working and it is no longer possible to obtain a loan on the interbank market. This means that there is no alternative to overnight loans from the Bank of Russia on the market, so their price (rate) is quite high and is currently equal to the Central Bank refinancing rate. But in last years Russian credit institutions prefer to receive mainly intraday loans, and at the beginning of the day. They use an overnight loan as insurance in the event that the expected receipts do not arrive in the correspondent account.

Loans secured by bills of exchange and guarantees

This is a relatively new refinance lending instrument for our conditions, which Central Bank specialists proposed in the Regulation “On the procedure for the Bank of Russia to provide loans to banks secured by collateral and guarantees” dated October 3, 2000 No. 122-P.

The document was experimental in nature, since it was assumed that it would initially be applied on the territory of St. Petersburg. Subsequently, its effect was also extended to banks in the Vologda, Leningrad, Rostov, Samara and Sverdlovsk regions and Primorsky Territory, as well as branches of Moscow banks operating in the listed regions.

According to this Regulation, the Bank of Russia was going to issue ruble loans to some banks, secured by: 1) collateral (in the form of a mortgage) of bills of exchange from organizations in the sphere of material production and/or rights of claim under loan agreements of such organizations; 2) bank guarantees, on the basis of which the guarantors, jointly and severally with each other and with the borrower bank, undertake to fulfill the obligations of the borrower bank to the Bank of Russia (to reimburse the latter for expenses incurred in connection with the sale of the collateral, interest, the principal debt on the loan and penalties for non-fulfillment or improper fulfillment of obligations under the loan agreement).

Regulation No. 122 was intended to intensify credit ties between banks and enterprises in the real sector of the economy, but there is no information on the effectiveness of its application.

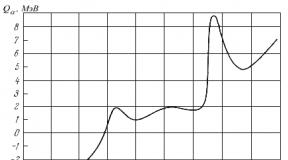

Dynamics of the refinancing rate

All types of Central Bank loans discussed above represent possible forms of refinancing, which the Bank of Russia is obliged to do as a “lender of last resort.” It directly follows from the Law that the Central Bank uses special interest rates for each of these types of loans. The base for all such rates is the general refinancing rate (used for other purposes) - a fairly important financial indicator and guideline. Its value in dynamics reflects significant trends in the real monetary and credit policy of the state (Table 17.3).

Table 17.3 Refinancing rate of the Central Bank of the Russian Federation

|

Validity |

Validity |

||

|

1.01.1991-9.04.1992 10.04.1992 - 22.05.1992 23.05.1992 - 29.03.1993 30.03.1993-1.06.1993 2.06.1993 - 21.06.1993 22.06.1993 - 28.06.1993 29.06.1993-14.07.1993 15.07.1993 - 22.09.1993 23.09.1993-14.10.1993 15.10.1993 - 28.04.1994 |

20 50 80 100 NO 120 140 170 180 210 |

||

|

29.04.1994-16.05.1994 17.05.1994-1.06.1994 2.06.1994"-21.06.1994 22.06.1994 - 29.06.1994 30.06.1994 - 31.07.1994 1.08.1994 - 22.08.1994 23.08.1994-11.10.1994 |

205 200 185 170 155 150 130 1 |

End of table. 17.3

|

12.10.1994-16.11.1994 17.11.1994 - 5.01.1995 6.01.1995 - 15.05.1995 |

|||

|

16.05.1995 - 18.06.1995 19.06.1995-23.10.1995 24.10.1995 - 30.11.1995 1.12.1995 - 9.02.1996 10.02.1996 - 23.07.1996 24.07.1996-18.08.1996 08/19/1996 - 10/20/1996 10/21L996-12/1/1996 2.12.1996 - 9.02.1997 10.02.1997 - 27.04.1897 28.04.1997-15.06.1997 16.06.1997 - 5.10.1997 6.10.1997-10.11.1997 |

