The company's cash position. Stock market technologies: Brokerage trading system. Technology and hardware

A cash position is the amount of cash that a company investment fund or the bank has on its books at a particular point in time. A cash position is a sign of financial strength and liquidity. In addition to cash, this position often takes into account highly liquid assets such as certificates of deposit, short-term state debt and other cash equivalents.

BREAKING DOWN "Cash Position"

Cash position refers specifically to an organization's level of cash in relation to its expenses and liabilities. Internal stakeholders look at the cash position as often as daily, and external investors and analysts look at the organization's cash position in their quarterly cash flow statement. A stable cash position is one that allows a company or other entity to cover its current liabilities with a combination of cash and liquid assets.However, when a company has a large cash position above and beyond its current liabilities, it is a strong signal of financial strength. This is because cash is needed to finance growing operations and pay off liabilities. However, too much cash position can often signal waste as the funds generate very little profit.

Other institutions, such as commercial and investment banks, are generally required to have a minimum cash position that is based on the amount of funds it holds. This ensures that the bank is able to pay its account holders if they require funding. When an investment fund has a large cash position, it is often a sign that it sees few attractive investments in the market and is sitting comfortably on the sidelines.

Cash Position and Liquidity Indicators

An organization's cash position is usually analyzed using liquidity ratios. For example, the current ratio is defined as a company's current assets divided by its current liabilities. It measures the ability of an organization to meet its short-term liabilities. If this ratio is greater than one, it means that the company has sufficient cash to continue working.

The cash position can be found by looking at the company's free cash flow (FCF). This FCF can be found by taking a company's operating cash flow and subtracting its short-term and long-term capital expenditures.

Example of a monetary situation

External analysts often look at a company's FCF to evaluate its performance. For example, Chase Corp. as of July 14, 2016, has an FCF that is 40% higher than its net income, representing an FCF yield of 7.2%. This means its available FCF is $34 million per year, which is expected to be used to cover obligations under its line of credit with Bank of America.

Lex van der Wielen, Willem van Alphen, Joost Bergen

Phillip Lindow, Vasily Chekulaev Chapter from the book “Organization of International Money Management”

Publishing house "Olympus-Business"

In different holdings, different financial functions are transferred to shared service centers. Sometimes holding companies prefer to continue to carry out part of the work on payment transactions. For example, they can receive invoices directly from suppliers and then forward them to an inbound and outbound payment center. Sometimes it is more convenient to organize the collection of outstanding accounts receivable at the local level.

OUTSOURCING

Centralizing certain cash management functions can provide significant savings to a company. However, at a certain point, the possibilities for saving through internal centralization are exhausted. In this case, further cost reduction can only be achieved by outsourcing a number of functions. Currently, payment transaction services are offered by different participants market, including financial consulting agencies, accounting firms and banks.

More and more mid-sized companies are outsourcing some of their cash management functions to focus on their core business. In some situations, outsourcing can significantly reduce overhead costs. However, many companies are reluctant to take advantage of this opportunity, especially if they have already spent a lot of effort and money on creating their own shared services center. In addition, many companies find that directly managing a company's cash flow provides an opportunity to keep a finger on its pulse. After all, a change in cash flows may be the first sign of future troubles.

Advantages and disadvantages of centralization

The benefits of centralization include:

- concentration of knowledge and experience, allowing you to achieve better results with fewer personnel and reduce the likelihood of error;

- linking (if possible) financial positions and cash flows, leading to increased profitability and reduced costs;

- centralized procurement of financial services, allowing for volume discounts;

- Tighter control over the implementation of treasury policy.

The disadvantages of centralization are:

- deterioration of knowledge of local conditions;

- local protest against the redistribution of powers;

- decreased attention of holding companies to the tasks of centralized cash management;

- the complexity of the management information system (MIS) and the need for enterprise resource planning (EPR) systems.

Overall, the advantages of centralization outweigh its disadvantages.

Geographical structure of the treasury service

Multinational corporations with branches around the world often open regional treasury centers in three major time zones - Asian, European and American.

