A program for keeping financial records at home. The best programs for home accounting. Cost accounting. Rubbishmoney

Programs for maintaining, accounting and planning a family budget, are reliable assistants for effective management of the family budget. Why? Because they allow you to automate many processes, which greatly simplifies the process of maintaining home finance.

In addition, this software has a lot of auxiliary functions that allow you to identify weak and strengths your relationship with money will open your eyes to seemingly obvious things, but for some reason not used in everyday life. Programs for maintaining a family budget greatly facilitate and help create a holistic picture of our relationship with finances.

Purpose of the review

- Determine from the variety of specialized software the best price-quality ratio;

- Select the most optimal and easy-to-use program for maintaining a family budget;

- Determine the main characteristics of the proposed programs for maintaining a family budget;

- Identify the simplest and most understandable solutions for beginners, as well as select more serious and complex products for advanced users;

- Determine the degree of convenience in working with each program;

- Select the most pleasant design and management software;

Evaluation criteria

I will evaluate all programs for managing a family budget according to five main criteria:

- Simple and intuitive interface;

- Ease of use;

- Functionality;

- Family budget planning;

- Reports and analysis.

Why exactly according to these criteria? Because these are the cornerstones of any special software for accounting and planning a family budget. Many programs today have much more complex capabilities. But they are needed only if the utility satisfies the criteria listed above.

If the product is difficult to learn or difficult to use on a daily basis, then the user will not need all the bells and whistles that the developers have stuffed into their product.

What programs for managing a family budget will be reviewed?

| NAME | DEVELOPER | WEBSITE |

| Greedy | AmoSoft | http://www.amosoft.net/ |

| Home Finance | Lab-1M | http://www.lab-1m.ru/ |

| Home accounting | Keepsoft | http://www.keepsoft.ru/homebuh.htm |

| Home Economics | AMS Software | http://home-economy.ru/ |

| Family budget | Nemtsev A.S. | http://www.familybudget.ru/ |

| Money Tracker | DominSoft | http://www.dominsoft.ru/ |

| Ace Money | MechCAD | http://www.mechcad.net/index_r.shtml |

| Family 2009 | Sanuel | http://www.sanuel.com/ru/family/ |

Today, these are one of the most popular programs for maintaining a family budget on a computer. I do not take into account online services for keeping track of personal finances online. In the future, I plan to regularly monitor new products and add reviews of them to my blog.

What the review will look like

I decided not to general overview according to all the program, since it will turn out to be too large and inconvenient for perception. Therefore, a separate report will be prepared for each program, with screenshots. In the blog, I will create a special section, which will be called “Software”. In this section, you can familiarize yourself with the list of reviewed programs. There will also be a link to a detailed review of each product and the cost.

The final stage will be the publication of a brief report on all programs, and a table with assessments of the main parameters of the program will be posted. There will also be an overall score below, based on which you can understand which product, in my opinion, deserves the highest ratings.

08.08.18 72 816 145

T-Z Readers' Choice

The first step to financial literacy is to understand where your money goes.

Maria Dolgopolova

analyzed user experience

We've collected apps that our readers use to record spending and plan a budget. Choose.

Monefy

Price: 229 RUR for the full version.

A simple application that allows you to skip the setup step and start tracking your income and expenses immediately after installation. There are two buttons on the main screen - plus and minus - you need to click on one of them, enter the amount and select the desired category. To make your own list of categories and take into account money in different currencies, you need to buy a paid version. Bonus: all data can be protected with a password:

|  |

Max Gerasimenko

I bought a car and went on vacation

“I use Monefy Pro on my phone - it’s very simple, it launches quickly and the data is entered quickly. And on my computer in Excel I create a budget by category for each month. At the end of the month, I copy the data into a table and understand whether I am living within my means. In the past, with a good salary in a year, I didn’t save anything and didn’t really acquire anything, but this practice helped me a lot. I started keeping a budget - I bought a car, paid off a quarter of the mortgage, and went on vacation!”

YNAB

Price:$83.99 per year.

A service with its own budgeting methodology - the creators are confident that accounting for income and expenses should begin with planning. When receiving income, it must be entered into the program and distributed between categories that each user configures manually: how much of this money will go to food, how much to rent, and so on.

