What does a promissory note mean or by order? What is a bill of exchange: a detailed description of the types, forms, details and other features of the document. Where are these documents used?

The requirements for bills of exchange are determined by Law No. 48-FZ of March 11, 1997, according to which the bill of exchange must be drawn up only on paper and contain the mandatory details provided for by the Regulations approved by the resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR of August 7, 1937 No. 104/1341.

You can draw up your own bill:

- on a special form;

- in any form in compliance with the necessary details.

Using forms

There are approved bill forms of a single sample:

To draw up a bill of exchange using these forms, simply fill out the necessary document details. The only restriction is that only organizations located on the territory of Russia have the right to use bills of a single sample (clause 7 of the Decree of the Government of the Russian Federation of September 26, 1994 No. 1094).

You can purchase bill forms at territorial treasury branches or through banks (clause 4 of the Decree of the Government of the Russian Federation of September 26, 1994 No. 1094). The Russian Ministry of Finance has established a single price for the sale of forms of promissory notes and bills of exchange throughout Russia - 100 rubles. for one copy (clause 5 of the Decree of the Government of the Russian Federation dated September 26, 1994 No. 1094, order of the Ministry of Finance of Russia dated June 26, 2000 No. 171). However, in practice, the cost of acquiring these documents may exceed the specified amount.

Situation: Is it possible to draw up your own bill of exchange yourself without using a special uniform form? The organization issuing the bill is located in Russia.

Yes, you can.

Forms of promissory notes of a single sample, approved by Decree of the Government of the Russian Federation of September 26, 1994 No. 1094, are of a recommendatory nature (clause 2 of the Information Letter of the Supreme Arbitration Court of the Russian Federation dated July 25, 1997 No. 18). Resolution No. 1094 itself does not establish special requirements for the form of a bill of exchange. The required details of the bill are given in the Regulations approved by the Decree of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

Thus, the organization has the right, but not the obligation, to use bill forms of a single standard in its calculations. If the organization’s own bill of exchange satisfies the requirements of the Regulations approved by the Decree of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341, it can also be used in a bill of exchange transaction (even if its form differs from the form of a bill of exchange of a single sample).

Bill of exchange in any form

In order to issue your own bill of exchange free form , the document must indicate the following mandatory details:

- the name “bill” included in the text of the document itself and expressed in the language in which this document was drawn up;

- a simple and unconditional promise (promissory note) or offer (bill of exchange) to pay a certain amount (bill order);

- name of the payer (only in the bill of exchange);

- payment deadline (for example, upon presentation, in such and such a time from presentation or preparation, on a certain day);

- the place where the payment is to be made;

- the name of the person to whom or on whose order the payment should be made;

- date and place of drawing up the bill;

- the name of the organization (drawer of the bill) issuing the bill, position, surname, first name, patronymic of the person who signs the bill, and his signature.

This procedure is provided for in Articles 1 and 75 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

The following reservations should apply to this list:

- a bill for which the due date is not specified is considered to be payable upon sight;

- in the absence of any indication, the place indicated next to the name of the payer is considered the place of payment and at the same time the place of residence of the payer;

- a bill of exchange that does not indicate the place of its drawing up is considered signed in the place indicated next to the name of the drawer.

This procedure is provided for in Articles 2 and 76 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

Taking into account the specified reservations, a number of bill of exchange details can be considered optional (these include the payment period, the place where the payment must be made, and the place of drawing up the bill). The formality of the bill is manifested in the fact that the absence of at least one of the required details deprives the bill of legal force. Thus, the absence of any of the required bill of exchange details in a document deprives it of the force of a bill of exchange. This follows from the provisions of Articles 2 and 76 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

At the same time, the lack of bill of exchange force in a document does not prevent it from being considered as a debt document of a different legal nature, for example, a promissory note (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 23, 1996 No. 6385/95).

In a bill of exchange that is payable at sight or after a certain time after presentation, the drawer may stipulate that the amount of the bill will be charged interest. The interest rate must be stated on the promissory note. In the absence of such an indication, the condition is considered unwritten, that is, interest is not accrued. This is stated in Articles 5 and 77 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

A bill drawn up independently can be:

- fill out by hand or type;

- issue it in a typographical way by ordering the production of your own form from a printing house.

This is stated in Article 4 of Law No. 48-FZ of March 11, 1997, and Order of the Ministry of Finance of the Russian Federation of February 7, 2003 No. 14n.

Advice: if there is a need to protect a bill from forgery, it is better to use a typographic method of reproducing it. Since in this case the bill of exchange will be produced in accordance with the technical requirements and conditions for the production of security printed products (Order of the Ministry of Finance of the Russian Federation dated February 7, 2003 No. 14n).

Situation: In what language can a bill of exchange issued in Russia be drawn up?

