Fractal analysis is a new approach to the analysis of currency and stock markets. Alexey Almazov. Fractal theory of the Forex market Peters fractal analysis of financial markets pdf

This book is devoted to presenting the fractal market hypothesis as an alternative to the efficient market hypothesis. Fractals, as a consequence of the geometry of the Demiurge, are present everywhere in our world and play a significant role, including in the structure of financial markets, which are locally random, but globally determined, according to the author. The book will examine methods for fractal analysis of stock, bond, and currency markets, methods for distinguishing between independent process, nonlinear stochastic process, and nonlinear deterministic process, and explore the impact of these differences on custom investment strategies and modeling abilities. Such strategies and modeling capabilities are closely related to the asset type and investment horizon of the user.

For risk managers, financiers, investment strategists, technical market analysts, as well as individual investors and currency speculators independently entering the financial markets of the world, including the FOREX market and Russian markets.

In 1991, I finished writing a book entitled Chaos and Order in Captain's Markets. It was published in the autumn of that year (Peters, 1991a). My goal was to write a conceptual introduction for the investment community to chaos theory and fractal statistics. I also wanted to provide some preliminary evidence that, contrary to accepted theory, markets are not well described by random walk models, and the widely presented Efficient Market Hypothesis (EMH) is not well supported by empirical data.

In general, my book received very positive reviews. Many readers approved of it, although some expressed their disapproval and asked detailed questions. The questions were divided into two categories:

(1) technical and (2) conceptual. The technical category included questions asking for more information about the analysis. My book was not intended to be a textbook and I skipped many of the technical details involved in the analysis. This approach improved the book's readability, but left many readers asking, "What to do next?"

The second category included questions related to conceptual problems. If the EMN has shortcomings, how can it be corrected? Or rather, what is its viable replacement? How do chaos theory and fractals fit into trading strategies and the dichotomy of technical and fundamental analysis? Can these seemingly disparate theories be unified? Can traditional theory become nonlinear?

In this book I address both categories of issues. Although the book is different from the previous one, it nevertheless reflects many similar features. Fractal market analysis is an attempt to generalize Capital Market Theory (CMT) and explain the heterogeneity of the investment community. One of the failures of traditional theory is its attempt to simplify “the market” to the average prototypical rational investor. The reasons for working in this direction were noble. In the tradition of Western science, the founding fathers of MMT attempted to learn something about the whole by dividing a problem into its main components. The attempt was successful. Thanks to the visionary work of Markowitz, Sharpe, Fama and others, we have made tremendous progress over the past 40 years.

However, the reductionist approach has its limits and we have reached them. It's time to take a more holistic look at how markets work. In particular, it is time to recognize the greater heterogeneity that underlies markets. All investors do not participate for the same reason, nor do investors use their strategies over the same investment horizons. The stability of markets is inevitably associated with the heterogeneity of investors. The “mature” market is heterogeneous, as well as old. If all participants had the same investment horizon, if they responded to the same information in the same way and invested for the same purpose, instability would reign everywhere. Mature markets, on the other hand, have been remarkably stable for a long time. A day trader can trade anonymously with a pension fund: the former trades frequently for short-term profits; the latter trades infrequently and for the sake of long-term financial security. The day trader reacts to technical trends; investments pension fund based on long-term economic growth potential. And yet, everyone acts simultaneously, and each diversifies the other.

This book is not a story, although the main emphasis is still on conceptual aspects. Analytical methods are scrutinized within the conceptual framework. As with the previous book, I believe anyone with a solid background in business statistics will find much useful information here. The main emphasis is not on dynamics, but on empirical statistics, i.e. on time series analysis to determine what we are dealing with.