During the month, you need to enter expenses and, depending on the circumstances, change the budget, redistributing money between categories if some expenses turned out to be more than planned. To use the program, you must install the desktop version - you won’t be able to limit yourself to the mobile version. But in the program you can

|  |

stopped living paycheck to paycheck

“The main thing this program gives is the idea of living not from paycheck to paycheck, but from the money earned last month. That is, if you follow the “YNAB method”, you automatically have an airbag for one month. Of course, all this long-term planning becomes a little more complicated taking into account inflation (and the authors of the program do not see this problem, since they themselves are from the USA).”

Cost Track

Price: 749 RUR for the full version.

The application allows you to maintain several budgets simultaneously. For example, create separate pages with expenses for weddings and renovations. Expenses for each month are displayed on a pie chart; you can see how much money was spent on each category as a whole or for a certain period. For each expense, you can add a comment, location, photo, and even an audio recording if you want to remember what exactly was purchased, but don’t have time to write:

|  |

Polygraph Sharikov

was ready to pay

“I chose the application for a long time, I was even ready to pay. It was important for me that the application was pleasant to look at, not confusing, and that it was possible to view expenses for different periods in different categories, as well as look at everything together on charts - so that it was visually clear where the most money was spent.

The first months I simply entered all expenses and looked at how much money was actually spent on what. It turned out that any little thing can add up to some fantastic sums of 100-200 RUR. I've been using the app for two years, and it still never ceases to amaze me. I like to meditate on the numbers for the year - I would never have thought that I would take 100,000 R each to the Pyaterochka in the neighboring house. And of course, it’s nice to see how much income is growing - for example, this year we managed to earn a serious amount of money from hack jobs.

Now that I know how much money I'm spending on, it allows me to plan my future budget - I do it separately, just in a spreadsheet. By the way, my budget is planned in more or less detail for a year in advance, and in broad strokes for about another three years. It turned out that planning for a year is very convenient - if you know how much I will earn in 12 months and how much of this money will be spent on everyday life, then it’s clear how many vacations you can afford and how many more large purchases you can plan.”

Visual Budget

Price: 529 RUR for the full version.

A detailed application that allows you to view data in a list, in the form of a pie or line chart. Categories can be grouped: for example, take into account business lunches, takeaway coffee and home products separately, but combine them into the large “Food” category. To make it easier to deal with the intimidating interface, the developers added a Sample Account to the application - it looks as if you were logged into someone else’s account, but it’s clear how it works:

|  |

loves simplicity

“I tried many applications - I couldn’t find anything simpler or more convenient. The interface is simple, but it is very easy to record your income and expenses. You can see in advance how much money is left, how much is missing, and what needs to be reduced in another category. Just like in YNAB, all revenues need to be budgeted, divided into categories. All regular expenses can be set up so that they are paid automatically.”

Personal Finance

Price:

An application that allows you to maintain not only a personal, but also a joint budget - there is a function “Analysis for each family member”. You can create an unlimited number of categories and subcategories and configure automatic downloading of data from bank SMS. The application predicts the approximate budget for next month and the amount of savings:

|  |

Irina Potapova

enters daily expenses into the application

“I don’t pay anything to use the application, I really like it. It is possible to manage a family budget or an individual one. Categories: income, accounts, expenses (plan and actual). I don’t use the function of downloading bank SMS from my phone. Yes, and I don’t track the ruble - the balance can be adjusted. But yes, I make changes every day.”

Money Manager EX

Price: free, only for Android.

A free, open source service that anyone can take part in improving. Thanks to teamwork, the service was translated into 30 languages and an Android application was created. Here you can plan your budget for the month and year, set up automatic entry of regular expenses and make a list of your expense categories:

|  |

Previously, to preserve and increase their capital, people kept records on paper, but today for this there is a program for recording income and expenses, and many such useful applications have been developed, which allows everyone to choose the most suitable option.

Every person, the more he earns, the more he begins to spend money. As a result, all the money goes somewhere. And to avoid this, it is necessary to establish financial discipline. This is why it is so useful to keep constant records of income and expenses.

Today we invite you to familiarize yourself with the most popular and easy-to-use applications that allow you to control your personal finances. Moreover, such programs can be used both to account for the family budget and to control the finances of an enterprise.

Today, more than ever, optimizing family expenses in accordance with the level of personal income, because most people tend to regularly make useless purchases, which as a result leads to a shortage of funds for living.