These regional treasury centers handle the treasury operations of all subsidiaries located in the relevant time zone. Regional treasury centers are often located in a different country than the holding company, but are nevertheless its most important divisions.

Regional centers are usually located in countries with a favorable financial and investment climate. In Europe, they can be found in cities such as Brussels, Amsterdam, Dublin, Zurich and London, which are called "financial centres". Figure 3 shows a diagram of the organizational structure of a European TNC with regional treasury centers.

Figure 3. Structure of a European holding company with treasury centers

Distribution of expenses and income related to treasury operations

In the case of centralization of all or some treasury functions, it is necessary to determine who will bear the risk associated with their implementation and how the resulting costs and income will be distributed between the centralized treasury and the holding companies. Depending on whether the centralized treasury is a profit center or a cost center, there are two options.

PROFIT CENTER

If the treasury is a profit center, then it has its own profit target. To achieve this, the treasury has the right to take financial positions that are not related to the positions of the holding companies. Whether treasury discounts or markups can be applied depends on the transfer pricing rules adopted. These discounts and surcharges must, of course, be established taking into account the opinion of the tax departments.

COST CENTER

If the treasury department does not have a profit target, it is called a cost center. In some cases, the treasury is required to immediately hedge all positions held by holding companies (defensive strategy). In other cases, the treasury is allowed to postpone a necessary hedging transaction for a while or leave some positions open (an offensive strategy). In the latter case, the treasury department is sometimes called a service center.

Separation of tasks

Having clearly outlined the tasks of the treasury department as a whole, it is necessary to precisely define the tasks of the various services within this department. The day-to-day work of a corporation's treasury consists of managing cash balances, determining positions, and entering into financial agreements. The following functions are performed:

For control purposes, the tasks of different services should be delineated as clearly as possible. One of the most important organizational risk factors is an insufficiently clear distribution of responsibilities, rights and functions. Therefore, it is necessary to give completely unambiguous answers to the questions: who is allowed to do what, and who is not; who is obliged to do what; finally, who is responsible for monitoring, authorizing and verifying?

It is especially important to distribute responsibilities between the front office and back office. The closing officer should never control the final payments. Figure 4 illustrates the distribution of functions within the treasury department.

Figure 4. Sequence of operations when conducting a treasury transaction

Sometimes companies create a special department between the front office and the back office, called the mid office. The mid-office takes on a number of tasks from other departments: its responsibilities primarily include reporting on positions, performance and risks.

Treasury control

Treasury deals with two main types of risk: operational and positional. The first arises from shortcomings in the organization itself. Examples include poor work practices, system errors, human errors and fraud. Positional risks are explained by the presence of so-called open positions, exposing the company to currency risk. To minimize these risks, the company must take certain measures.

Restrictions

To facilitate risk management, it is necessary to introduce a system of restrictions. It is necessary to specify exactly which transactions are allowed, with which counterparties and for what maximum amount. Concluding transactions that do not fit within these frameworks requires obtaining special permission. The system of restrictions concerns:

- tools used;

- possible counterparties;

- countries and currencies;

- officials, groups and (or) departments.

TOOLS

Most companies place restrictions on some of the instruments the treasurer can use to cover positions. For example, many companies prohibit the use of derivative financial instruments (derivatives). Derivatives are financial products whose value depends on the value of other financial products.

CONTRACTORS

The company must also indicate with which parties the treasurer is permitted to deal. Often a maximum amount is set for a particular counterparty. This means that the total value of all transactions with this counterparty must not exceed a certain maximum.

COUNTRIES AND CURRENCIES

Very often, when conducting its trading operations, the treasury department is required to comply with country and currency restrictions. Typically, in addition to the currency of the home country, these transactions may be concluded in the currencies of OECD countries (i.e. the most developed countries) and in the currencies of major trading partners outside the OECD area.

