What is account card 51 for a bank. See what “51 counts” is in other dictionaries. Reflection of the cashless system in accounting

Account 51 "Current accounts" is intended to summarize information on the availability and flow of funds in foreign currency Russian Federation on the organization's current accounts opened with credit institutions.

The debit of account 51 “Settlement accounts” reflects the receipt of funds to the organization’s settlement accounts. The credit of account 51 “Current accounts” reflects the write-off of funds from the organization’s current accounts. Amounts erroneously credited or debited to the organization's current account and discovered when checking statements credit organization, are reflected in count 76“Settlements with various debtors and creditors” (sub-account “Settlements for claims”).

Transactions on the current account are reflected in accounting on the basis of statements from the credit institution on the current account and the monetary settlement documents attached to them.

Analytical accounting for account 51 “Current accounts” is maintained for each current account.

Account 51 "Current accounts"

corresponds with accounts

| by debit | on loan |

|

50 Cashier 51 Current accounts 52 Currency accounts 55 Special bank accounts 57 Transfers on the way 58 Financial investments 75 Settlements with founders 80 Authorized capital 86 Targeted financing 90 Sales 91 Other income and expenses 98 Deferred income 99 Profit and loss |

04 Intangible assets 50 Cashier 51 Current accounts 52 Currency accounts 55 Special bank accounts 57 Transfers on the way 58 Financial investments 60 Settlements with suppliers and contractors 62 Settlements with buyers and customers 66 Calculations for short-term loans and borrowings 67 Calculations for long-term loans and borrowings 68 Calculations for taxes and duties 69 Calculations for social insurance and security 70 Settlements with personnel for wages 71 Settlements with accountable persons 73 Settlements with personnel for other operations 75 Settlements with founders 76 Settlements with various debtors and creditors 79 On-farm settlements 80 Authorized capital 81 Own shares (shares) 84 Retained earnings (uncovered loss) 96 Reserves for future expenses 99 Profit and loss |

Application of the chart of accounts: account 51

- In what cases will the security payment be considered taxable income of the lessor?

The security payment is counted towards the fulfillment of the corresponding obligation for... the security payment is counted towards the fulfillment of the corresponding obligation for... the amounts of money received to the lessor's current account on the simplified tax system were... the security payment was received to the current account of the lessor company on January 15 ... entries on the debit of account 51 “Settlements” and the credit of account 76 “Settlements with... on analytical accounts of account 76: on the debit of the analytical account “Settlements with...

- Pledge. Accounting and Taxation

51 "Current accounts" 50,000 Bank statement on current account, ...; 51 "Current accounts" 5,000,000 Bank statement on the current account, ... The loan amount was returned by the debtor 51 "Current accounts" 58 "... by debit of account 51 "Current accounts" in correspondence with account 76 & ... 54,000 - 300,000) 51 “Settlement accounts” 76 “Settlements with other... sales of materials from the auction organizer 51 “Settlement accounts” 76 “Settlements...

- Security costs. Accounting and tax accounting

Reflected in the debit of account 60 and the credit of account 51 "Current accounts" (Instructions... for using the Chart of Accounts... based on the invoices and invoices issued by the contractor. Cost of services for... premises 60 51 59 000 Bank statement for current account Expenses for... Instructions for using the Chart of Accounts for financial and economic... security of the general director 60 51 118 000 Bank statement for the current account

- Accounting for discounts and bonuses from the parties to the supply agreement

Documents (delivery note and invoice) in the amount of 23,600 ... 000 Payment from the buyer was received on the current account 51 62 23 600 ... the seller must issue an adjustment invoice to the buyer no later than five calendar ... Russian Federation). Based on the adjustment invoice, the seller has the right to accept... including issuing adjustment invoices) it is better not to include... 000 Premium transferred to the buyer's current account 76 51 408,000 B... 408,000 Premium received to the current account 51 76 408 000 V...

- Preparation of invoices by a broker when purchasing goods on the exchange

The cost of purchased petroleum products in the petroleum products supplier's invoice may exceed... the program for receiving and re-issuing invoices by a broker? Since most... when creating a receipt document for a current account, you need to indicate the type of agreement -... petroleum products). When money is received from the principal to the current account, the following... entries are generated: Debit 51 Credit 76.06 – received... petroleum products; Debit 76.05 Credit 51 – money transferred to the exchange...