195 180 170 160 120 110 80 60 48 42 36 24 21 |

||

|

11.11.1997-16.02.1998 17.02.1998-1.03.1998 |

|||

|

2.03.1998 -15.03.1998 16.03.1998 -18.05.1998 |

|||

|

19.05.1998 - 26.05.1998 27.05.1998 - 4.06.1998 |

|||

|

5.06.1998 - 28.06.1998 |

|||

|

29.06.1998 - 23.07.1998 |

|||

|

24.07.1998 - 9.06.1999 10.06.1999 - 23.01.2000 24.01.2000 - 20.03.2000 21.03.2000 - 9.07.2000 10.07.2000 - 3.11.2000 4.11.2000 - 8.04.2002 9.04.2002 - 6.08.2002 08/7/2002 - 02/16/2003 02/17/2003 - 06/20/2003 06/21/2003 - 01/14/2004 01/15/2004-06/14/2004 06/15/2004 - present |

55 45 33 28 25 23 21 18 16 14 13 1 |

In particular, the rate for an overnight loan (one-day settlement loan from the Central Bank) exactly corresponds to the refinancing rate.

Reanimation of refinancing mechanisms

After August 1998, the Central Bank almost completely stopped issuing refinance loans. Moreover, this policy of his lasted for five whole years (Table 17.4).

Table 17.4

Participation of the Bank of Russia in the refinancing of commercial banks

1 In the numerator - absolute values (billion rubles), in the denominator - as a percentage of the amount of liabilities.

Almost all bankers and experts agreed that the Central Bank should resume refinancing banks, at least changing the procedure for issuing pawn loans. After all, all these years, essentially the opposite process took place - the Bank of Russia financed its operations using free (Fora) or cheap funds from commercial banks (see the next paragraph).

Only at the end of 2002 - beginning of 2003 did the management of the Bank of Russia decide to try to gradually begin to revive refinancing mechanisms. The first cautious step on this path was the introduction into practice of relations with banks that are counterparties of the Central Bank for transactions of purchase and sale of foreign currency in the domestic foreign exchange market, such a financial instrument as a currency swap (purchase from banks of US dollars for rubles for a period of “today” at the official dollar exchange rate with their subsequent sale for a period of “tomorrow”).

The tool is not used actively enough. Thus, after September 2002, these transactions were not carried out in November of the same year, in February - June, August, November and December 2003, in January - March 2004. In April, such transactions with authorized banks were concluded for the total amount at $3.714 billion, in May - by $1.211 billion, in July - by $67.5 million.

Then the Central Bank announced that from January 2003 it would begin holding weekly exchange auctions of the so-called modified repo 1 . The following steps were then taken.

1. As already noted, the composition of the pawnshop list has been expanded.

2. Since October 2003, the Bank of Russia began regularly holding the following types of auctions: weekly - pawnshop credit auctions for a period of two weeks; weekly - direct repo auctions for one week; monthly - direct repo auctions for three months. Applications are accepted for participation in auctions at the following minimum rates (% per annum) - 7; 6.5; 9.

Repo (repo transaction) is a bilateral transaction for the sale (purchase) of securities (the first part of the transaction) with the obligation to repurchase (sell) securities of the same issue in the same quantity (the second part of the transaction) after a period specified in the terms of such a transaction and according to the terms specified in its terms and price. Title to the papers passes first to the original buyer and then back to the original seller.

For example, since the end of 2003, the Central Bank began to regularly announce (by publishing an official offer) the purchase from credit institutions of any number of individual issues of federal loan bonds with debt amortization (OFZ-AD) previously sold by it.

3. Already in 2003, the number of Russian regions whose banks were able to use overnight settlement loans and intraday loans increased from 5 to 30.

4. In 2004, the Bank of Russia planned to continue the practice of providing money to credit institutions through direct repo auctions. In this case, the period for which these operations were supposed to be carried out, if necessary, will range from one day to 90 days.

Nevertheless, it is too early to say that the refinancing mechanisms have worked as expected, since there are many unresolved issues here. This is evidenced, in particular, by the not yet very high popularity of pawnshop credit auctions among banks. So, during 2003-2004. approximately every second such planned auction was declared invalid.

The reason, apparently, is that loans are different. Loans that the Bank of Russia Lately nevertheless began to issue, they represent for banks that can receive them only additional and meager resources to maintain their short- or ultra-short-term liquidity; commercial banks are actually unable to refinance their operations in the full sense of the word with such funds. In other words, the whole point is that with the help of these methods, the Central Bank releases its money into circulation for such a short period of time that it cannot be used in any serious projects related to financing the economy. Let us note, by the way, that only such “short money” can provoke an increase in the level of inflation. In addition, not all banks can actually receive loans from the Central Bank.