On October 14, 2010, Benoit Mandelbrot passed away, a man who largely changed our understanding of the objects around us and enriched our language with the word “fractal,” meaning “a structure consisting of parts that are in a certain sense similar to the whole” 1. Now it is thanks to Mandelbrot that we know that fractals are all around us. Some are constantly changing, like moving clouds or flames, while others, like coastlines, trees or our vascular systems, retain the structure acquired in the process of evolution. Moreover, the real range of scales where fractals are observed extends from the distances between molecules in polymers to the distances between galaxy clusters in the Universe. The richest collection of such objects is collected in Mandelbrot’s famous book “Fractal Geometry of Nature” 2.

The most important class of natural fractals are chaotic time series, or time-ordered observations of the characteristics of various natural, social and technological processes. Among them there are both traditional (geophysical, economic, medical) and those that have become known relatively recently (daily fluctuations in the level of crime or road accidents in the region, changes in the number of views of certain sites on the Internet, etc.). These series are usually generated by complex nonlinear systems that are of very different nature. However, everyone’s behavior pattern is repeated on different scales. Their most popular representatives are financial time series (primarily stock prices and exchange rates).

The self-similar structure of such series has been known for a very long time. In one of his articles, Mandelbrot wrote that his interest in stock market quotes began with a statement from one of the stock traders: “...The price movements of most financial instruments are superficially similar, on different time scales and prices. By appearance graphic, the observer cannot tell whether the data refers to weekly, daily or hourly changes.” Mandelbrot, who occupies a very special place in financial science, had the reputation of “subverting the foundations,” causing a clearly ambiguous attitude among economists. Since the emergence of modern financial theory, based on the concept of general equilibrium, he was one of its main critics and until the end of his life he tried to find an acceptable alternative to it. However, it was Mandelbrot who developed a system of concepts, which, with appropriate modification, as it turned out, allows not only to construct an effective forecast, but also to offer, apparently, the only empirical justification at the moment classical theories of finance.

Fractal market concept

The main characteristic of fractal structures is the fractal dimension D, introduced by Felix Hausdorff in 1919. For time series, the Hurst index is often used H, which is related to the fractal dimension by the relation D = 2 – H and is an indicator of the persistence (ability to maintain a certain trend) of a time series. Typically, there are three fundamentally different modes that can exist in the market: when N= 0.5 price behavior is described by a random walk model; at N> 0.5 prices are in a trend state (directional movement up or down); at H< 0,5 цены находятся в состоянии флэта, или частых колебаний в достаточно узком диапазоне цен.

However, for reliable calculation H(as well as D) requires too much data, which excludes the possibility of using these characteristics as indicators that determine the local dynamics of the time series.

As is known, the basic model of financial time series is the random walk model, first obtained by Louis Bachelier to describe observations of stock prices on the Parisian market. stock exchange. As a result of rethinking this pattern, which is sometimes observed in price behavior, the concept arose effective market ( EffectiveMarketHypothesis, EMH), in which the price fully reflects all available information. For such a market to exist, it is enough to assume that it is occupied by a large number of fully informed rational agents who instantly react to incoming information and adjust prices, bringing them to a state of equilibrium. All the main results of classical finance theory (portfolio theory, CAPM model, Black-Scholes model, etc.) were obtained within the framework of precisely this approach. Currently, the concept of an efficient market continues to play a dominant role in both financial theory and financial business 3 .

By the early 1960s, empirical research had shown that large price changes in the market occurred much more frequently than predicted by the basic efficient market model (the random walk model). One of the first to thoroughly criticize the concept of an efficient market was Mandelbrot. Indeed, if we correctly calculate the value of the indicator H for any promotion, then it will most likely be different from H= 0.5, which corresponds to the random walk model. Mandelbrot found all possible generalizations of this model that could be relevant to real behavior prices As it turned out, these are, on the one hand, the processes he called Levi's flight(Levi flight), and on the other - the processes that he called generalized Brownian motion(Fractional Brownian Motion). The behavior of a time series for which (quite often observed in the real market) can be denoted using any of these processes.