- What exactly are entertainment expenses?

Entertainment expenses are accounted for in accounts 26 “General business expenses” ... sales” in correspondence with accounts: 60 “Settlements with suppliers ... catering for delegates. Correspondence of invoices Amount, rubles The content of the transaction... of the current account will be reflected by the posting: 76 subaccount "Settlements with the transport organization" 51 "Current account" ... 10,000.00 Paid invoice for transport... Other settlements" 51 "Current account" 10,000.00 Paid invoice for rendering...

- Accounting for the transfer of property as collateral

To reflect it, off-balance sheet account 009 is used “Securing obligations and... collateral is recorded in the debit of account 009, and upon termination... accordingly, in the credit of account 009. Referring to the description of account 009 does not allow... regularly adjusting the amount listed on account 009 (for example, to the accrued... .2016 Loan credited to the current account 51 66 10,000,000 ... - 640,893 rubles. At the expense of the value of the sold property were repaid... .78 rubles credited to the current account of the unitary enterprises. 21.04.

- How to recognize compensation for delayed payment of earnings as expenses?

The worked period must be issued to the employee with a pay slip in the form approved by the order... wages (reflected using account 70 "Settlements with personnel for... other expenses (reflected using account 73 "Settlements with personnel for... -2 " Other expenses" and to the credit of account 73. Accordingly, when paying compensation... an entry is made to the debit of account 73 and the credit of account 50 "Cash" (51 "Cash accounts"). Despite... each individual from the beginning of the billing period on an accrual basis. , with the exception of...

- Reflection of the transaction to acquire a 100% share in the authorized capital of LLC

PBU 19/02). According to the Chart of Accounts for accounting financial and economic activities... loans granted to other organizations are allocated to account 58 "Financial investments" ... shares. Analytical accounting for account 58 "Financial investments" ... the following posting will be made from the current account: Debit 76 Credit 51 "Current accounts" ...

- When can a bank refuse to open an account for you?

In concluding a bank account agreement and opening a current account? In what cases does a bank... conclude a bank account agreement and open a current account? In order to open... an account, the client needs to conclude with... the bank an offer to open a current account for the debtor in a bankruptcy case... dated June 30, 2011 No. 51 and taking into account the impossibility of fulfilling the requirement... similar situations are grounds To open a current account, a court decision on...

- Promotion of products by third parties

... (see Instructions for using the Chart of Accounts). Partially allocated to partial cost... and fees for its promotion 51 62 The reader may notice that... entrepreneurs for a fee and at the expense of the organization carry out legal and... Individual entrepreneurs, employees of the sales department opened current accounts, issued bank cards, which... and paid taxes from their checking accounts. The above was confirmed by the testimony of those interviewed... the volume of revenue received into the company's current account as payment for products...

- The sole founder deposits money into the LLC account free of charge: accounting and taxation

Participation 100%) wants to be deposited into the company's current account cash on a gratuitous basis... 100% participation) wants to deposit funds into the company's current account on a gratuitous basis... that expenses incurred from funds received from the founder... Thus, taking into account the Chart of Accounts of financial and economic accounting activities... its application (hereinafter referred to as the Chart of Accounts and Instructions), approved by order of the Ministry of Finance... accounting of the company as follows: Debit 51 (50) Credit 91, subaccount &...

- Redemption of treasury property: payment of VAT to tax agents

Cash to the seller 60 51 Bank statement on the current account The debt on... is reflected in the budget 68 51 Bank statement on the current account VAT amount (for... property 60-Av. 51 Bank statement on the current account VAT amount transferred... to budget 68 51 Bank statement on the current account... funds to the seller 60 51 Bank statement on the current account The debt on... is reflected in the budget 68 51 Bank statement on the current account * Using account 19 is advisable to...

- Application of the GHS “Rent” in an educational institution

Conclusion of an agreement (contract): corresponding analytical accounting accounts 0 401 40 121 ... right to use leased objects (in the estimated amount of the lease agreement) 0 ... right to use the asset (monthly in the estimated amount of lease payments due... use 0 401 51 241 0 401 51 251 0 210 ... 20 251 0 401 51 241 0 401 51 251 Accrued... early termination of the contract was adjusted in the remaining estimated amount of payments using the "red reversal" method... 560 0 401 51 241 0 401 51 251 0 401 ...