Russian bill of exchange legislation does not establish restrictions regarding the language in which a bill of exchange can be drawn up.

It is acceptable to draw up a bill of exchange in both Russian and foreign languages. The only condition: the name “bill” and the text of this document must be drawn up in the same language. This follows from Articles 1 and 75 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

At the same time, according to the legislation on accounting, documents drawn up on foreign language, must have a line-by-line translation into Russian (clause 9 of the Regulations on Accounting and Reporting). Therefore, translate the text of a bill of exchange issued for settlements in Russia in a foreign language into Russian (on a separate document certified by a translator) (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow District dated October 4, 2005 No. KG-A40/9281-05, dated September 29, 2005 No. KG-A40/9001-05).

Situation: Is it possible to include any conditions in the bill, only after the fulfillment of which the bill obligation can be fulfilled? The organization issues its own bill.

No you can not.

A bill of exchange obligation (bill order) must be unconditional, that is, not related to the occurrence of any event or the fulfillment of any conditions. Otherwise, the bill is invalid. This follows from Articles 1 and 75 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341. For example, it is impossible to provide for the payment of a bill only after any creditor of the organization pays off its debt under the agreement.

A bill of exchange may contain only a monetary obligation; no other obligations may be indicated in the bill of exchange (for example, transfer of goods) (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 9, 1998 No. 7033/97, clause 3 of the Information Letter of the Supreme Arbitration Court of the Russian Federation dated July 25, 1997 No. 18).

Situation: Who should sign their own promissory note issued by the organization?

Legal representative of the drawer.

The bill must be signed by the drawer - these are the requirements of the law (Articles 2 and 76 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341).

Signature on the bill of exchange legal representative organization (a person who has the right to act on behalf of the organization without a power of attorney, for example the general director) (Article 53 of the Civil Code of the Russian Federation, Articles 40 and 42 of the Law of February 8, 1998 No. 14-FZ and Article 69 of the Law of December 26, 1995 . No. 208-FZ).

Situation: Is it necessary to certify the drawer's signature on his own bill with the organization's seal? The drawer of the bill is the organization.

No no need.

In accordance with paragraph 3 of paragraph 1 of Article 160 of the Civil Code of the Russian Federation, sealing refers to additional requirements established by law, other legal acts or agreement of the parties. Bill of exchange legislation does not establish requirements for mandatory affixing of a seal when issuing a bill of exchange by an organization (Article 143.1 of the Civil Code of the Russian Federation, Law of March 11, 1997 No. 48-FZ, Regulations approved by the resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR of August 7, 1937 No. 104/ 1341).

Thus, the absence of a seal on a bill of exchange is not a basis for declaring it invalid (Articles 2 and 76 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341).

At the same time, in practice, drawers certify issued bills with a seal. This does not contradict the rules of bill legislation and increases the information content and reliability of this document. This follows from Article 5 of the Civil Code of the Russian Federation.

Situation: Is it possible to certify your own bill of exchange with a facsimile signature? Is the drawer of the bill an organization?

No you can not.

A bill of exchange is recognized as having been drawn up in violation of the form if there is no handwritten signature of the drawer on it (clause 1 of the Information Letter of the Supreme Arbitration Court of the Russian Federation dated July 25, 1997 No. 18). It is explained this way.

The bill must be signed by the drawer (Articles 1 and 75 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341). The absence of any of the required details makes this document not have the force of a bill of exchange (Articles 2 and 76 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341).

Paragraph 2 of Article 160 of the Civil Code of the Russian Federation allows facsimile reproduction of a signature on the basis of a law, other legal act or agreement of the parties. However, the bill of exchange legislation does not provide for the affixing of the drawer’s signature on the bill using a facsimile (Law of March 11, 1997 No. 48-FZ). And there are no other legal acts that allow the use of facsimiles when signing a bill of exchange.

In this regard, you can only sign the bill with your own hand.

Situation: How to draw up an endorsement (endorsement) on a bill of exchange?

The endorsement on the bill of exchange is drawn up in accordance with Russian legislation on promissory notes and bills of exchange (Law of March 11, 1997 No. 48-FZ, Regulations approved by the resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR of August 7, 1937 No. 104/1341).

A bill of exchange can be transferred to another holder by issuing an endorsement - endorsement. Endorsement written on the reverse side of the bill . Such an inscription can be made by the endorser, that is, the organization or citizen that is the owner of the bill. In this case, the right to perform transactions on the bill of exchange is transferred to another person - the endorser. The endorsement must be unconditional and cannot be partial; it transfers all rights under the bill to the endorsee. A crossed out endorsement is considered unwritten.

There are two types of endorsement:

- blank endorsement - without specifying the person to whom execution should be made (which corresponds to a bill “to bearer”);

- order (nominal) endorsement - indicating the person to whom or whose order the execution should be carried out.