To describe price behavior it is usually used fractal market concept (FractalMarketHypothesis, FMH), which is usually considered as an alternative to EMH. The concept assumes that there is a wide range of agents in the market with different investment horizons and therefore different preferences. These horizons vary from a few minutes to intraday traders up to several years for large banks and investment funds. A stable position in such a market is a regime in which “the average profitability does not depend on scale, except for multiplication by the corresponding scale factor” 4 . In fact, we are talking about a whole class of modes, each of which is determined by its own indicator value H. In this case, the value H= 0.5 turns out to be one of many possible and, therefore, equal to any other value (). These and other related considerations have given rise to serious doubts 5 regarding the existence of a real equilibrium in the stock market.

Price efficiency

A study of the fractal properties of prices of Russian (in the MICEX Index) and American (included in the Dow Jones Internet Index) companies, together with the corresponding indices over the past ten years, emphasizes the special position of the value H= 0.5. To do this, however, it is necessary to use a new fractal indicator (fractality index), introduced by the authors of this article in a separate work 6. It is related to the indicator N ratio, however, to determine it with acceptable accuracy, two orders of magnitude less data is required than for the indicator H, therefore, it can be considered as a local fractal characteristic. It turns out that using the fractal index it is possible to provide a rationale for the modern theory of finance, as well as predict strong fluctuations in the stock market.

To a first approximation, the general picture observed in all series is as follows. The fractal index (and the fractal dimension of financial series) performs quasi-periodic fluctuations around position = 0.5 (this mode corresponds to a random walk). At the same time, the time series continuously changes its mode, moving from a trend (< 0,5) через состояние случайного блуждания во флэт (>0.5) and vice versa. From time to time, for each series, states with relatively stable values other than 0.5 appear and disappear. In this case, the regime with = 0.5 occupies a clearly privileged position. For each time series, it is the longest in all intervals containing eight points or more.

It should be noted that the interpretation of price fluctuations based on the description of the behavior of market agents can vary greatly at different scales. So, for example, intraday, where more than half of the transactions are carried out by trading robots (in US markets), the behavior of agents is apparently very close to rational. On a scale from several days to several months, social psychology plays a significant role, which always contains an irrational element. Meanwhile, the constant nature of oscillations with the most frequently occurring random walk mode is reproduced on all scales, starting from the smallest. This suggests that the nature of these oscillations is apparently based on general mechanism delays accompanying the very method of decision-making by agents in the stock market. At the same time, the main state of prices is still a random walk, which remains the main mode of attraction on all scales. In other words, despite frequent long-term local deviations, prices tend to return to the efficient behavior described by the random walk model.

Forecasting method

The presence of the described fractal properties of the price series, observed in a wide range of scales, allows us to take a fresh look at the possibility of forecasting the stock market. In general, the task of a forecast is to determine the qualitative or quantitative parameters of the future behavior of a time series based on the entire array of historical data. In this case, it is of particular interest to determine the early precursors of the critical behavior of a series.

Let's consider one of the new approaches to solving this problem, based on the fractal properties of prices. It has been strictly proven 6 that if you introduce the average amplitude of fluctuations as the average difference between the maximum and minimum price values averaged over size segments t, then the average amplitude of oscillations will be related to the observation scale by a power law:

,Index (which, like the index, requires two orders of magnitude less data for its definition than the indicator H) coincides with H in those areas where H can be calculated with acceptable accuracy. The dependence of the average amplitude of oscillations on the scale of observations for different values of H is presented in graph 1.

It turns out that knowledge of the law of dependence of the amplitude of fluctuations on time in different modes allows us to substantiate a very interesting effect, which can be the key to predicting the occurrence of strong movements in the market. Indeed, let us assume that at the moment the market is in a transition mode from a random walk to a strong trend. This means that after a certain time, the amplitude of fluctuations on large scales (for example, several months) will become significantly larger than the current amplitude (arrow 2 in graph 1 shows the transition from a random walk to a trend on large time scales). This simultaneously means (due to the property of a power function) that on small time scales (hours, days of the week) there should be a decrease in the amplitude of oscillations compared to the previous period (arrow 1 in graph 1 shows such a transition on small scales). Thus, by observing the behavior of the amplitude on small scales, in some cases it is possible to predict a significant increase in the amplitude of price fluctuations in the future.