The banking system in the Russian Federation is represented by the Central and commercial banks, as well as other non-bank credit organizations. We can say that the banking system of the Russian Federation is two-tier. The top level is represented by the Central Bank, and the bottom by everyone else.

Central Bank of the Russian Federation

The Central Bank of Russia is the largest bank operating in Russia. It is a subject of monetary regulation. Its goals and objectives are regulated at the level of the Constitution and federal legislation.

All banks can be divided into two categories: emission banks, which are the Central Bank, and commercial banks. A special feature of the issuing bank is that it has the right to issue national monetary units, as well as to regulate the circulation of funds on the territory of Russia.

Commercial banks

This category of banks includes credit institutions that are created to serve legal and individuals, providing them with the opportunity to conduct various financial transactions. Banks attract deposits, provide loans, and also carry out settlement, payment and intermediary operations. In addition, commercial banks participate in transactions in the stock and bond markets.

Commercial banks and the Central Bank differ in that the purpose of the former is to make a profit. Bank profit is called margin. It is calculated as the difference between the interest rate on loans issued by the bank and the interest rate on deposits.

Services provided by commercial banks

The adjective “commercial” indicates that the bank was created to make a profit. But there are also banks that specialize more in providing certain banking services.

The most common services provided by commercial banks are the following:

- providing loans to individuals and legal entities;

- conducting currency transactions;

- car loans;

- mortgage;

- exchange of damaged banknotes for undamaged ones;

- creation and maintenance of current accounts for economic entities;

- operations with precious metals.

Tasks and goals of financial institutions

The tasks of the Central and commercial banks are different. The Bank of Russia works in three main areas. Firstly, he must try to maintain the stable functioning of the banking system, and also try to reduce as much as possible the rate of decline in liquidity of the entire banking system in the country. Secondly, the Central Bank of Russia must ensure the reliability and efficiency of the entire payment system. The third task of the Central Bank is to maintain the purchasing power of the ruble, as well as maintain a stable exchange rate.

At the moment, the Russian government has established a floating ruble exchange rate regime. Previously, the Central Bank tried to maintain the exchange rate of the national currency through targeted influence on the foreign exchange market.

Unlike various non-bank credit institutions and commercial banks, the Central Bank does not pursue any commercial goals in the course of its activities. The Bank of Russia is responsible for development financial market in the Russian Federation, and also ensures its stability. Making a profit is not its main goal. This is the main difference between commercial banks and the Central Bank of the Russian Federation.

The importance of commercial banks

As mentioned earlier, the main objective of the operational activities of commercial banks is to make a profit. This is where their commercial interest lies. A commercial bank can be created on the basis of any form of ownership and is a business entity.

In the modern economy, commercial banks play important role. They are intermediaries and distribute capital between industries and regions of the state. One of the main tasks of commercial banks is to ensure the uninterrupted circulation of funds and capital in the state. Also, this category of banks is responsible for providing loans to industrial enterprises, the state and the population. In addition, commercial banks create conditions for the accumulation of funds of organizations and citizens.

Functions of the Central Bank

Due to the fact that commercial banks and the Central Bank pursue different goals in their activities, their functions also differ. To solve the tasks assigned to the Central Bank, it performs the following functions:

- storage of gold and foreign exchange reserves;

- accumulation and storage of reserves of credit institutions;

- control over credit institutions;

- issue of credit funds;

- providing loans to commercial banks;

- monetary regulation of the economic sector.

There are many methods to perform these functions. The Bank of Russia has the right to change the norms of required reserves of banks and carry out market operations. Such operations include the acquisition and sale of government bonds, bills and other securities.

The Central Bank also has the right to change the size of lending rates. This task is implemented within the framework of credit regulation. Another important area of activity is the development of exchange rate policy. All of the above methods are usually called general, since they affect the activities of all commercial banks, as well as the credit capital market.

In addition to general methods, selective ones are also distinguished. Their use is aimed at regulating certain types of loans (annuity or consumer, for example). These methods can also focus on providing loans to a variety of industries.