OFFICERS AND DEPARTMENTS

The company must determine what transactions each officer is permitted to engage in, as well as the maximum amounts involved in those transactions. These amounts are called “transaction limits”. The Company must also determine for each employee (including the Treasurer) whether and for each amount he or she is authorized to enter into or approve external transactions, such as outgoing payments, foreign exchange, money market or derivatives transactions. Each operation must have its own initiator and its own person authorizing its implementation.

Internal and positional control

Since treasury operations involve two main types of risk, the company must have two types of control - internal and positional.

INTERNAL CONTROL

Internal control is the control over treasury operational risks performed by the internal auditor or controller. Internal control includes retrospective audits to ensure that applicable requirements and restrictions were met when all contracts were concluded and all payments were made. In this regard, the internal auditor checks the following points:

- powers (who has the right to sign and for what maximum amount);

- authorization (who must approve what in advance);

- compliance with restrictions;

- compliance with procedures.

POSITIONAL CONTROL

Positional control aims to monitor the value of existing contracts. The treasurer is responsible for this. In this regard, the treasurer calculates short-term and long-term profit (loss) for each open position and for all positions together. To do this, he requires fairly frequent (at least once a day) reports on all open positions. This information allows the treasurer to take timely action if positions become unbalanced. In emergency situations, reporting data must be updated several times a day.

Treasury systems

A good information system is vital for the modern corporate treasurer. In addition to the remote service system provided by the bank, it must have a treasury information system that reflects all the company’s cash flows. The most important functions of such a system are:

- collecting information about transactions;

- reporting preparation;

- information support for decision making.

To provide reliable information, the treasury system must import it from other systems (for example, remote banking and accounts receivable/payable systems, payroll, etc.), and also obtain it from information providers such as Reuters and Bloomberg. Most systems, among other things, are directly connected to the main accounting system enterprises. Therefore, the reporting generated by the treasury system must comply with the accounting standards adopted by the company.

Figure 5 shows the most important data sources used by a treasury system, its main functions, and the purpose of the information it generates.

Figure 5. Data used and generated by the treasury system. Functions of the treasury system

Collecting information about transactions

Today, data on most transactions is entered into the treasury system by traders themselves, and the actual execution of transactions becomes possible only after they are approved by the back office. This module contains information about all restrictions and selected counterparties, which allows you to avoid unnecessary risks such as fraud.

Preparation of reports

A treasury information system can be used to evaluate the results of all treasury management activities. This system should periodically provide information on interest income and foreign exchange performance. In addition, it allows you to evaluate the income from deposits or other financial investments, as well as financing costs, and compare these indicators with the market average. The goal is to determine how optimal the actions of the corporate treasurer were. Similarly, you can evaluate the effectiveness of foreign currency transactions.

The information generated by treasury systems also includes data that is critical for company management on current and future cash positions, as well as interest rate and currency positions.

Information support for decision making: risk management

In most MNCs, the treasurer plays a major role in managing the company's risks. Treasurers' experience in managing risk—counterparty risk, foreign exchange risk, interest rate risk—as well as their knowledge of cost estimation techniques and risk measurement techniques enable them to do this job well. As the task of risk management becomes more important for the treasurer, it is necessary that the treasury system helps him evaluate open positions by interest rate and currency.

The most important concepts of risk management are:

- duration;

- value at risk (value-at-risk, VaR);

- stress testing.

Duration expresses the sensitivity to interest rate changes of, say, a portfolio of loans, and is defined as the relative change in market value resulting from a small change in interest rates. Using duration, you can, for example, calculate the decline in portfolio value if interest rates rise by 1%. For completeness, note that the duration of the entire portfolio is approximately equal to the weighted average of the durations of its components.

In professional securities trading, interest rate changes are expressed in basis points (1 basis point = 0.01%). The decrease in portfolio value due to a 1 basis point increase in the interest rate is called basis point value (BPV).