Market conditions with increased amplitude of fluctuations are usually observed in corners (sharp rises in market prices) or crashes (sharp collapses). The effect of increasing large-scale oscillations while decreasing small-scale ones was theoretically substantiated by the authors 6 . As testing has shown across the entire financial database mentioned above, this effect occurs with a probability of 70–80%. In those cases where it is possible to minimize the influence of external factors, this percentage turns out to be even higher.

Prospects 2011

The most interesting, of course, is the forecast using this method not of local movements in individual stocks, but of global events such as the global financial crisis of 2008. When analyzing this kind of analysis, in addition to the behavior of individual country indices, one should also take into account the flow of capital in the global financial market, which has been greatly liberalized over the past 20 years. Therefore, we selected the nine largest stock markets 7, both developed markets and emerging markets, built instability indicators for them and calculated the average for all markets.

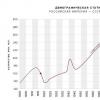

The calculation results are shown in Chart 2. Here, country indicators for different markets are depicted as lines of different colors. The indicator, averaged over all markets, is depicted as a wide red line. An increased indicator value means the market is moving to a flat mode. Decreased and upward reversal - a possible increase in the future amplitude of fluctuations and a transition to a trend mode. The figure clearly distinguishes two types of behavior. From April 2001 to April 2004, individual country indicators behaved quite independently of each other, which led to the fact that the average indicator fluctuated around zero. In the language of microeconomics, this apparently meant that participants in individual markets made decisions without significant consideration of what was happening in neighboring markets. After April 2004, the synchronization of individual indicators begins: they all decrease and increase at approximately the same time, which leads to quite strong fluctuations in the average indicator. From May 2009 to May 2010, there was also a rather weak synchronization, and from May 2010, all country indicators simultaneously began to decline synchronously. What happened in the stock markets?

In Chart 3, the average indicator constructed above (red dotted line) is presented together with the average aggregated index of the original series (blue solid line), which includes stock indices of the specified markets. This approach excludes the factor of influence of stock markets of different countries on each other, which is associated with the flow of capital in the global financial market. The graph shows that the indicator has shown a sharp decrease in small-scale fluctuations, two times since 2001. The first time was in December 2004, after which six months later a rapid growth of all indices followed, which lasted about two years. The second time was in April 2008, after which also about six months later, due to the crisis, there was a sharp drop in all indices.

In addition, the graph shows that a new signal is currently being actively formed, which is a harbinger of strong fluctuations in the stock market in the medium term (from six months to one year). And although the indicator does not say anything about which direction the movement will take place, the information obtained may be quite sufficient, for example, to build a successful asset management strategy in the stock market. If we define the forecast more precisely, then based on it it turns out that the recovery will either be rapid with a possible exit to historical highs of stock markets as early as next year (the minimum value of the RTS index, which in this case will be reached, is 2150 points), or stock markets will cover something similar to the second wave of the crisis (in this scenario, the minimum target for the RTS index will be 1050 points). It should be noted that the forecast is in clear contradiction with the generally accepted expectation of a “slow exit from recession.”

From the point of view of a theory based on the fractal properties of prices, a decrease in the amplitude of fluctuations on small scales should be accompanied by two most significant effects: a general decrease in trading activity in the markets and a special adjustment of participants to each other’s actions. The second, unfortunately, is not currently possible to verify using methods independent of fractal analysis. But trading activity has indeed decreased. Thus, the average weekly trading volume Russian shares, according to the MICEX, decreased to 230 billion rubles. for January-November 2010 from 253 billion rubles. in the same period of 2009. In the US, the decline is even more significant - from $5.5 billion to $4.7 billion over the same periods.