- Purchasing a car under a leasing agreement

Payments" 51 236000 Bank statement on the current account Accepted for deduction... 36000 Leasing agreement, invoice, bank statement on the current account Cost of the item received... payments" 51 47200 Bank statement on the current account On the date of return... payments "51 236000 Bank statement on the current account Accepted for deduction... 36000 Leasing agreement, invoice, bank statement on the current account Debt is reflected (... payments" 51 47200 Bank statement on the current account VAT has been restored with...

- (account) 1. A document indicating the debt of one person to another; invoice. A person providing professional services or selling goods may invoice his client or customer; solicitor selling on behalf of... ... Financial Dictionary

check- to take into account, to invent at someone else’s expense, there is no money, to live at someone’s expense, to take into account, to someone else’s account, to someone else’s account, not to count, to end the account, to end the account, to take words at one’s own expense, walk around at someone's expense, reduce... ... Synonym dictionary

Capital account- (capital account) 1. Account into which investments in land, buildings, structures, machinery and equipment, etc. are recorded. 2. Budgeted expenditures for major items, especially in public sector financial plans... Financial Dictionary

Check- (account) 1. A document indicating the debt of one person to another; invoice. A person providing professional services or selling goods may invoice his client or customer; solicitor selling on behalf of... ... Dictionary of business terms

Vostro account- (vostro account) A foreign bank account in a British bank, usually maintained in pounds sterling. compare: nostro account. Finance. Dictionary. 2nd ed. M.: INFRA M, Ves Mir Publishing House. Brian Butler, Brian Johnson... Financial Dictionary

DEPO NOSTRO ACCOUNT- an active analytical securities account opened in the accounting records of the domiciliant's depository. This account is intended for accounting valuable papers, placed for storage or for accounting in a depository domiciliated, or securities registered with the registrar on ... ... Legal encyclopedia

Accounting Account 20 Main Production Dictionary of business terms

Vostro account- (vostro account) A foreign bank account in a British bank, usually maintained in pounds sterling. compare: nostro account. Business. Dictionary. M.: INFRA M, Ves Mir Publishing House. Graham Betts, Barry Brindley, S. Williams... Dictionary of business terms

INVOICE- an invoice issued by the seller in the name of the buyer and certifying the actual delivery of goods or services and their cost. Issued after final acceptance of the goods by the buyer. Contains details of the sale transaction, including volume (quantity... ... Great Accounting Dictionary

ACCOUNT(S), REPORTING- (account(s)) Report on activities (operations) for a certain period. Accountability means the obligation to prepare and provide the following reports: company directors are accountable to shareholders, and British ministers are accountable for the performance of... ... Economic dictionary

ACCOUNTING ACCOUNT 20 "MAIN PRODUCTION"- an account designed to summarize information about the costs of the main production, that is, production, the products (works, services) of which were the purpose of creating this enterprise. In particular, this account is used to record costs: ... ... Dictionary of business terms

Conducting non-cash settlements with suppliers and customers today occupies one of the highest priorities in the accounting process of any enterprise or organization. In order to reflect generalized information about non-cash transactions, the company uses accounting on account 51. Let’s try to understand in more detail what features this procedure has, what nuances arise when using it, and so on.

general information

Absolutely every enterprise, in the course of its work, most often operates with cash and non-cash financial resources. In the event that a cash register is used to keep track of cash, then for the process of accounting for non-cash money, 51 accounting accounts must be used.

Most often, cash funds are used in the process of making cash payments by individuals. If we are talking about the need to make payment legal entity, then you need to use a non-cash payment method.

It should be noted that for this purpose, an enterprise has the opportunity to choose for itself the banking organization that best suits its requirements and, accordingly, opens a cash account with it.

It should be noted that for this purpose, an enterprise has the opportunity to choose for itself the banking organization that best suits its requirements and, accordingly, opens a cash account with it.

It should be said that the process of accounting for the sale and acquisition of currency is quite complex and must be considered separately from this issue.

Here we will try to figure out how is accounting carried out financial resources, what features this process has, what primary documents need to be drawn up, as well as accompanying financial transactions.

An open bank account that is associated with the organization’s activities may receive funds from other persons. These include:

- Payment for the purchase of goods.

- Payment made by a credit institution.

- Transfer of an individual.

In this matter, the recipient is the organization to whose account the funds are credited.