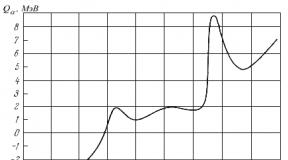

VALUE AT RISK

Value at risk (VaR) analysis allows you to assess the risks of any portfolio. In this analysis, the risk of a position or portfolio as a whole is reflected in a single metric. The VaR method is based on probability calculations and shows the maximum loss that is unlikely to be exceeded. This loss is called the portfolio's value at risk. The VaR method is based on a model whose main determinants are the volatilities of market variables, i.e. risk parameters. Risk parameter volatilities are used to calculate how much a portfolio's market value is likely to change from its current market value. Thus, the VaR model allows you to determine the possible results of a change current value portfolio. To calculate the value at risk of a loan portfolio, the expected change in the market interest rate is multiplied by the duration.

But which of the possible outcomes is value at risk or “potential loss”? To answer this question, all possible results obtained using this model are arranged in a certain order - from the largest possible losses, through smaller losses and larger gains, to the largest profit. As will soon become clear, the analyst is only interested in possible losses in this case. After all, it is with them that risk is associated, and the VaR method is a risk analysis tool. Then a certain level is selected: say, 95% of observations. Thus, we can identify losses that are exceeded only 5% of the time.

Example

The company has a loan portfolio estimated at $3 billion. USA, with a duration of 4.8. There is a 95 percent chance that the maximum interest rate change will be 20 basis points.

The value at risk of such a portfolio of loans would be:

$3 billion × 4.8 × 0.20 = $28.8 million.

The VaR method can be used not only to calculate negative changes in market value. It can also be used to calculate the negative change in interest income or loan losses. However, the principle remains the same.

VaR is a reliable indicator of possible losses under normal market conditions, i.e. The VaR method gives a loss figure that will not be exceeded in 95% of cases. However, it does not show what will happen in one of the remaining 5% of cases and what losses the company will suffer.

STRESS TESTING

Under normal circumstances, VaR is a useful tool for assessing portfolio risk. However, as we have seen, it is not suitable for emergency situations. This is why an additional method is needed to provide more information about the risks during a market emergency. This additional method is called stress testing.

Stress testing is the general name for a whole group of methods. Their main principle is the analysis of portfolio risks under conditions of marginal changes in price or interest rate. Stress testing determines whether a company will survive a market cataclysm. Most often, a stress test is carried out as a scenario analysis. The treasurer must make certain assumptions about what emergencies may arise in the market. However, these estimated changes in market conditions should not be insignificant, since in this case the stress test would give essentially the same results as the VaR analysis. At the same time, the test parameters should not be too high, so as not to make the selected scenario implausible and unlikely. In other words, the treasurer is obliged to choose realistically possible options for unfavorable developments that the board of directors could take seriously.

Typically, a back-office is understood as a department whose responsibilities include internal accounting of transactions performed by a company (bank).

Front office - departments and services of a company (bank) directly involved in concluding transactions.

I read the book “The Peter Lynch Method. Strategy and tactics of the individual investor." In his book, Peter Lynch reveals a lot of different information about what you should pay attention to when buying American stocks. For myself, from this book I highlighted the chapter “key investor indicators”, which I will briefly outline in this article. Even though this book is about the American market, I think we can take something from it and apply it to our reality in Russian market.

Indicators that you should pay attention to when deciding whether to buy a stock. The order in which they appear is not related to their significance:

1. Share of sales.

If the company's interest is due to a particular product, the first step is to find out what this product means for the company, what is its share in the company's sales. If the share of sales of products you are interested in in the total income of the enterprise is not large (less than 10%), then you should not choose this company to buy shares only because of the product. You need to ask if there is another manufacturer of this product or forget about it.

2. P/E ratio

Serious earnings analysis involves the ratio of a stock's price to its earnings, known as the P/E ratio or multiple. This coefficient numerically characterizes the relationship between the stock price and the company's profit. The P/E ratio helps you understand whether a stock is overvalued or undervalued relative to the company's earnings potential. The P/E ratio can be thought of as the number of years it will take to pay back the initial investment, assuming earnings remain the same.