Accounting for income and expenses is simply necessary for those who wish to invest funds or they are divided into different types. And it is very difficult to do this on paper or in your mind, so it is recommended to use a special application. Through such programs, each individual and family as a whole will have the opportunity to:

- Have a general idea of your own expenses, that is, where the entire budget goes every month.

- See an increase in expenses for a specific group, thereby being able to influence it in a timely manner.

- Reduce the group of expenses, and, perhaps, gradually eliminate some irrational expenses.

- Plan expenses taking into account various influencing factors.

- Follow the balance of income and expenses.

- Calculate deficits and surpluses of a prepared budget for a family or organization.

- Calculating all planned costs will allow you to avoid unplanned and unnecessary purchases. That is, the budget will be rationally distributed over a certain period.

- A program for tracking income and all expenses is a necessary tool to start investing.

Family Pro 11 and Personal Finances - programs for home accounting

Family Pro 11 is not a free program, but you still shouldn’t immediately discard this option and look further for more affordable applications. The fact is that initially you can download a trial version of Family Pro 11 for free on the official website. It is provided for a month so that a person has the opportunity to familiarize himself with all the functions and understand whether this application is suitable for keeping track of his own finances. Convenient and easy to use, and thanks to extensive use, you can easily master the application in a short period.

Family Pro 11 has several useful advantages, namely:

- It allows you to maintain accounts in different currencies, both cash and bank.

- Tracking loan payments.

- Creating goals and planning a family budget.

- Generating reports for a specified period.

- Ability to synchronize with other gadgets.

- Supports operating systems: Windows XP, Windows 7 and 8. There is a version for Android with paid synchronization.

Family Pro 11 is often chosen by users who know how to succinctly manage a budget, since the application contains only the main categories that are presented in the photo.

Another convenient home accounting application is Personal Finances. On the official website you will also find both a free version and a paid version for a long period of use. This program has more opportunities for maintaining family financial records than the previous version.

Electronic book for accounting income and expenses Personal Finances

The main ones include the following:

- User-friendly interface. The program has an additional demo base, thanks to which you can easily and quickly master the application.

- Accounting for income and all family expenses, convenient budget management.

- Tracking bank deposits, paying off loans.

- Family budget planning in different currencies, with exchange rates updated regularly.

- Organization of expenses and income not only in general, but also separately for each family member.

- Possibility of transferring funds from one account to another.

- Debt accounting.

- Creation of reports, and for selected categories or projects.

- Supports operating systems such as: Windows, iOS. The program can be run from a flash drive.

Read also

Ways to earn money on Odnoklassniki

AbilityCash Program Overview

If you need a free program, then AbilityCash will do an excellent job of accounting for finances, not only within the family budget, but also within the organization. Even though the application has many features, it will not take up much space on your computer. AbilityCash is quite simple to use, so you can use it without special knowledge and skills. Even beginners in the matter of financial planning will be able to master and use this program in a short time.

One of the main advantages of the application is the ability to adapt any function. So, for example, you can keep records for each expense item separately, without adding it to the proposed category. AbilityCash, like previous options, can make calculations in any currency. The application also copes well with the task of financial planning, that is, with it you can conveniently accumulate the required amount of money within a given time frame. This program allows you to draw up a plan of monetary income and expenses for any period.

Expense Manager program

The next program, Expense Manager, is designed for operating system Android. Its main advantage is that in addition to accounting for expenses and income, it is capable of performing an in-depth analysis of expenses and purchases for a specific period. The program can also quickly find necessary information and compare data. Expense Manager is the best option for those who want to summarize the past year and plan a budget for the long term.

To protect yourself from major expenses and save up for a small house in a European province, you don’t have to deny yourself everything and sew your savings tightly into your socks. By installing EasyCost, you can achieve more: for example, save for one-room apartment. To do this, you just need to indicate the amount of your income and note your expenses every day. All expenses can be divided into several cards: work, family, travel, and so on. This application is not without its shortcomings and has an extremely high entry barrier for beginners, but if you manage to figure it out, you will get a convenient financial planner.

No registration or Internet access is required to use.

It is possible to select icons for manually created expense categories.

Overloaded, not friendly to beginners and absolutely non-obvious functionality with a bunch of incomprehensible buttons.

Getting to know new functions happens completely by accident, as a result of pixel hunting across the screen. Most of the application's options remain a mystery to us.