A blank endorsement does not contain an indication of the person in whose favor it is made. It consists only of the signature of the citizen or the signature and seal of the organization (depending on who the endorser is).

The order endorsement must contain:

- the name and bank details of the future owner of the bill, if the rights under the bill are transferred to the organization;

- last name, first name, patronymic, passport data and account information, if the rights under the bill are transferred to the citizen.

A bill of exchange can be transferred by endorsement an unlimited number of times. If the bill states that it cannot be transferred, then any endorsement made has no legal force.

This procedure for issuing an endorsement follows from the provisions of paragraph 3 of Article 146 of the Civil Code of the Russian Federation, Articles 11-16 of the Regulations approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

A bill of exchange is a security that allows deferred payment or unconditional payment for goods or services delivered within a predetermined period. Liquid bills can also be used as a means of payment or collateral.

A bill of exchange is a security that confirms the obligation of the debtor (the drawer) to pay the required amount to the creditor (the holder of the bill) within a specified period after its presentation. The right of claim may pass to third parties without additional conditions and agreements with the drawer.

It was from the bill that all subsequent stocks, futures, options, derivatives and other debt options originated. Their active use as a means of payment and credit led to the adoption in 1930 of the Geneva “Unified Law on Bills of Exchange and Promissory Notes,” which was adopted by most countries as the basis for the creation of internal regulations, for example, the Federal Law of the Russian Federation “On Promissory Notes and Bills of Exchange.”

A number of countries, such as England, the USA, Canada, Australia, are guided in their practice by the English Law of 1882, the main provisions of which coincide with the Geneva Convention. There is also a group of countries that use bill circulation standards separate from the two listed: Egypt, Spain, Taiwan and others.

Like all securities, it is in free circulation, but has its own distinctive features:

- Abstractness− obligations have only a monetary value and are not directly related to specific obligations that preceded its registration.

- Indisputability− the requirements are unconditional for fulfillment in full.

- Solidarity− financial responsibility lies with all persons involved in the execution and circulation of the bill.

- Documentation− exists only in the form of paper forms of strict reporting with several degrees of protection.

Use in commercial practice solves the following main problems:

Types of bills

- Simple. An obligation to pay the required amount within a specified time frame, in favor of the creditor in whose name it is issued. What is a bill of exchange in your own words? It is an analogue of a promissory note;

- Transfer or draft(Italian “tratta” - transfer) - the debtor (drawee) makes a payment in favor of a third party (remitee) on his order or on behalf of the person who issued it (drawee). An analogue of debt transfer under a loan agreement.

- avalized. Additional guarantee of the bank (avalist) for the execution of payments. It can be either simple or translated. Partial avalization of the required amount is allowed.

Required details

The text on the form must contain the following information:

Acceptance

The payer's (acceptor's) agreement to fulfill the requirements of the bill of exchange. This is not required for promissory notes, since in this case the obligation to repay arises and is accepted at the time of presentation.

Transfer of rights

With the help of an inscription on the reverse side of the form or in the absence of space on an additional sheet (allonge), called an endorsement, the current owner (endorser) transfers all rights under it to the new holder (endorse).

The endorsement must be certified personally by the endorser and with a seal if he is a legal entity. He can remove his obligations for acceptance and payment with the phrase “no recourse to me,” which usually leads to a decrease in liquidity during the sale. Partial endorsement is not permitted. If it is necessary to exclude the possibility of the next transfer of rights, the phrase “not by order” is included in the text of the endorsement. In this case, only the sales contract applies.

Endorsement options:

- Named. With full details of the endorser.

- Blank or bearer. In this case, the details of the new holder are indicated by the endorser. After the payment deadline, it automatically turns into a registered one.

- Collection An inscription in favor of the bank, which receives the right to accept or demand payment. The holder receives compensation in the form of the specified amount minus interest (discount) for early repayment;

- Non-negotiable. With the phrase “without recourse to me,” freeing the current owner from acceptances and payments.

- Preferential. Gives the transferee the right to act on behalf of the endorser without ownership of the bill.

- Collateral to secure the loan.

Payment on a bill

The procedure contains:

- presenting the bill for payment within the acceptable time frame; if the maturity date falls on a weekend, payment is made on the first working day;

- immediate payment by the debtor of the amount specified therein, deferment of payment is allowed only in case of force majeure;

- early presentation for payment does not oblige you to make and accept payments before the final repayment date;

- the debtor has the right to pay part of the required amount, about which a corresponding note is made on the form.

Protest bill

A notarized refusal to pay confirms the fact of the emergence of joint and several liability of all persons associated with it. A special register of protests is maintained and it is important to understand that such a bill may be the basis for filing a financial lawsuit.

Dyatlov Sergey Vladimirovich, expert consultant of the Legal Support Department of the company PRAVOVEST

When issuing a bill of exchange, the organization faces a minimum of obstacles and restrictions. Firstly, even an unprofitable company can issue a bill.