If you buy shares whose price is twice as high as earnings (P/E=2), then the initial investment will pay off in two years, and if its price is 40 times higher (P/E=40), then after 40 years. Slow-growing companies have the lowest P/Es, high-growth companies have the highest P/Es, and cyclicals have the highest P/Es. Below average P/E is (7-9), average P/E is (10-14), above average P/E (14-20). But buying shares just because a company's P/E is low makes no sense.

A company with fairly priced shares has a P/E equal to its earnings growth rate. For example, Coca-Cola, with an equal P/E of 15, should grow profits by 15% per year. If P/E half as much profit growth rate, this is considered very positive signal if at two more growth rate is very negative.

You need to read the company's consolidated balance sheet, which shows assets and liabilities. Pay attention to short-term assets in the form of cash and cash equivalents, plus in the form of liquid shares. These two items constitute the cash position.

It is also necessary to refer to the second part of the balance sheet, namely the article “ Long-term loans". A reduction in debt obligations compared to previous years is a sign of prosperity. A cash position that far exceeds debt obligations improves the balance sheet. A lower cash position worsens the balance sheet. The calculations do not take into account short-term debt, given that the value of the company's other assets (inventory, etc.) exceeds short-term debt obligations.

Need to determine net cash position from the company's prepared statement by subtracting long-term debt from the cash position. Often long-term liabilities are higher than the cash position, cash items are reduced, debt increases, and the company has a weak financial position.

Dividing the net cash position by the number of issued shares of the company shows that per 1 share there is N amount of cash, this indicator is important. He says that N is the amount of cash per share, a kind of paper bonus that represents a hidden return of money. In addition, information about the company's own share repurchase is also important, which is a good sign. It is also necessary to take into account information about whether profits are growing and whether dividends are always paid. Target brief analysis is to find out whether the company's position is weak or strong.

4. Share of borrowed funds

How much does the company owe and how much debt does it have? Debt versus equity. This is the question that a credit officer is interested in when determining your credit risk.

A company's financial strength can be quickly assessed by comparing equity with debt on the right side of the balance sheet. It is necessary to calculate the debt/equity ratio (total share capital of the company).” In a normal balance sheet, equity should account for 75% and debt should account for 25% of the ratio. Short-term liabilities can be ignored when assessing if there are enough cash to cover them. Weak balance if 80% debt, and 20% equity.

Bank loans are the worst type of borrowing and are repayable on demand. Bond loans are the best type of borrowing; they do not provide for payment on demand while the borrower pays interest.

5. Dividends

Those who pay dividends are not inclined to throw away money on diversification. Dividends keep stocks from falling to a certain extent. On the other hand, less large companies Those that don't pay dividends and use the money to expand profits often experience faster growth.

prefers a company with an aggressive growth policy over boring companies that pay stable dividends. If you're buying a company's shares for the stability of its dividend payments, ask about the company's ability to pay them during downturns and financial difficulties. The best option for an investor is a company that increases dividends for 20-30 years.

6. Book value

Book value often has no relation to the actual value of the company. It is either higher or lower than the real value of the company. Overvalued assets are especially treacherous when there is a lot of debt.

Hidden assets: Book value is lower than actual value as often as it is higher. Companies that own natural resources (land, timber, oil, precious metals) or brands like Coca-Cola may only show a fraction of their true value on their balance sheet.

7. Cash flow

Cash flow is the amount of money a company receives as a result of its activities. All companies receive funds, but the costs associated with receiving them are different for everyone. If it requires significant expenses to generate cash, the company will not be able to get very far. You need to take into account free cash flow - this is the money that remains after subtracting capital costs.

Cash flow is used to value a stock. A stock priced at $20 with annual cash flow of $2 per share has a standard ratio of 1/10. This 10% cash flow yield represents the stock's minimum expected return over the long term.

will compete with the old one, as a result, inventories will increase so much that the company will have to greatly reduce prices, and therefore profits. Rising inventories aren't as bad for auto companies.