To conclude this article, let's say a few words about the effect of increasing large-scale oscillations while decreasing small-scale ones. Essentially, this effect means that trends in complex systems (natural, social, technological), which form very slowly and imperceptibly, but have increased persistence, often become global over time, determining the main vector of development of such systems. Note that the well-known calm effect(suppression of the high-frequency component of noise), which usually precedes natural disasters (for example, earthquakes), is a particular manifestation of this effect. Thus, many global trends in their evolution actually resemble mustard seed from Gospel parable, “which, although smaller than all seeds, when it grows, is greater than all herbs and becomes a tree, so that the birds of the air come and take refuge in its branches” (Matthew 13:32).

1 The history of the emergence of fractal geometry was described in sufficient detail by one of the authors in the article “From MA to FRAMA via EMA and Fractal”, published in D′ No. 15 for August 23, 2010 (algoritmus.ru/?p=2638).

2 Mandelbrot B. The Fractal Geometry of Nature. San Francisco: W. H. Freeman, 1982.

3 See Shiryaev A. N. “ Fundamentals of stochastic financial mathematics". T. 1. M.: “Phasis”, 1998.

4 See Mandelbrot B. Journal of Business. № 36, 1963; Mandelbrot B. & Van Ness SIAMRev. № 10, 1968.

5 See V. M. Polterovich “ EconomicsciencemodernRussia» . №1, 1998.

6 See Dubovikov M. M., Starchenko N. S., Dubovikov M. S. Physica A 339 591, 2004.

7 USA, Germany, France, Japan, Russia, Brazil, China, Korea.

Behavior of the average stock index (blue line, right scale, starting value in April 2001 is taken as one) and the average instability indicator (red dotted line, left scale)

Fractals are quite popular among many traders. Interest in fractal analysis arose after the publication of several works by Bill Williams on this topic. Fractals were invented before him, but were referred to under a different name. Williams, studying financial markets, came to the conclusion that the movements of the rates of many financial instruments are chaotic. As a result of his research, he proved that the graph of changes in the value of cotton is similar to the coastline and the movement of blood in the human body.

In his research, Williams came to the conclusion that markets are chaotic rather than linear systems, so the use of indicators based on linear functions, no use. In his opinion, stability in the markets is present only a small fraction of the time, and in all other cases chaos reigns in them.

A fractal is a repeating formation that can be found in one form or another on any price chart. Coastline fractals, like stock market fractals, are of the same nature. A fractal consists of at least five bars.

Upper and lower fractals can be in the same group of bars. Sometimes an upper and lower fractal are formed simultaneously on the same bar. When a fractal is formed, it is endowed with all the properties.

When assessing the upper fractal, you need to pay attention to its maximum. When studying the lower, accordingly, the minimum. A fractal start is formed from two successive fractals directed in different directions. The fractal signal appears on the side opposite to the start. The fractal stop is located behind the far fractal. If an opposite signal appears, it cancels the previous ones.

This technique allows you to increase the percentage of profitable trades, but the average losing trade will be higher. Since stop losses when using such a strategy will be infrequent, you can ultimately count on good profits. Fractal market analysis does not always give 100% profitable trades. In this regard, it should not be used only in a trading system. It is recommended to use other tools to confirm signals or filter.

When using fractal analysis, it is also important to study data from different time frames. The system that Bill Williams described in his works is trendy. To use it correctly, you must first determine the dominant trend in the market by looking at the older period.

The system should also take into account the “fractal lever”. This is the name of the possible amplitude during rollbacks. You can evaluate “fractal leverage” using the standard Fibonacci lines that are available in MT4. Corrections up to 38% Fibonacci are evidence of a strong trend movement. In this case, the fractal lever is strong. The opposite is true if the rollbacks are 62% fib or more.

Fractals and wave theory

Fractals can also be used in conjunction with wave theory. After all, in its essence, a fractal is nothing more than the beginning or end of an impulse movement or wave. A certain complexity arises here, because different impulses are formed at different periods of the charts. Traders who have gained experience in using wave theory have no difficulty in accurately identifying a specific wave on a specific time frame.