Secondly, no permission or license is required. Thirdly, such an operation does not need to be registered anywhere and there is no need to pay a state fee for it. And finally, there is no need to place bills on the stock exchange or resort to the services of a depository.

This is due to the fact that a bill of exchange is not an issue-grade security, so it is used quite widely in commercial circulation. Let's try to figure out how to formalize the issuance of our own bills. Relations related to the circulation of bills of exchange are currently regulated by the Federal Law of March 11, 1997 “On Bills of Exchange and Promissory Note” and Resolution of the Central Executive Committee and Council of People's Commissars of the USSR dated August 7, 1937 N 104/1341 “On the Entry into Force of the Regulations on Transferable and Promissory Notes” bill of exchange." DataAnnex 1 to the Convention constitutes the Uniform Law on Bills of Exchange and Promissory Note, the text of which does not indicate the time or grounds for issuing the bill. Moreover, any question concerning the relations constituting the basis for the issuance of a bill remains outside the scope of the law. These rules apply to both bills of exchange and promissory notes.

Thus, the grounds for issuing a bill of exchange are determined not by special bill legislation, but by the provisions of civil law.

A bill of exchange is a security, that is, a document certifying property rights, the exercise or transfer of which is possible only upon presentation. The Civil Code of the Russian Federation defines one single basis for issuing a bill of exchange - borrowing money.

However, it often happens that banks and other organizations transfer their own bill of exchange to the counterparty on the basis of a purchase and sale agreement. It turns out that the drawer sells his bill to the first bill holder. How legal are such actions?

Since the drawer is not the owner of the bills being issued, he cannot transfer ownership of them, that is, he cannot sell a security that does not yet exist.

Thus, issuing your own promissory note under a purchase and sale agreement is simply an incorrect execution of a cash loan.

Consequently, the provisions of civil law on a loan, and not on purchase and sale, should be applied to the relations of the parties associated with the transaction that served as the basis for the issuance of a bill of exchange. In this regard, when releasing a bill of exchange into circulation by issuing it to the first bill holder and concluding a purchase and sale agreement, the drawer should still reflect this operation in accounting as an operation to obtain a loan.

At the same time, when concluding an agreement for the sale and purchase of one’s own bill of exchange, there is another danger for the drawer - such an agreement may become the basis for additional assessment of income tax, fines and penalties, since the tax authorities may consider the money received for the sold bill of exchange as income from the sale. This position, of course, is unfounded, but is it necessary to take risks in order to later defend your interests in court?

Arbitration practice shows that transactions on the basis of which a bill of exchange was issued or transferred may be declared invalid by a court. Such a decision “does not entail the invalidity of the bill as a security and does not interrupt the series of endorsements, but the result is the application of the general consequences of the invalidity of the transaction directly between its parties.”

Such conclusions are based on the unconditionality (abstractness) of the bill of exchange obligation. It is this distinctive feature of the bill that serves as one of the prerequisites for the stability of bill turnover.

| Possible consequences of issuing a bill of exchange before receiving goods or a loan, if the drawer demands the first bill holder to return his unreasonably issued bill: 1) The first holder of the bill has not yet sold the bill to third parties. In such a situation, the parties, by mutual agreement, can cancel the issuance of the bill of exchange, regardless of whether the supply (loan) agreement will be executed or terminated. 2) The first holder of the bill refuses to return the bill to the drawer, since he has transferred or is going to transfer it to third parties. In this case, the drawer may demand that the first bill holder pay him the funds in payment for which the unfounded bill was issued. If by this time the first bill holder has already fulfilled his obligations under the supply agreement as a supplier (or issued a loan as a lender), then he can offset the presented claim with his counterclaim for payment for the goods supplied or for the repayment of the loan. |

Issuance of a bill of exchange before actual receipt of the loan

A loan agreement is considered concluded only from the moment of transfer of money or other things, but often a bill of exchange is issued by the borrower to the lender in repayment of a loan that has not yet been provided. In this case, the borrower is at great risk, since he has not yet received the loan, and the lender already has the opportunity to transfer the bill to a third party, who will present the bill for payment. This is possible, for example, when a bill of exchange was issued with a payment term upon sight, in such and such a time from presentation, or, if the holder of the bill does not fulfill his obligations to provide a loan or fulfills them untimely, after the maturity of the bill.The lender himself, having presented such a groundless bill for payment, may not receive anything, since the failed borrower (the drawer) has the right to refuse payment on the bill due to the lack of an obligation underlying the issuance of the bill (in this case, a concluded loan agreement).