Using non-cash funds, the organization can make payments to suppliers of goods, services, materials, as well as. In addition, taxes, fees and charges are paid from it. It is also possible to cash out funds based on traveler's checks for wage payments, employee reporting amounts, and so on. In this matter, the organization can act as a tax payer.

The primary document on the basis of which funds will be written off from the current account is.

Performing accounting in accounting

The plan provides for an account used to record actions related to the transfer or crediting of funds by non-cash method. It is worth saying that receipts can be reflected in debit. If we talk about a loan, then this means writing off financial assets.

Note that accounting account 51 is active. If you analyze it, you will notice that it keeps records of all the existing assets of the enterprise. In turn, the loan may show a decrease in an asset or, otherwise, a decrease in financial resources.

Receipt and withdrawal of money is a business transaction. For each of these, postings must be created. To create a transaction, you must determine the presence of two accounting-type accounts that take part in this action. In addition to this, you need to add sum of money the same way, both in the table where information about debit is posted, and in the table with credit.

Nuances of crediting funds

In the process of crediting funds, you need to add them to the debit table. It is worth saying that in this case it should act as a corresponding account. In turn, the deposited amount is added to the loan.

Separately, you should talk about the write-off procedure. In this case, the received money must be added to the loan. These include correspondent type accounts, in the debit of which money is deposited. Here they depend on the purpose of the payment. Let's try to understand the most common transactions related to the write-off of non-cash funds.

Postings for accounting for non-cash funds in accounting must be made on the basis of a document that was taken from a banking organization. IN this document All receipts and write-offs must be reflected.

How to conduct

This type of account was created specifically to record, analyze and control information about the funds that the company has. It should be used to display information about the amount of funds in the national currency - Russian rubles.

Documents of various types can serve as the main evidence of available financial resources. For example, these may include statements from banking organizations or.

Speaking about the reports that are necessary to analyze this account, these include:

- Turnover balance sheet.

- Cards related to the account.

- Account analysis.

Documentation process

Absolutely all payments and receipts of funds must be entered into the cash book. Maintenance in this case is mandatory for organizations. Entries in cash books are made through the use of primary documents, which represent incoming and outgoing cash orders.

Absolutely all payments and receipts of funds must be entered into the cash book. Maintenance in this case is mandatory for organizations. Entries in cash books are made through the use of primary documents, which represent incoming and outgoing cash orders.

The process of posting funds to the cash desk must be carried out by issuing cash receipt orders. In turn, write-off occurs using cash orders in form No. KO-2.

All actions that are carried out must be provided through the use of cash registers. At the same time, there are certain exceptions in this matter that relate to certain types of activities for which forms with strict reporting can be used. Each organization must set a cash balance limit.

Thus, cash funds that may remain in the cash register until the end of the working day, as well as profits that exceed the established limit, must be transferred to a bank account after the end of work. It should be noted that the conduct of cash transactions must be regulated by certain regulatory documents, which are studied to obtain competent cash accounting and correct cash management.

Conclusion

In general, there are no difficulties in maintaining 51 accounting accounts. However, this issue has its own nuances and difficulties. That is why, often, people who are faced with this issue for the first time have certain difficulties. It is worth saying that in order to avoid difficulties, it is recommended to hire a specialist who is competent in this matter and knows the basic nuances of drawing up 51 invoices.

Such a specialist will be able to easily maintain accounting records of non-cash funds. If we are talking about a small organization, then it is advisable to hire a specialist from a third-party company that provides services of this type. Based on the contract concluded with the company, the specialist will periodically perform accounting activities.

If necessary, he will also be able to provide advice to the organization's managers on issues of interest to them related to accounting.

Please note that it is extremely important to maintain account 51 correctly, since otherwise, during tax audits or submitting reports to the tax office, competent department employees may have certain questions. Thus, the management of the organization will have to solve the problem in a short time and sometimes with the need to pay fines.

That is why, in order to prevent such problems from arising, it is recommended as responsibly as possible relates to the work of the accounting department and coordinates their actions, including in the matter of accounting.

Postings and examples for this account are presented below.

Characteristics of account 51

Account 51 of accounting is included in section V “Cash” of the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

The main characteristic of account 51 is that it is a synthetic active accounting account, which reflects all transactions occurring on the organization’s ruble current accounts. The accountant records cash inflows as a debit and expenses as a credit. The primary documents that allow him to do this are a bank statement with documents attached to it. The application can be, for example, a payment or collection order, a check, etc. Account balance 51 is the balance of money in the organization’s current account. Analytics for account 51 is carried out for each current account opened by the company with credit institutions.