If several groups of fractals are formed at the same level, then if this level is broken through, a long and powerful trend should be expected. Fractal market analysis gives very good results in the presence of trends. When the price stays in the channels for a long time, the strategy for breaking out the fractal brings losses. The difficulty is that recognizing an emerging flat can be quite difficult.

How to apply a fractal strategy in a flat?

You should trade a breakout only in the direction of a pronounced trend. You should not worry about several losses in a row. The future profit will certainly cover all the losses that the strategy incurred during fluctuations in the corridor. A good effect is achieved when working on small time intervals. If a trader enters a fractal breakout based on the daily chart, then a stop loss can be set based on H4. Typically, the more fractals are located at the same level and the longer the flat lasts, the stronger and more directional the future movement will be.

To reliably determine whether a fractal breakout is true or false, you can use breakout candlestick analysis. If the breakout candle is “strong”, that is, it has a large body and its closing level is located far from clusters of fractals, then there is a high probability that the movement will continue in the chosen direction. Using this conclusion, you can successfully trade on small charts in order to increase profits. For example, if yesterday there was a breakout on D1, then today we can consider breakouts on the four-hour chart.

If after the breakdown of a cluster of fractals a reversal candlestick pattern has formed, then in the future most likely a flat will reign in the market and new fractals will appear. In this regard, great attention should be paid to the analysis of the breakout candle. To increase efficiency, it is recommended to familiarize yourself with at least the basics of Price Action (candlestick analysis).

Bill Williams recommended looking not only at the reversal candle, but also analyzing the volume. If the candle has a large body, but the volume is small, then the signal is weak. Signals that come from fractal clusters are strong when they form on longer-term charts (as is the case with candlestick analysis). Williams himself recommended watching D1. At the same time, it is necessary to analyze other timeframes. As mentioned in this article, fractal analysis is best combined with something else to increase the profitability of the strategy, because no tool can boast of 100% accurate signals.

The video contains useful information on the topic under consideration.

The best Forex and binary options brokers

| Broker | Founded | Regulator | Min. deposit |

Year of manufacture: 2004

Genre : finance, forex, trading

Publisher:"Internet trading"

Format: DjVu

Quality : Scanned pages

Number of pages: 304

Description : It's time to take a more holistic look at how markets work. In particular, it is time to recognize the greater heterogeneity that underlies markets. All investors do not participate for the same reason, nor do investors use their strategies over the same investment horizons. The stability of markets is inevitably associated with the heterogeneity of investors. The “mature” market is heterogeneous, as well as old. If all participants had the same investment horizon, if they responded to the same information in the same way and invested for the same purpose, instability would reign everywhere. Mature markets, on the other hand, have been remarkably stable for a long time. A day trader can trade anonymously with a pension fund: the former trades frequently for short-term profits; the latter trades infrequently and for the sake of long-term financial security. The day trader reacts to technical trends; pension fund investments are based on long-term economic growth potential. And yet, everyone acts simultaneously, and each diversifies the other. The reductionist approach, with its rational investor approach, cannot cope with such heterogeneity without complex multi-element models that resemble a Rube Goldberg contraption. These models, characterized by numerous limiting assumptions and requirements, inevitably fail. They are so complex that they lack flexibility, and flexibility is a critical factor in any dynamic system.

The first goal of this book is to present the fractal market hypothesis - a basic reformulation of how and why markets function. The second goal of the book is to present tools for analyzing markets within a fractal framework. Many existing tools can be used for this purpose. I'll introduce new tools that analysts can add to their toolkit, as well as review existing tools.

This book is not a story, although the main emphasis is still on conceptual aspects. Analytical methods are scrutinized within the conceptual framework. As with the previous book, I believe anyone with a solid background in business statistics will find much useful information here. The main emphasis is not on dynamics, but on empirical statistics, i.e. on time series analysis to determine what we are dealing with.