When registering a relationship with the first bill holder with a purchase and sale agreement with deferred or installment payment or a loan agreement with a deferred provision of the loan, the drawer faces other risks. If the holder of the bill transfers to the maker only part of the money for the bill or only part of the loan, then, referring to the loan agreement that was not actually concluded for the remaining amount, the drawer will not be able to demand the remaining amount from the first holder of the bill, since the bill itself also does not stipulate for what obligations he was issued. In fact, the loan took place only in the part in accordance with which the money was transferred to the drawer.

Issuance of a bill of exchange for payment of future deliveries

Often, as an advance payment for future deliveries, the buyer issues his own promissory note to the supplier as confirmation of the buyer's prepayment obligations. In our opinion, in this case the grounds for issuing the bill also cannot be called impeccable. The rules of Chapter 42 of the Civil Code of the Russian Federation “Loan and Credit” apply to a commercial loan (in this case, an advance), and the loan agreement is considered concluded only from the moment of the actual transfer of property. At the same time, the buyer had not yet received any property on loan at the time the bill was issued.Thus, the buyer (drawer of the bill) bears the same risks as when issuing a bill of exchange on the basis of a purchase and sale agreement with a deferred or installment plan or a loan agreement with a deferred provision of a loan.

As we see, the situation is solvable, but is it worth exposing yourself to unnecessary risks? legal proceedings with counterparties and tax authorities?

Which provides for deferred payment or unconditional payment for purchased goods, work or services within a predetermined period.

A bill of exchange is a security that confirms the obligation of the debtor (the drawer) to pay a specified amount to the creditor (the holder of the bill) within a specified period after presentation of the bill for payment.

In this case, the right of claim may pass to third parties without additional conditions and approvals from the drawer.

The bill of exchange is used as a means of payment and settlement, and is also used as a means of obtaining a loan, which was provided by the seller to the buyer in commodity form in the form of deferred payment.

Therefore, we can say that a bill is a dual market instrument, ensuring obligations on the one hand and repayment of debt on the other.

Functions of a bill

A bill of exchange is an important financial instrument that performs certain functions:

A promissory note is primarily a means of obtaining a loan. Using a bill of exchange, you can pay for purchased goods or services, repay a loan received, or provide a loan. For creditors, the formal and material strictness of the bill, its easy transferability and speed of debt collection are attractive.

Another function of a bill of exchange is the ability to use it as security for transactions. In other words, the holder of a bill of exchange has the right to receive money on a bill of exchange earlier than the deadline established in it in two ways: by discounting the bill of exchange in a bank or by obtaining a loan against the security he has.

The bill serves as a tool for monetary settlements. In addition, it is able to speed up settlements, since before payment the bill passes through several holders, extinguishes their obligations and thereby reduces the need for real money.

Advantages of a bill

Bill transactions are the issuance (receipt) of cash loans.

Enterprises and organizations can carry out such transactions bypassing the banking system with its conditions and mandatory commissions.

In addition, the bill is financially mobile. Being a security, it can always be sold at stock market or deposited in a bank.

Distinctive features of the bill

The distinctive features of the bill are as follows:

Abstractness of the bill. That is, the obligations under the bill have only a monetary value and are not directly related in any way to the specific obligations of the drawer.

Possibility of transfer to third parties without documenting such a transaction;

Indisputability of the bill. That is, the requirements under the bill are unconditional for execution and are implemented in full.

Solidarity bill. That is, liability for the bill is borne by all persons involved in the execution and circulation of the bill.

Documentation of the bill. That is, the bill is drawn up in the form of a strict reporting form in paper form.

In case of failure to pay the debt within the stipulated period, no legal proceedings are required. In this case, it is enough to make a notarial protest.

What problems does the bill solve?

Using a bill of exchange solves the following problems:

creates conditions for unconditional receipt Money for goods supplied, work performed or services provided;

makes it possible to conclude a purchase and sale transaction for goods, works, services without the condition of prepayment;

can be used as an effective means of payment between legal and individuals, for offsetting mutual claims;

may be the object of sale or purchase or be the subject of a pledge.

Types of bills

In practice, the following types of bills are distinguished:

Promissory note. The bill contains an obligation to pay the required amount within a pre-agreed time period and to the creditor in whose name the bill is drawn up. That is, the bill acts as an analogue of a promissory note. We can say that a promissory note is a security that contains an unconditional obligation of the drawer to pay the amount to the holder or his legal successor. The circulation of a promissory note presupposes the presence of two subjects: the drawer and the recipient of the bill (holder of the bill);

A bill of exchange or draft (Italian “tratta” - transfer) bill. Under such a bill of exchange, the debtor (drawee) makes payment in favor of a third party (remitee) on his order or on behalf of the person who issued it (drawee). A bill of exchange is analogous to the transfer of debt under a loan agreement. We can say that a bill of exchange, or draft, is a security that contains a written order from the drawer to the payer to pay a specified amount to the holder or his legal successor within a certain period of time. A bill of exchange binds at least three entities: the drawer, the recipient of the bill and the payer.