A completely unobvious button for adding funds to the budget, hidden in the general list of expenses - look for plastic card with the signature "Salary".

m8 - my money. My way

The main feature of this application is the visualization of expenses in the form of two columns. Having indicated your quarterly income and daily expenses, you will see a scale of expenses in the right column, and the cash balance in the left column. The second feature of the application that the developers are proud of: when you reach a certain threshold of your cash reserves, the smiley face, serenely floating at the top, will gradually begin to become sad until it finally frowns - this will be a signal that it’s time to get off the couch and go earn some more money.

Good visualization of expenses, clearly showing the state of affairs in your wallet.

By clicking on the emoji, you can see how your financial affairs are: very good, good, not bad or bad - the developers call this the current status.

If desired, you can change the emotions of the emoticon and the names of the stages. For example, the emoticon will smile even despite your bankruptcy.

Once you add a new expense line, it automatically joins a cloud of tags that pop up every time you type it. If desired, they can be deleted in the settings.

Expenses can be recorded for the future or after the fact.

The general chart does not display the types of your income and expenses - to access them you need to make one extra move.

Money Care

An application for meticulous accountants and simply big money lovers who are ready, like Scrooge McDuck, to recalculate their income every free minute. If you are not afraid to sacrifice your time and convenience for the sake of accurate expense tracking, then this application will definitely take its rightful place in your phone. For all its unprepossessing and outward unfriendliness, Money Care has rich functionality that allows you to take into account a bunch of different little things: look at graphs of your expenses, divide expenses among several people, and so on.

To prevent your recordings from being lost, the application provides the ability to send a backup copy of the file to email, Dropbox or Google Drive.

A hint system is provided for beginners. But even figuring it out the first time is not so easy.

All transactions can be divided into several accounts. This feature is especially useful for families with a shared budget.

You always have three indicators at your fingertips: receipts, expenses and balance.

All information about your income and expenses can be exported to Excel and sent by mail.

You will be allowed to make no more than 50 entries for free, and for the unlimited version you will have to pay 99 rubles.

The process of adding income and expenses is too complex and long: enter the name of the transaction - confirm, add the amount - confirm, do not forget to assign a category - confirm, and then confirm the entire operation again.

Very small menu elements - to get to the right buttons you need to have very thin fingers.

Daily Budget

The perfect app for consumers suffering from daily shopping syndrome, which is the rest of us. If you want to start saving money for something more meaningful than lunch, this app will help you take control and calculate your daily expenses. To begin the cost containment exercise, you need to enter your monthly income, indicate the amount of standard monthly expenses (for example, utility bills) and indicate the percentage of your total income that you want to save in the piggy bank. After a little thought, the application will give you an amount that you can safely spend during the day.

To prevent you from being fooled, the app provides reminders to enter expenses.

For each expense, you can add a comment that justifies your extravagance.

Moni

The most unpleasant feature of income is that it quickly turns into expenses, threatening to leave you without money at the most inopportune moment. To prevent this from happening so quickly, you can make a vow to yourself to only earn money without buying anything, or you can simply keep track of your expenses. Thanks to Moni, your cash will always be visible to you, all you need to do is meticulously mark each purchase.

If you live among thieves and hypocrites, then the application can be protected with a PIN code. Four identical numbers are not accepted as a precaution.

There are tips for beginners.

There are no fancy icons, colors or other visualizations for different types of expenses.

Looking for free home accounting software? Then you've come to the right place.

Maintaining home accounting is the success of maintaining wealth in the family.

You can control your income and expenses the old fashioned way, i.e. in a notebook, and using modern methods, by installing the appropriate software on a PC.

In particular, we will consider the 5 most convenient and widespread programs for these purposes.

- HomeBank;

- Family Budget Lite;

- Family Accounting;

- CashFly;

- Home Accounting Lite.

HomeBank

A free application that allows you to keep track of your finances.

With the help of software, you can fully control your income and expenses, plan your family budget, analyze expenses and more. Take complete control of your spending.

The program supports tight integration and import of data from Microsoft Money and Quicken services, as well as other applications for managing your own funds.

Supports QIF, QFX, CSV and OFX formats.

The functions include detection of duplicate transactions. This allows you to avoid confusion in calculations and clutter in the database.