Account 51 corresponds with many accounting accounts designed to reflect transactions related to cash flow. For example this:

- account 60 - for settlements with suppliers;

- account 62 - for settlements with customers;

- 70 - for settlements with employees;

- 71 - for settlements with accountable persons, and so on.

If there was an erroneous crediting or debiting of funds to the organization’s current account, then if this fact is identified, the erroneous amount must be reflected in correspondence with account 76 (sub-account “Settlements for claims”). A complete list of corresponding accounts is given in Order No. 94n.

Nonprofits and small businesses can use simplified accounting. They can significantly enlarge the breakdown of accounts and, accordingly, not use many of them. However, this does not apply to accounting account 51. It will be present in the accounting of any enterprise.

Analysis of account 51

Analysis of account 51, like other accounting reports, can be done for any period of time. The report consists of several columns.

The first column shows the accounting accounts with which account 51 corresponded. The second column shows the funds received into the current account for the selected period, in accordance with the accounting accounts to which the accountant posted the receipts. The third column is similar to the second - only for written-off funds. The top line indicates the balance, that is, the cash balance at the beginning of the selected period, the bottom line indicates the end of the period.

Don't know your rights?

This report is convenient if you need to learn in general about the movement of funds in an organization’s account and its source. For example, that the money came from the counterparty, but it does not matter from whom exactly. Or that the money was spent on taxes, but for which ones specifically, it is not necessary to know at the moment.

The analysis of the account is presented in the figure.

Sample account card 51

The account card provides complete information about the cash flow on account 51. Here, similar to the account analysis, there is an opening and closing balance for the period and turnover for the period.

In the report you can see the date of the transaction on the current account and the essence of the transaction - income or expense. The numbers of the corresponding accounts, the amounts of transactions and the account balance after each of them are indicated. You can also get an idea of what kind of operation was performed. Was it a tax transfer, payment for bank services, or receipts from the buyer. In the case of transactions with counterparties, the names of the counterparties and the numbers of accounts or agreements on the basis of which the cash flow was made can be easily read in the account card.

A sample of account card 51 is shown in the figure.

Balance sheet for account 51

The essence of the report is contained in its name: it displays the beginning and ending balance and account turnover for the selected period of time. The report is general in nature and provides information only about account balances 51 and the total amount of funds received and withdrawn from the current account. If the organization has several current accounts, then each of them will be highlighted in a separate line in the balance sheet. That is, the number of lines in the balance sheet is equal to the number of current accounts of the organization. Income and expense for each of them, respectively, will be indicated on a separate line. But the total turnover of all current accounts can be seen in the bottom line.

What the balance sheet looks like for account 51 can be seen in our figure.

***

Account 51 is one of the most frequently used accounting accounts, so it is important for every accountant to be able to correctly make entries in correspondence with it. At the same time, it is very easy to use, being an active account, and accounting reports on it provide a large share of information about the movement of finances in the enterprise.

Any economic activity of an organization is impossible without the movement of financial flows. Cash is involved in all processes occurring in enterprises of any form of ownership. Purchasing working capital, investing in fixed production assets, settlements with budgets of different levels, founders, employees of the enterprise - all production and administrative actions are carried out with the help of money and with the aim of obtaining it.

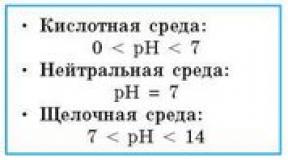

Types of calculations

In practice, two main types of payments are used - cash and non-cash. Cash, as a rule, is used for small volumes of cash flow - these are one-time payments that can be made through the company's cash desk. For small businesses with low turnover and modest income, using cash is the best option. Large companies more often adopt a cashless system; as the results of its use have shown, it is much more effective, faster and cheaper than working with large amounts of money. Therefore, today 98% of all payments are carried out through the banking system, on a non-cash basis.