9. Pension plans

The absence of pension obligations is a big plus. Even in bankruptcy, the company is obliged to fulfill pension obligations.

A business that, despite annual price increases, retains its clientele is an excellent investment opportunity. All other things being equal, a company with a growth rate of 20% and a P/E of 20 is a much better acquisition than a company with a growth rate of 10% and a P/E of 10.

11. Summary

The bottom line is the number at the end of the income statement, in other words profit after tax. Profit before taxes or gross profit is the main indicator by which a company is evaluated. It shows what is left of annual sales revenue after subtracting all costs, including depreciation and interest payments. Comparing the gross profit of companies in different industries is of little use; comparison in the same industry is another matter. The company with the highest gross profit is the lowest cost business, and the business in turn has the highest chance of survival.

Here is a brief summary of the important points of the book that I wrote; they were the first things I noticed when reading it.

Trading on the stock exchange in the 21st century is an extremely high-tech process. In order for an investor to carry out a transaction, various trading terminals are developed, brokerage systems are created that can cope with heavy loads, APIs are implemented for them, high-speed communication channels are laid, new technologies are introduced, etc. This is not surprising - after all, the difference between success and failure, profit or loss in the stock market is often only a fraction of a second. Therefore, everything should work like clockwork and very quickly.

We have already talked about direct connection technologies, which are used to send trading orders directly to the exchange, bypassing the broker's systems. However, direct access costs a lot of money and is not affordable for all traders, who nevertheless want to make transactions with maximum speed. In this topic we will talk about how we carried out a complete upgrade of our trading system, which allowed us to create an infrastructure product that meets world technology standards stock market.

Welcome to the matrix

ITinvest has always been not just a broker that provides clients with the opportunity to trade on the stock exchange, but also a technological developer of trading products. Our founders are people who had experience in programming and have always been associated with technology. Therefore, part of the company's strategy has always been the development of its own software products.Both money and time have always been invested in this. As a result, at the beginning of the 2000s, its own trading system, it-trade, was created, which included modules for processing trade orders, middle and back offices, as well as a digital signature system to ensure security. In addition, we have created a line of our own trading terminals. One of them, SmartTrade, has become very popular on the Russian market and, in principle, still remains a reliable and convenient means of placing trading orders on the market and analyzing the market itself. Clients could also carry out trading operations using the web interface.

The system has been operating for more than 13 years and the entire set of software products is objectively outdated. It became increasingly difficult to maintain them and develop functionality (one SmartTrade terminal has more than 1 million lines of code), in addition, the architecture itself also ceased to meet modern requirements - we had two trading desks with servers, and in order to develop the company’s business, their the number had to be increased, which would lead to problems with controllability and synchronization.

As a result, all efforts were spent on maintaining and normal functioning shopping complex, but there was no talk of developing new products. Requirements for work speed and quality were constantly growing, and meeting them within the framework of the old architecture and paradigm was becoming increasingly difficult. In addition, the “old” trading system had one weak link - its core, the risk management system (RMS), which fundamentally could not be parallelized and duplicated. Accordingly, its failure could stop trade.

All this confronted us with the need to create a new trading system that would meet the best world standards. Due to its matrix structure, and also due to the fact that the apparatus of matrix theory was used in calculating risks, the new system was called MatriX, that is, “Matrix”.

Architecture

If in the previous generation brokerage system clients received all exchange data (orders, transactions, account status, etc.) by connecting to a single access server, then in the Matrix project it was decided to divide these data streams into two main “banks”: servers for order acceptance servers (Order Mamagemegent Servers - OMS), and servers that supply market data and account information to clients.The hardware of the complex uses PowerEdge blade servers and PowerVault storage systems from Dell.

Technology and hardware

In addition to the architecture, the quality of a brokerage trading system depends on the quality of the software that implements the main functions, as well as on the reliability of the hardware on which it runs. In order to be sure that our product truly complies with global standards, tenders were held among suppliers of both hardware solutions and software developers.As a result, the iron part new system was provided by Dell, and the software (and some hardware) was supplied to us by IBM.