Avalized bill. Such a bill provides an additional guarantee from the bank (avalist) for the execution of payments. A bill of exchange can be either simple or transferable.

Thus, bill types valuable papers are divided into promissory notes and transferable bills.

The first type involves the issuance of a loan and the signature of the debtor that he undertakes to return it to the creditor within a clearly established period in a specified place. There are only two parties involved in such a transaction: the drawer and the holder of the bill.

A bill of exchange (draft) is issued and signed exclusively by the creditor. The text of such a document contains an order to the debtor to pay the debt within a specified period, but not to him, but to a third party (the remittor).

Types of bills

In addition to classifying bills by type, they can additionally be divided into forms:

Commercial (commodity) - documents intended to ensure transactions between sellers and buyers.

Financial - allows businesses to obtain loans and credit from other businesses.

Blank documents - documents for trade transactions when the price of a product or service has not yet been established or may change. In this case, the buyer, fully trusting the seller, certifies with his signature the blank form, which will be completed later last.

Friendly bills are bills that are issued only to those who deserve unconditional trust.

Bronze - documents without real security, issued to fictitious persons or enterprises. Such bills are often used simply for bank accounting or to artificially increase the debts of a bankrupt.

Security - bills of exchange issued to secure a loan or credit from a known unreliable borrower. Such a document is usually kept in an escrow account with the debtor and is not intended for circulation. Upon settlement of the loan, the bill is repaid.

Rekta-bill (registered) - a security from which the drawer has taken away its main property: transfer to another person.

Acceptance and

The process of the future payer accepting financial obligations to pay a bill of exchange is called acceptance.

In essence, this is his consent, confirmed by the corresponding signature of the acceptor. Endorsement of a bill is its transfer to a third party.

It can only be applied to promissory notes. An endorsement provides for the presence of an endorsement on the document itself, according to which all rights to it are transferred to another person.

Typically, such an inscription is made on the reverse side of the bill or on a special additional sheet called an allonge.

The person who left his signature on the endorsement and accepted the rights to the financial document is called an endorser.

Aval bills

Aval is a kind of guarantee for a bill. It can be carried out by any person, with the exception of the holder of the bill and the drawer. The person who puts an aval on a document is called an avalist.

What is a bill of exchange as a document?

In accordance with the “Regulations on promissory notes and bills of exchange”, the document must contain:

an appropriate mark indicating that this is a bill of exchange and not some other security;

a bill mark is usually used twice: at the top of the document and in its text, and bill forms without a mark are considered invalid;

a clearly defined amount of money;

payer details (for bills of exchange);

payment deadline (upon presentation, at such and such a time from drawing up, at such and such a time from presentation, on a clearly indicated date and time);

the place where the payment is to be made;

details of the person to whom the payment should be made;

date and place of drawing up the bill;

the handwritten signature of the person issuing the bill.

Required bill of exchange details

The text on the bill of exchange must contain the following information:

Heading: Indicates “Promissory Note” or “Bill of Exchange”;

Order or obligation. In the case of a bill of exchange, the phrase is indicated: “Payment ...<данные организации или физического лица>or his order";

Details for presentation after maturity. The name and address for legal entities, place of residence and personal data for individuals;

Amount to be paid. The amount must be indicated in numbers and in words, which is considered the main one in case of discrepancy with the figure. If there are several amounts, the smaller amount is payable. In this case, no corrections or breakdown of the amount due for payment by terms or parts are allowed.

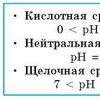

Payment term. Current legislation provides for the following options:

- "on presentation". The bill is payable no later than one year from the date of preparation, unless a different period is specified. In case of delay, the bill becomes invalid.

- "after the end of the period." Payment of a bill must be made within a specified period after presentation. The specified period is the final day not only for payment, but also for protesting.

- "the period after the commencement of action." Payment on the bill must be made after a certain number of days from the date of execution.

- "on a certain day." Payment under the bill is carried out on a specific day specified in the bill.

Place of payment. Unless otherwise agreed, the bill of exchange is presented for payment at the location of the drawer-payer. Multiple locations are not allowed.

Date, address of statement and payment. Multiple locations are not allowed. An unreal date, its absence, or a non-existent address will invalidate the bill.

Signature of the drawer. Signature must be handwritten only. The bill will be invalid without a signature, or if a forgery is detected. For legal entities, it is necessary to put a stamp and certify the bill with two signatures: the signature of the director and the signature of the chief accountant.