Pay attention! Transactions can be organized into categories. You can also schedule the automatic addition of incoming transactions to the created database, adding various tags and more. There is also a function that allows you to edit several fields at once, which significantly speeds up and simplifies the accounting process.

Set annual or monthly budget levels for each category as needed.

Generate dynamic reporting that reflects the current state of your financial situation. If necessary, they can be provided with diagrams for clarity.

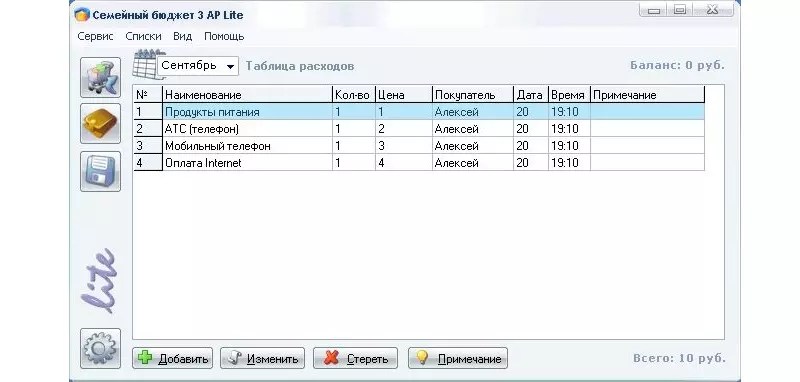

Family Budget Lite

This program is designed to relieve your agony regarding counting personal expenses. All you need to do is enter your own income and expenses in the appropriate columns.

The program will perform all other operations independently.

The client benefits are as follows:

- profitability for several main categories and accounts is taken into account;

- you can account for your own debts, loans, investments, deposits and other calculations;

- you can use the auto-category function, i.e. when entering product names, the program will automatically select the required category from the table;

- detailed report of 8 parts in one click;

- export to HTML, BMP, TXT, Word and . It is also possible to print and save the document.

The client can be used by several people at the same time. In this case, everyone will have their own account and password.

The latter can be installed when the application starts.

Searching for income and expenses is very convenient, since it is possible to customize the results using several filters at once: product, date, category, etc.

Accounting Family

If you don't want to systematically wonder where your money is constantly going, use this program.

You don’t have to speculate and remember where the money went, which was put aside for so long for an important purchase, but at a critical moment it took it and evaporated in the literal sense of the word.

The program will allow you not only to analyze, but also to control revenue. You will also be able to plan your own expenses by thinking through your budget more carefully.

The client has enough options:

- accounting of income and expenses;

- accounting of debts (both borrowed and borrowed);

- analysis of financial transactions;

- Possibility of accounting in different currencies.

You are free to work in the program yourself, or give access to other users. Everyone will log in with their own credentials.

For security, archival copies of the databases are provided, which can be saved for later restoration from the archive or uploaded to Excel/.

CashFly

CashFly is a simple and very user-friendly program for recording personal financial transactions.

You can create multi-level structures displaying income and expense items.

It is also possible to build charts of varying degrees of complexity, based on previously entered data and other financial information that is important to you.

There is an address book, a list of organizations, as well as personal diary, which allows you to record reminders about events that are important to you.

The application is capable of keeping records in almost any given currency, performing scheduled calculation operations and printing data.

Databases are password protected for greater reliability and security of content.

Home Accounting Lite

This application is designed for financial accounting. You can systematize both personal and family expenses.

The program is also perfect for systematizing the profitability of small companies and enterprises.

The software is very easy to use and does not require any accounting knowledge from the end user. You have the opportunity to take into account income, expenses and other transactions.

The number of accounts is unlimited.

Pay attention! You can make your entries in several currencies without being tied to any specific unit of account. If several people use the application at the same time, entries are entered independently, since they are logged in under different accounts.

The program interface is in Russian. It is intuitive even for beginners. It is possible to adjust the interface to the needs of a specific user.

A special help system is provided to resolve questions.

As you can see, home accounting is possible not only on paper.

Now, in order to store several records and not get confused in the calculations, you just need to install one of the applications, create your account and start making calculations, systematizing the total profitability and other financial transactions.

This is much more convenient than spending many hours calculating expenses on a calculator and then filling out tables.

And it is much more difficult to make mistakes in calculations, since the system will warn about possible duplicate data.

The best program for home accounting. Review of home accounting

Top 5 free programs home accounting for every day