Examples of selective methods are credit ceilings (limits), which represent a direct limitation on the size of loans that can be provided by certain banks on the territory of the Russian Federation. The second example of selective methods is the regulation of the conditions under which certain types of loans are issued. The central bank can set the difference between lending and deposit rates.

"Bank of Banks"

The Central Bank does not cooperate with entrepreneurs and the population of the Russian Federation. Its main clients are commercial banks, which act as intermediaries between the Central Bank of the Russian Federation and economic entities.

The Central Bank keeps the cash of commercial banks. This money is called reserves. Historically, reserves were intended to help repay deposits. The minimum amount of the reserve in relation to the amount of deposit liabilities is established by the Bank of Russia.

Being the "bank of banks", the Central Bank of the Russian Federation is the body that provides regulation of the entire payment system of Russia. His responsibility is the creation and organization of interbank settlements, coordination and regulation of settlement systems. The Central Bank is the center of the entire banking system of the Russian Federation.

Functions of commercial banks

The main functions of the Central Bank and commercial banks differ significantly. If the work of the Central Bank is more of a regulatory nature, then the activities of commercial banks are associated with the redistribution of monetary resources and stimulation of savings.

The main function is to mediate loans. The bank is engaged in the redistribution of money that can be released in the process of turnover of capital of enterprises and income of individuals. Redistribution of funds is carried out horizontally, that is, from the lender to the borrower. There are no intermediaries in this area. Payment for the use of capital is established under the influence of supply and demand.

The second function of commercial banks is to stimulate the creation of savings in the household. In theory, it is the funds of commercial banks that should make up the majority of the money intended for reforms in the economic sector.

The main incentive to create savings is an increase in deposit rates. In addition to them, guarantees of the reliability of placing accumulated funds in a bank can act as an incentive. The third function performed by commercial banks is the intermediation of payments between economic entities.

Types of commercial banks

The economic role of commercial banks is growing every year. This is reflected in the fact that the scope of their activities is expanding, and new financial services are emerging. There are banks in the world that provide their clients with more than three hundred services.

Classification of banks can be carried out according to various criteria. Depending on how the authorized capital is formed, commercial banks can be created in the form of joint stock companies or LLCs. In addition, they can be created with the participation of foreign banks or foreign capital.

Based on the types of operations carried out by commercial banks, they are divided into universal and specialized. Based on the territory where they operate, commercial banks can be divided into federal and regional.

Joint-stock commercial banks

This category of banks is the most widespread in the world. The first joint-stock bank on the territory of the Russian Federation appeared in the mid-19th century in St. Petersburg. Joint-stock banks can be divided into open joint-stock companies and closed ones. Anyone can buy and sell JSC shares. The subject composition of transactions with CJSC securities is significantly limited.

The largest Russian commercial banks are Sberbank, VTB, Alfa-Bank, FC-Otkritie and Gazprombank. These banks are the most profitable in the Russian Federation. Recently, Tinkoff Bank has been gaining popularity. Its peculiarity is the complete rejection of branches. All transactions are carried out on the Internet. The bank has a large number of partners, in whose terminals you can withdraw cash from a bank card.

Bank licenses

A banking license is a government license that is issued to a commercial bank and gives it the right to conduct various banking operations. First of all, we are talking about the fact that the document allows you to attract customer money as deposits, issue loans and carry out settlement and payment transactions by opening bank accounts.

In the Russian Federation, the Central Bank is responsible for issuing a permit to a commercial bank. A commercial bank is allowed to conduct banking operations only in accordance with the obtained license, which is issued by the Central Bank in the manner established at the legislative level.

The license must be recorded in the register. It indicates all operations that can be carried out by the bank, as well as the currency in which these operations can be carried out. The validity period of the document is unlimited, however, the Bank of Russia can revoke licenses of commercial banks for violating certain conditions for conducting business.

Relations between the Central Bank of Russia and commercial banks

The main difference between the Central Bank and a commercial bank is the controlling role of the former. It carries out the functions of general regulation of the activities of each individual commercial bank.

The Bank of Russia uses all economic management methods. And only in the case when their use is not able to achieve the required effect, the Central Bank can use administrative management methods in the regulatory process. The relationship between the Bank of Russia and commercial banks that operate on the territory of the state is determined by the current banking legislation.