Payment on a bill

The bill payment procedure includes the following steps:

presentation of a bill for payment within the acceptable time frame. If the repayment date of the bill falls on a weekend, then payment is made on the first working day;

immediate payment by the debtor of the amount specified in the bill. Deferment of payment is possible only in case of force majeure.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Bill of exchange: details for an accountant

- The organization issues its own bill of exchange and settles it with the supplier: accounting entries

The organization issues its own bill of exchange, then settles the bill with the supplier. The denomination of the promissory note issued by the buyer... transactions? The organization issues its own bill of exchange, then settles the bill with the supplier. The face value of a simple... the obligation to pay upon the maturity of the bill of exchange to the holder of a certain sum of money... provides for the security of the obligation by transferring one's own bill of exchange. To the methods of securing obligations established...

- Flow of money within a group of companies

An unconditional obligation of the person obligated under the bill (drawer or acceptor) to pay... additionally, by the rules on the loan agreement; a bill of exchange is a property that is the subject of transactions... with the issuance of its bills of exchange by the Trading House. OOO Zakup transfers the received bills of exchange to a subsidiary..., whose task is to demonstrate the unique features of the bill of exchange, which effectively solves specific issues. Another... debtor receives a bill of exchange from his debtor. The company transfers this bill to its only...

- Practice of the Supreme Court of the Russian Federation on tax disputes for March 2017

To take into account the results of transactions for the exchange of bills and the variation margin under contracts ... of the Code, we proceeded from the fact that the bills were transferred to the applicant free of charge for the purpose of ..., and the income from the disposal of these bills (the amount of revenue received from the implementation ... of the transaction for the transfer of bills in compensation) is subject to reflection... the property and the issuance of the bill, as well as the transfer of the bill, was a formal cover...

- Developer in a group of companies: taking into account the new rules of the game in shared construction

Securities, including bills of exchange The developer has no right 5: to acquire... securities, including bills of exchange of third parties; issue or issue... (other than shares), including one's own promissory notes. Thus, the developer will not be able to attract... a loan by issuing his own promissory note. Considering that payment of the price by... cannot accept third party bills of exchange from the shareholder in payment...

- Contribution to net assets: how do we use it and what mistakes do we avoid?

If a participant deposits a third party's bill of exchange into the CA? At the first stage... the general rule is that the transaction of contribution of a bill of exchange to the NA is not subject to tax... as is the further transfer by the company of this bill of exchange to a third party for repayment... profit is only the cost of selling the bill of exchange. Another controversial point...

- Guide to tax amendments for medium-sized businesses. Winter 2019

2018. Promissory notes received during liquidation are subject to personal income tax. Now in the code... .2018. With the further sale of promissory notes received during liquidation, income can be... double taxation in the event that a participant receives a bill of exchange (from a third party) from his... pay personal income tax on the value of the bill of exchange received, and then again when...

- Practice of the Supreme Court of the Russian Federation on tax disputes for March 2018

Loan agreements The taxpayer issued his own bills for the amount of the loan and transferred... to the lenders according to acts of acceptance and transfer of bills. At the same time, the disputed companies are... returned to these organizations upon presentation of bills at the time of their repayment by the Taxpayer... . Evidence that the bills issued were actually secured by property...

- Review of letters from the Ministry of Finance of the Russian Federation for June 2019

Property used in business activities, bank bills, income from the sale of this... in the part attributable to payment by bill of exchange, is taken into account by an individual entrepreneur applying a simplified... tax system, on the date of payment of the bill by the bank (day of receipt of funds...

- Practice of the Supreme Court of the Russian Federation on tax disputes for June 2019

Obligations, not the moment of receipt of bills. Conclusions of the courts on determining the moment... according to which a citizen receives a bill of exchange as property that does not have consumer... levying a tax at the time of receipt of the bills of exchange as the taxpayer's income in kind...

- The income tax rate is 0% when carrying out medical and (or) educational activities: there is little time left for its application

In the tax period of transactions with bills of exchange and derivative financial instruments (pp... in the tax period of transactions with bills of exchange and financial instruments of forward transactions... to them, the absence of transactions with bills of exchange and financial instruments of forward transactions...

- Income tax in 2017. Explanations from the Russian Ministry of Finance

... (expenses) in the form of a discount on bills with the clause “at sight...; the estimated maturity of such a bill is used as the maturity date of such a bill, which... is the period from the date of the bill of exchange to the date indicated as “...

- Practice of the Supreme Court of the Russian Federation on tax disputes for May 2017

Received by the Taxpayer through the sale of his own bills of exchange in the audited period to the investor for..., as payment, bills of exchange received by the Cargo company from the taxpayer were transferred... each time these transactions were carried out with bills of exchange, while the counterparties transferred to each other...

The regulatory documents of bill law do not regulate the issue of the procedure for presenting a bill of exchange for payment, therefore, presenting a bill of exchange with a demand for payment often leads to a conflict of interests between the holder of the bill and the payer. The holder of the bill is interested in paying the bill only after the funds arrive in his current account, and the payer, in turn, is interested in making the payment after first withdrawing the presented bill.