Fractal analysis of financial markets is relative new way predicting behavior exchange rates on the market. Instead of mechanical systems and indicators, this type of analysis uses a completely new approach based on fractals. Thanks to this, it became not just an alternative to technical analysis, but also allowed us to get rid of its shortcomings. Before talking about fractal analysis itself, you need to understand what it is based on:

In fact, he did a lot of work before declaring that markets are in fact in constant motion, which is similar to the movement of chaotic systems and is not at all linear, as previously thought. For the same reason, Bill Williams affirmatively stated that when analyzing a chaotic market, it is stupid to base your conclusions on ordinary, linear indicators. After all, chaotic movement in the market is constant, but stability, on the contrary, is changeable. To give examples, we can say that the prices of grain, cotton or stocks, as well as the movement of water in a pipe or blood, have an identical structure.

Subsequently, the method of fractal market analysis became widespread among many traders, thanks to Williams’ books such as “Trading Chaos”, “Trading Chaos Second Edition” and “New Dimensions in Stock Trading”.

Fractal analysis of the Forex market

Despite the positive results of such an analysis, it should be remembered that this analysis does not work 100%. There are also erroneous signals here, so you should not use it in pure form- this is, first of all, another method of analysis, which can become the main or additional one for a trader. The trader also needs to take into account that when using this type of analysis, he will need to master the technique of connecting timeframes for his strategy. The synthesis technique was also introduced by Bill Williams, who applied it only to trending positions, based on trends on a higher time frame.

In addition, an important point in this type of analysis is the “fractal lever” - the depth of the rollback of the previous movement. To measure this movement (fractal leverage), it is necessary to stretch the Fibonacci grid to the last movement. If the rollback on the grid is less than 38%, this is a strong fractal leverage and confident movement. If the retracement is greater and is 62% on the Fibonacci grid, then the fractal leverage is small and the movement is very weak.

Since fractal analysis as is is not 100% effective, most traders use it in conjunction with Elliott waves. After all, a fractal is, in fact, a turning point where the beginning or end of the next wave is formed. Bill Williams himself in his book “Trading Chaos” recommends using these waves. But since it is quite difficult to correctly calculate waves, it will also be very difficult for a beginner to make a correct forecast using fractals without some experience in determining waves. Therefore, for beginners, you need something simpler, such as trend lines.

How to start using fractal analysis?

A novice trader must first learn to make small, short-term forecasts, since they require less external data. To do this, it is better to use a familiar currency pair, commodity or other asset with which the trader has already worked. A trader needs to make a forecast and monitor whether it was justified or not. If the forecast is incorrect, then the trader needs to understand the reason why this happened. Find out where his mistake lies, perhaps he did not take something into account in his analysis.

If a trader made the correct forecast several times and correctly determined the price change, even before the trend he identified became visible to other participants, this is an excellent result.

Moreover, the novice trader has an advantage. Since brokers offer their clients demo accounts with real market quotes, a novice trader can practice without risking anything.

Also using fractal analysis, a trader must pay increased attention to the factors that formed the price in a certain period of time. This is done so that the trader can be more confident in his forecast. After all, if social, political and other factors coincide, there is a high probability that the price will behave in exactly the same way as before in a similar situation. Therefore, fractal analysis, in addition to knowledge about the formation of the fractal itself, also requires knowledge from the trader. Accordingly, it would be very useful to learn at least the basics of fundamental analysis.

Fractal market analysis is more complex than it seems at first glance and requires the trader to have knowledge in various areas of financial market analysis: fundamental analysis (which is already difficult in itself), timeframe synthesis, economic and other indicators that work together to filter false signals, and so on. . But at the same time, fractal analysis allows a trader to discover the relationship between past and future prices. Which in turn allows you to more accurately determine the future rise or fall of prices earlier than other traders. Since they are basically waiting for the market to confirm their intentions.

Due to its complexity, such analysis is used by experienced and strong traders. But on the other hand, it is worth understanding this method of analysis, because it is as effective as it is complex.