In order to regulate commercial banks, the Central Bank can increase or decrease the minimum rates of required reserves, which are placed by commercial banks in the main bank of the state. Also, the Central Bank of the Russian Federation provides loans to commercial banks and can change their volumes along with interest rates.

The amount of the cash balance that is subject to reservation at the Central Bank is determined on the basis of data from the balance sheet of commercial banks. Their balance sheet must take into account all funds that were raised as loans. The economic relationship between commercial banks and the Central Bank of Russia is that the latter provides loans to commercial banks, and they, in turn, can issue loans to business entities.

The Central Bank of the Russian Federation acts as an active participant in the market of interbank loans as loans of “last resort”. Loans from the Central Bank of the Russian Federation are one of the forms of bank refinancing in the process of implementing monetary regulation.

Until 1995, the main types of loans from the Central Bank of the Russian Federation were loans to the Ministry of Finance of the Russian Federation to finance the federal budget deficit and centralized loans to commercial banks.

Centralized loans provided by the Central Bank of the Russian Federation to commercial banks for lending to enterprises and organizations under government programs. This transaction was formalized by an interbank loan agreement based on an application from a commercial bank to provide it with credit resources to the territorial Main Directorate of the Central Bank of the Russian Federation. It contained an economic justification for the loan amount. Its goals and terms, collateral, loan repayment schedules by the borrower business entity to a commercial bank, and by the bank to the Central Bank of the Russian Federation. A prerequisite for the provision of loans was the commercial bank's compliance with established economic standards, taking into account the receipt of a loan from the Central Bank of the Russian Federation.

Agreements on the provision of loans from the Central Bank of the Russian Federation to a commercial bank were concluded after careful consideration of its application. The Central Bank of the Russian Federation studied the reasons for the need for credit, the policies pursued by the bank, the volume of lending to intermediary activities and other banks.

Since 1995, the Central Bank of the Russian Federation has been developing refinancing of commercial banks on a market basis in the form of credit auctions, providing pawn loans, etc.

Unlike conventional centralized loans, credit resources purchased at auction are not directed to specific sectors of the economy or regions, but provide liquidity to the banking system, because are intended for stable operating banks.

Provision of loans by the Central Bank of the Russian Federation to commercial banks

The Bank of Russia provides loans to commercial banks within the limits of the total volume of loans issued, determined in accordance with the guidelines of the unified state monetary policy. Such loans include intraday loans, one-day settlement loans (overnight) and pawn loans (loans in a firmly fixed amount provided by a lender to a borrower for a certain period of time secured by property or property rights) for periods established by the Central Bank of Russia.

Since March 1998, they are issued only on the security of government securities included in the Lombard list.

After August 1998, the collateral for these loans were GKOs and OFZs with a maturity date after January 1, 1999, federal loan bonds with a constant coupon income and bonds of the Central Bank issued for circulation in accordance with the Regulations of the Bank of Russia “On the procedure for issuing bonds of the Russian Federation” dated August 28, 1998 №52-6.

The Board of Directors of the Central Bank, on the recommendation of the credit committee of a given bank, approves, changes and supplements the Lombard list and officially publishes it in the “Bulletin of the Bank of Russia”. He also approves loan terms, interest rates, as well as fees for the right to use intraday loans.

If there is sufficient collateral, a commercial bank can receive several types of loans in one day, including pawn loans for different or identical loans, or several intraday loans.

Loans on behalf of the Bank of Russia are provided to commercial banks by authorized institutions (GRCC, RCC) on the basis of a general loan agreement.

General conditions for the provision and repayment of loans from the Bank of Russia

The general conditions for the provision and repayment of Bank of Russia loans are:

1. Conclusion of a general loan agreement with the Bank of Russia, which defines the types of loans required by a commercial bank.

To obtain an overnight loan, an additional agreement must be concluded to the agreement on the possibility of such a loan and granting the Bank of Russia the right to describe funds in the amount of its claims on the loans provided, repaid on time, as well as fees for the right to use intraday loans without an order from the bank owner of the correspondent accounts

This description will be made on the basis of a collection order from an authorized institution of the Bank of Russia in the order of priority established by law.