According to Art. 815 of the Civil Code of the Russian Federation: “In cases where, in accordance with the agreement of the parties, the borrower issued a bill of exchange certifying an unconditional obligation of the drawer (promissory note) or another payer specified in the bill of exchange (bill of exchange) to pay the borrowed amounts upon the arrival of the period stipulated by the bill of exchange, relations between the parties to a bill of exchange are regulated by the law on bills of exchange and promissory notes.”

Receipt of payment on a bill of exchange can be entrusted to a bank, an independent depositary, or a notary. The bill will be kept in specialized institutions from the moment it is presented for payment until the creditor receives the money, and will be issued to one of the participants - the debtor or the creditor, depending on whether payment is made or not.

When processing bill transactions, organizations draw up the following documents:

In two copies, the purchase and sale agreement of the bill of exchange;

Based on the agreement, a bilateral act of acceptance and transfer of the bill of exchange is concluded;

An application for payment of the bill of exchange in two copies. One copy remains with the payer, the second, with a receipt and seal of the payer, is handed over to the holder of the bill.

An application with a receipt from the payer is evidence that the bill of exchange was presented for payment, but not a fact confirming the payment made.

If the client pays the bank with a bill of exchange for services rendered, then an agreement is concluded with the client to terminate obligations by providing compensation (payment of money, transfer of property, etc.) or novation (exchange) of the bill of exchange.

There are several deadlines for presenting bills of exchange for payment, which must be observed in order not to lose the rights of claim against bill debtors.

A bill with a firmly defined payment period (“on a certain day”, “at such and such a date from drawing up” and “at such and such a time from presentation” with a mark on presentation) must be presented for payment either on the day on which it is due to be paid, or on one of the next two working days. Presentation made at a later date may result in refusal of payment, which will lead to a missed deadline for making a protest, i.e. to the loss by the bill holder of his rights against all persons obligated under the bill, with the exception of the acceptor (in a promissory note - the drawer) (Article 53 and Article 78 of the Regulations on bills of exchange and promissory notes dated August 7, 1937 No. 104/1341, (hereinafter referred to as the Regulations )).

A bill of exchange due at sight must be presented for payment within one year from the date of its execution, unless the drawer has shortened this period or set the period to a longer one.

A bill of exchange with a maturity date of “so-and-so from presentation” must be stamped with a visa - a dated note indicating its first presentation. In a bill of exchange, a dated note of acceptance is considered a visa. The bill must be submitted for endorsement within one year from the date of preparation.

The bill must be transferred to the payer provided:

Payments sum of money cash (the established limit for settlements between legal entities is no more than 100 thousand rubles);

Transfer of a document confirming the fact of irrevocable payment (copies of the payment order with a note from the bank establishment about execution);

Receipt of funds to the current account. This payment option is most appropriate for the bill holder.

According to Article 39 of the Regulations: “When paying a bill of exchange, the payer may demand that it be handed over to him by the holder of the bill with a receipt of payment.” To prevent the situation of repeated payment by the payer of the presented bill of exchange, the holder of the bill issues the payer a receipt (acket) about his obligation personally or through a notary to deliver the bill presented for payment in exchange for a payment document, or the receipt of funds to the current account. When fulfilling the obligation from the receipt, the payer accepting the bill is obliged to return the receipt to the holder of the bill.

If the payer refuses to make payment, the holder of the bill may consider the acceptors as joint and several creditors. When a promissory note or acceptance (agreement to pay) on a bill of exchange is signed by several drawers (acceptors), it is sufficient to submit a demand for payment on one of them. The acceptor who made the payment independently negotiates with the remaining co-debtors, in accordance with the circumstance that served as the basis for them to jointly accept the bill (Article 28, Article 47, Article 49 of the Regulations).

If on the day the bill of exchange is presented for payment, the bearer does not receive evidence of payment, it is necessary to contest the bill with a notary within the next two business days. According to Art. 44. Provisions: “The refusal of acceptance or payment must be certified by an act drawn up in public order (protest of non-acceptance or non-payment).” The holder of the bill is issued a protest act, and a corresponding mark is made on the bill itself.

In case of refusal to pay, the holder of the bill has the right to file a claim against the endorsers, the drawer and other obligated persons when payment becomes due.

It is possible to file a claim before the payment deadline in the following cases:

Refusal to accept;

Insolvency of the payer, in the event of termination of payments by him, even if this circumstance was not established by the court, or in the event of unsuccessful foreclosure on his property;

Insolvency of the drawer on a bill not subject to acceptance (Article 43 of the Regulations).

Read also...

- Tasks for children to find an extra object

- Population of the USSR by year: population censuses and demographic processes All-Union Population Census 1939

- Speech material for automating the sound P in sound combinations -DR-, -TR- in syllables, words, sentences and verses

- The following word games Exercise the fourth extra goal