Dell PowerEdge Servers

Under each of these balancer servers there are several more servers that solve local problems. Client connections are distributed among them so that each server receives the same load.

Our servers are connected to each other and to the exchange trading system using a special high-speed bus built on IBM Data Power X75 and software MQ Low Latency Messaging.

Interesting fact: The MatriX project is the first case of using these servers in Russia. By the way, there were even some problems associated with this - the United States recognizes these technologies as having a dual purpose. That is, there is a possibility that someone will use them for military purposes. Due to the delays associated with all this, the delivery dates for equipment were delayed by as much as six months - and we were lucky that the famous Jackson-Vanik amendment was canceled, otherwise it is unknown how everything would have turned out in the end.

Behind this bus there are already exchange gateway servers. The bus decides on its own which of them to send a specific request through, or which of them to take data from. In principle, this is enough for the normal functioning of the entire system, but we also added a risk management server to it, which, unlike the previous system, is now not a central link, and any problems with it do not cause the entire system to stop.

Another innovation is the so-called FIX servers, which allow you to connect applications written under the FIX protocol to the MatriX vehicle. We will talk about this solution in more detail in a separate topic.

The final system architecture looks like this:

What did it give?

This “matrix” approach to building a system made it possible to reduce the damage from possible failures (failure of a specific link does not lead to irreversible consequences), and also makes it possible to easily scale the system in the future. What is most important is that the speed of work has increased dramatically. Now the application processing speed in the system ranges from 500 microseconds to 2 - this is a very good result. The total time for an application to pass from the moment it enters the “Matrix” to its output to the exchange systems is from 2 to 5 milliseconds (excluding losses on communication channels to the system) - this is approximately 40/50 times faster than in the previous generation IT system. trade|SmartTrade…For traders trading hands this is, of course, not so important, but for algorithmic traders using robots connected via API it is a significant advantage.

Other advantages of the new trading system include:

- Increased productivity (up to 2000 orders per second in one thread, more than 10 million orders per trading day).

- The already mentioned ability to access external systems via OMS-FIX 4.4 Gates.

- Single cash position (SCP) and own risk accounting for client portfolios.

Single cash position

The single cash position service for clients has become one of the main “features” of the entire new trading system. Its essence is as follows:When working with the previous version of the it-trade/SmartTrade trading system, the client was provided with a separate personal account for each trading platform. For example, the Moscow Exchange Stock Market is an MS account; Moscow Exchange derivatives market - RF account; Currency market Moscow Exchange - FX account (non-deliverable) or CD account (deliverable) and others. With such a division, securities and funds located on one trading platform cannot serve as collateral for transactions on another.

When using a single cash position, the client is provided with a single account with an MO identifier, which includes several trading platforms at once:

- Stock market of the Moscow Exchange (all instruments traded in T+2 mode).

- Derivatives market of the Moscow Exchange (futures, options).

- Foreign exchange market of the Moscow Exchange (non-deliverable mode).

- London Stock Exchange section IOB (ADRs of Russian issuers).

The easiest way to understand the benefits of a single cash position is simple example. If in the old it-trade trading system, to purchase 100 shares of Lukoil (LKOH), 43,800 rubles would be required as collateral (the cost of a share as of 10/22/2013 was 2,030 rubles, the amount of collateral for the T+2 market was 438 rubles, i.e. . 100 x 438 - 43500), and to sell 10 futures contracts for shares of the same issuer LKOH-12.13 (on the same date, 1 futures cost 20,650 rubles, collateral - 2,132 rubles) would require 10 x 2132 = 21320 rubles In total, to complete two not very large transactions, the amount of funds required to secure the transaction would exceed 65,000 rubles.

In the new trading system it would be equal to 26,746 rubles. The difference is quite significant - it turns out that you can manage your own funds more flexibly; they can work, rather than being idle in a state blocked as collateral.