2. The borrowing bank must have a securities account with an authorized depository and enter into an additional agreement to the depository agreement, including:

· on the opening of the section “Blocked by the Bank of Russia” on its securities account and on the right of the Bank of Russia to assign a full number to this section, on the right of the Bank of Russia to open and assign numbers to certain sections on the bank’s securities account, etc.

3. Loans from the Central Bank of the Russian Federation are provided subject to the preliminary blocking by the bank of government securities in the “Blocked by the Bank of Russia” section of the bank’s securities account at the depository.

Banks independently determine the quantity and issue of government securities and securities of the Central Bank of the Russian Federation that are subject to preliminary blocking.

Securities accepted as collateral must meet the following requirements:

· must be included in the pawnshop list;

· be accounted for in the bank's securities account opened at the depository;

· belong to the bank by right of ownership and not be

encumbered by other obligations of the bank;

· have a repayment period no earlier than 10 days after the maturity date of the loan.

4. The borrowing bank at the time of granting the loan must meet the following requirements:

· have sufficient collateral for the loan;

· fully comply with mandatory reserve requirements;

· have no overdue debt on loans previously

provided by the Bank of Russia, and interest on them, as well as other overdue monetary obligations to the latter.

The Bank of Russia will be the “bank of banks”, it provides loans to commercial banks and attracts deposits from commercial banks.

During the first year of activity, the newly created commercial bank does not have the right to attract loans from the Bank of Russia. In the future, he can take out the following types of Bank of Russia loans:

- one-day settlement loans;

- loans secured by government securities (intraday, overnight, pawnshop)

It is important to note that overnight overdrafts

It is important to note that one-day settlement loans are provided in the currency of the Russian Federation for one business day within the total volume of loans issued by the Central Bank within the framework of a unified state monetary policy.

Providing a one-day overdraft to a bank means that payments are made from the bank's correspondent account, despite the temporary absence or insufficiency of funds in the account. Lending to the bank's correspondent account is carried out within the established limit on the basis of the agreement. The interest rate on an overdraft loan is established by the Board of Directors of the Bank of Russia and is specified in the agreement.

It is important to note that a one-day settlement loan is provided at the end of the current operating day for one operating day and is not subject to extension. It is not allowed to receive an overdraft loan within two consecutive working days.

For non-fulfillment (improper fulfillment) by the bank of its obligations to repay the overdraft loan and pay interest, a penalty in the form of a penalty in the amount of 0.5 of the refinancing rate for each day of delay until the day of repayment of the entire principal amount is collected.

To obtain an overnight overdraft loan, a commercial bank must meet the following requirements:

- ϲʙᴏcomply promptly and in full with mandatory reserve requirements;

- not have overdue debt on loans from the Bank of Russia and interest on them, as well as on mandatory payments established by law;

- the total need for additional funds to pay for all settlement documents due before the end of the current day should not exceed the lending limit established by the bank by more than 1.5 times;

- ϲʙᴏpromptly and in full transfer the fee for the right to use a one-day overdraft loan.

Interest for using a one-day overdraft loan is paid simultaneously with the repayment of the loan. In case of delay, interest is repaid first, then the amount of the overdue principal debt and, lastly, the amount of penalties due.

Loans secured by government securities

Loans secured by government securities issued to resident banks of the Russian Federation in the currency of the Russian Federation in order to maintain and regulate the liquidity of the banking system within the limits of the total volume of loans issued, determined by the Bank of Russia in accordance with the accepted guidelines of state monetary policy. The loan will be secured by collateral (blocking) of government securities included in the Lombard List of the Bank of Russia.

At the time of granting a loan secured by government securities, a commercial bank must meet the following requirements:

- have sufficient collateral for the loan;

- fully comply with mandatory reserve requirements;

- not have overdue debt on loans previously provided by the Bank of Russia, and interest on them, as well as other overdue obligations to the Central Bank of the Russian Federation.

Repayment of Bank of Russia loans by borrowing banks and payment of interest on them are made within the established time limits; changing the repayment terms of loans is not allowed.

The Bank of Russia can set different interest rates for different types of loans, taking into account the term and frequency of the loan.