Reflection of the cashless system in accounting

For analysis, planning, accounting, and transfer of non-cash payments, the enterprise opens a synthetic balance sheet 51. It is active, which means that incoming funds are reflected in debit, and the expenditure of financial resources is reflected in credit. 51 accounts were created to account for the most mobile of the company's assets - non-cash funds. It is reflected in the balance sheet in a generalized form; the balance is determined daily for the prompt management of finances. Analytical accounting is carried out for each item of receipt and expense separately. An organization can simultaneously open the required number of accounts in one or more credit institutions. Regardless of their number, all information on non-cash transactions is summarized and posted to 51 accounts. The balance (remainder) is formed according to the formula: balance at the beginning + turnover on the debit of the account - turnover on the loan. The result obtained is the amount of funds available (currently). It is applied to account 51 as the opening debit balance for the next period.

Types of non-cash payments

All settlement and payment transactions are carried out by the bank with which the organization has entered into an agreement for servicing the account. The basis for carrying out operations with the withdrawal or transfer of funds is a written notification of the owner, which is checked for compliance with legal norms and unified forms. The organization that owns the funds chooses the form of non-cash payment independently, based on the contractual obligations of specific counterparties. Most often, the paying company, using the appropriate document, gives the bank an order to withdraw (write off, transfer) non-cash funds from the account in favor of the specified counterparty. Less common are unconditional write-offs, the confirmation of which is not required from the owner of the assets. Cash withdrawals for own needs are carried out by the organization using checks. Bank account holders receive the required check limit based on the application. The sheets filled out and certified with appropriate signatures and seals can also be used for settlements between the account holder company and contractor organizations, suppliers, etc. In this case, the check is issued to the organization or individual(its representative) and is cashed upon presentation at the payer’s bank.

Current account document flow

51 accounts are maintained on the basis of a bank statement. Documents are necessarily attached to it, which serve as instructions for the movement of funds in a specific account of the enterprise. All write-offs and transfers that the owner of the assets made during the statement period are confirmed by a copy of the outgoing payment order or request. The counterfoil of the check serves as justification for the cash withdrawal. The transfer of received amounts from the owner company (delivery of part of the proceeds in cash) is recorded by a bank order. Funds received from buyers and other debtors, within the framework of contractual obligations, are confirmed by a copy of the incoming payment order of the paying organization. All documents for the movement of non-cash money are drawn up in strict accordance with the unified forms and requirements of the bank, certified by the signatures of authorized persons and the seal of the organization.

Debit

The debit of account 51 is a reflection of the receipt of funds. Enrollment comes from the following sources:

- Enterprise cash register (D 51, K 50) - this entry is drawn up when cash from the cash register is credited to the current account.

- Settlements with counterparties (D 51, K 62/60/76) - the account is credited with the amount from buyers, other debtors, and suppliers (return of advance payment, excessively transferred funds, settlements on outstanding claims).

- (D 51, K 66) - the operation is carried out if the received borrowed funds arrive in the current account.

- When making settlements with shareholders and owners (D 51, K 75), the founders' funds are contributed (as working capital or when increasing the authorized capital).

- Settlements with budgets and extra-budgetary organizations (D 51, K 68, 69) - overpaid taxes or amounts of social support for the population (benefits, sick leave, etc.) are listed.

Debit turnover is summed up for the reporting time period and is a generalized indicator of the receipt of funds into the current account of the enterprise. To analyze receipts by item, account analysis is used.

Loan movement

The credit of account 51 is formed from write-off (expense) transactions of non-cash funds of the enterprise. The loan turnover shows the total amount of transfers, write-offs and cash withdrawals deposited into account 51. The loan entries are as follows:

- Cash withdrawal (D 50, K 51) - funds are withdrawn from the current account and received at the enterprise's cash desk (cash out occurs on a limited basis, indicating the item of expense). Most often, organizations use part of the funds when paying wages or for household needs.

- Transfer of non-cash funds (D 51/55, K 51) - this correspondence is carried out when transferring part of the funds to another account or opening special letters of credit intended for settlements with counterparties.

- Payment to suppliers, contractors and other creditors (D 60/62/76, K 51) - transfer of the amount of assets from the current account to counterparties (for goods and services, product returns, etc.).

- Calculations for loans, advances and credits (D 66, K 51) - interest on the use of borrowed funds is transferred or repaid

- Fulfillment of obligations to budgets of various levels and extra-budgetary funds (D 68/69, K 51) - depending on the tax or fund, the corresponding sub-accounts are indicated in correspondence.

- Salary (D 70, K 51) - transferred salary to employees.

- Settlements with founders (D 75, K 51) - based on the results of activities, payments were made to the founders.