Need for Speed

A single cash position, as you might guess, with all its advantages, can be of interest to traders and traders of any type - from investors who do not make very many transactions, to scalpers who do not take their fingers off the keyboard.At the same time, it is obvious that the speed advantages of the Matrix trading system most of all attract high-speed traders (HFT traders) who trade on the stock exchange using mechanical trading systems. It is this type of traders that “makes” most of the turnover of all popular exchange platforms. Such traders play a big role in the stock market ecosystem (read our special topic for more information about the trends and prospects of algorithmic trading). But no algorithmic trading strategy, even the most successful in theory, can work properly in practice if proper speed is not ensured.

Therefore, both the exchanges themselves and brokers are constantly developing their own infrastructure - in 2010 alone, exchanges, telecommunications companies, algorithmic hedge funds, corporate and private algorithmic traders spent more than $2 billion on technical re-equipment in order to increase the speed of trading worldwide.

Domestic exchange platforms (in particular, the Moscow Exchange) also follow this trend. If in 2010 the execution time of orders in the trading systems ASTS (MICEX stock market) and FORTS (RTS derivatives market) was 5-15 and 15-50 ms, respectively, then already in 2013 the figures were 0.700 ms and 3-5 ms. Now the execution time of orders in the core of the exchange system does not exceed 50 microseconds.

When looking at all these efforts, it is clear that brokers simply do not have the right to lag behind, so further upgrade and improvement of this link in the chain that the application passes on the way from the user to the exchange is simply inevitable.

Tags: Add tags

Single Cash Position (SMP) is a modern service with great margin trading capabilities, available in our MATRIx trading system. The EDP has replaced the rigid division of a brokerage account into several trading platforms, but if desired, the client can open separate accounts, the balances of which will not be taken into account in the Single Cash Position.

Together with the Single Money Position, you will have a single “Money” (MO) account, which can be used on several trading platforms at once:

- Stock market of the Moscow Exchange (all instruments traded in T+2 mode)

- Moscow Exchange derivatives market (futures, options)

- Foreign exchange market and precious metals market of the Moscow Exchange (non-deliverable mode)

- Foreign market valuable papers St. Petersburg Exchange

Assets that were purchased on one market trading platform can be used as collateral on other markets included in a single cash position.

In addition to the personal accounts that are included in the EDP and are combined within one money account with the suffix - MO (Money), the MATRIx trading system may contain personal accounts (portfolios) not included in the EDP. The old suffixes are retained for them. Assets in these accounts cannot serve as collateral for transactions in other accounts. Including for accounts included in the EDP.

A single cash position is convenient because:

You have access to a single risk management for all trading platforms.

You have the opportunity to balance risk across correlated instruments.

The amounts of guarantee collateral and the cost of funding operations will be lower.

You will be able to use previously unavailable arbitrage operations.

The shoulder size will be increased.

You will not need to transfer funds between sites included in the Unified Cash Position.

Example 1: Reducing the amount of guarantee collateral. LKOH (OJSC NK Lukoil) shares purchased with “our own” money (without “leverage”) are collateral for a position on a futures contract on the RTS index.

Example 2: Risk balancing for correlated instruments. The purchased shares of SBER (Sberbank PJSC) are collateral for a short position under the futures contract SBRF-6.18 (June futures for shares of Sberbank PJSC) and form an arbitrage pair, the risks of which are balanced.

Example* Buying 100 shares of SBER and selling 1 futures contract SBRF-6.18

Share price: RUB 21,426. The initial margin for opening a position is RUB 9,411.

Futures contract price: RUB 21,719. GO - 4,202 rub.

Settlements on trading platforms that are part of the EDP occur on a single MO account.

Read also...

- Will I get married? Fortune telling online. Fortune telling for a new acquaintance. Fortune telling with playing cards Fortune telling by a friend

- Morozov Nikolay Aleksandrovich Nikolay Morozov Narodnaya Volya

- You can cook French fries in the microwave How to make your own French fries in the microwave

- Crispy pickled cucumbers in jars