The bank chooses what types of loans from the Central Bank of the Russian Federation it will use and enters into an agreement with the Bank of Russia general loan agreement. An additional agreement is also drawn up to the correspondent account agreement of a commercial bank, which secures the right of the Central Bank of the Russian Federation to write off funds in the amount of outstanding claims of the Bank of Russia for loans provided, as well as amounts for the right to use intraday and loans without an order from the bank that owns the correspondent account.

A commercial bank must have custody account in the authorized depositories, with whom he must enter into an additional agreement on opening a section “Blocked by the Bank of Russia” on which deposit account.

Loans from the Central Bank of the Russian Federation are provided subject to the preliminary blocking by the bank of government securities owned by it by right of ownership. These securities must have a maturity date no earlier than 10 calendar days after the maturity date of the provided loan from the Bank of Russia. The Bank independently determines the number and issues of government securities subject to preliminary blocking.

The maximum possible loan amount (including accrued interest) that a bank can receive is the market value of government securities, adjusted by the Bank of Russia correction factor.

Lombard loans from the Bank of Russia are provided in the following ways:

- according to bank applications for a pawn loan: a pawn loan is provided on any business day at a fixed interest rate established by the Bank of Russia;

- based on the results of a pawnshop credit auction: pawnshop loans are provided after an auction is held by the Bank of Russia at an interest rate determined based on the results of the auction and published in the official statement on the results of the auction.

Lombard credit auctions are held by the Bank of Russia (venue: Moscow) as interest-based competitions for banks' applications to participate in a pawn credit auction.

It is worth noting that the basis for the auction will be the official notification of the Bank of Russia about the holding of a pawnshop credit auction, which establishes: the method of conducting the auction; the period for which the loan is provided; the size of the maximum share of non-competitive applications for participation in a pawnshop credit auction (as a percentage of the total volume of applications submitted by the bank) and, if necessary, other conditions for the auction. The official statement is published in the Bank of Russia Bulletin and other media. The Bank of Russia has the right to set restrictions on the number of applications accepted for an auction from one bank. The restrictions established by the Bank of Russia are indicated in the official message of the Bank of Russia on the holding of a pawnshop credit auction.

Competitive bids from banks accepted for the auction are ranked according to the level of interest rate offered by banks, starting with the maximum. In the event of exhaustion of the volume of loans put up for auction, the Bank of Russia has the right to proportionally reduce the amount of each competitive bid, which indicates the interest rate accepted by the Bank of Russia as the cut-off rate in the list of satisfied competitive bids. In this case, competitive bids from banks may be partially satisfied.

Non-competitive bids from banks accepted for the auction are satisfied at the weighted average rate established as a result of the pawnshop credit auction. In this case, the calculation of the weighted average rate is carried out by the Bank of Russia based on the competitive bids of banks satisfied/partially satisfied following the results of the auction.

Lombard credit auctions are conducted in one of the following ways:

- according to the “American” method: competitive bids included in the list of satisfied competitive bids are satisfied at the interest rates offered by banks in these bids, which are equal to or exceed the cut-off rate established by the Bank of Russia based on the results of the auction;

- according to the “Dutch” method: competitive bids included in the list of satisfied competitive bids are satisfied at the minimum interest rate that will be included in the list of satisfied competitive bids of banks (i.e., at the cut-off rate established by the Bank of Russia based on the results of the auction)

If the bank fails to fulfill (improper fulfillment) its obligations to repay the loan and pay interest on it, the Bank of Russia begins procedure for the sale of pledged securities (collateral)

Proceeds from the sale of pledged government securities are used in the following order:

- expenses of the Bank of Russia associated with its implementation are reimbursed;

- the bank's interest debt and the bank's loan debt (in the amount of the principal debt) are repaid;

- the amounts of penalties (penalties) due for payment are repaid

If the amount of proceeds from the sale of collateral is higher than the amount of existing liabilities, the excess is transferred to the bank's correspondent account. If the proceeds are insufficient to repay all obligations, the Bank of Russia writes off the missing amount from the bank's correspondent account.

Read also...

- Insurance at Sberbank for traveling abroad

- Will I get married? Fortune telling online. Fortune telling for a new acquaintance. Fortune telling with playing cards Fortune telling by a friend

- Morozov Nikolay Aleksandrovich Nikolay Morozov Narodnaya Volya

- You can cook French fries in the microwave How to make your own French fries in the microwave