How to switch to electronic document management. Electronic document management with counterparties. Choosing a method of working with EDF

Electronic document management (EDF)- a set of automated processes for working with documents submitted in electronic form without the use of paper media.

Electronic documents in approved forms are components of all accounting programs, but in order for an electronic document to be legally recognized, it must be signed with an electronic signature.

Types of electronic documents

An electronic document signed with an electronic signature can be used if the legislation of the Russian Federation does not contain a direct ban on its use.

Thus, contracts, various invoices, applications, reports, applications, as well as delivery notes, acts and invoices can be electronic documents.

Also, electronic documents are divided into informal documents and formalized documents.

Non-formalized documents - letters, contracts, powers of attorney, technical documentation and other correspondence - are free from strict regulation by the state.

For formalized documents in separate legislative acts Strict requirements for the format and regulations of the transmission are prescribed.

A formalized document is a document created according to the Federal Tax Service format.

Formalized documents directly affect the accuracy of tax calculations, so compliance with all transfer procedures is important for them.

Formalized documents are, for example, electronic invoices.

For some primary documents, the Federal Tax Service of Russia has developed a recommended format for a consignment note in the TORG-12 form and an Acceptance Certificate (work) for services.

Despite the fact that the recommended format for such documents is indicated, this is the format in which companies must send these documents electronically at the request of the tax office if it is necessary to confirm income tax expenses.

Electronic document management options

There are two options for organizing an electronic document management system. The first is to conclude an agreement on electronic document management with counterparties and exchange documents signed with an electronic signature via email. In this case, you can use a simple electronic signature.

The second option is to organize electronic document management through a special operator.

With this method, the company joins the regulations for the exchange of electronic documents and can exchange with counterparties both formalized documents (for which the Federal Tax Service of Russia has officially approved the format) and informal ones (contracts, agreements, reconciliation reports, etc.).

Main functions of the electronic document management system

The main functions of the electronic document management system are:

registration of documents;

control over the execution of documents;

creating directories and working with them;

control of the movement of paper and electronic documents, maintaining the history of work with documents;

creating and editing document details;

generation of reports on the document flow of the enterprise;

import documents from the file system and the Internet;

creating a document directly from the system based on a template (direct integration);

working with document versions, complex multi-component and multi-format documents, attachments;

electronic distribution of documents;

working with documents in folders;

receiving documents through scanning and recognition.

reducing costs for accessing information and processing documents.

Advantages of electronic document management

The main advantages of electronic document management include the following:

centralized, structured and systematized storage of documents in an electronic archive;

reducing costs for printing, postage and storage of paper invoices;

a uniform approach to the procedures for generating and processing a document (registration, approval, etc.);

reduction of time for delivery, registration and approval of documents;

speed of signing documents;

the ability to carry out any operations with documents online around the clock: search, download, print, reconcile, reject, as well as track their movement;

quick search for documents.

Confidentiality of the exchange is ensured by document encryption.

An electronic digital signature (EDS) ensures the identification of the signatory and the integrity of the transmitted documents.

Delivery electronic documents guaranteed by the document flow operator.

Implementation of an electronic document management system

To operate an electronic document management system, you must:

develop and approve a procedure for electronic document management;

appoint those responsible for its maintenance;

organize an electronic archive of received and sent documents;

prescribe in the accounting policy the rules for creating, receiving and storing electronic documents, appoint those responsible for the generation and signing of electronic documents.

Each employee who is authorized to sign electronic documents must have an electronic signature.

Having created an electronic document management system, an organization can not print documents, but store them in an electronic archive.

If necessary, documents stored in the archive can be printed for inspectors, and a document signed with the electronic signatures of the parties can be presented, having first properly certified them.

EDI (electronic document management): details for an accountant

- We are entering the era of EDI

Service "1C-EDO". Advantages of “1C-EDO” The “1C-EDO” service is the most profitable... they make single shipments through EDO, the “1C-EDO” service is available without payment. ... EDF participant identifier.” Creating an EDF Settings Profile EDF Settings Profile After creation... proceed to “Configuring an EDF”. EDF settings In the window that opens, you need to... exchange documents via EDF List of EDF settings In the "EDF Settings" sent... regulatory authorities are displayed. EDI Archive Using the EDI system, organizations reduce costs...

- When changing your email address and EDF operator, you need to notify the tax authorities

And there are several agreements with EDF operators, so to communicate with them... . If a company decides to change its EDF operator, as a rule, the electronic one also changes... -6/19884@. Tax authorities must also be notified about the change of EDF operator. In addition...

- 8 arguments for connecting to electronic document management when working with a leasing company

Which is issued by any accredited EDF operator. – There are many operators on the market. ...as originals. The EDI process itself is regulated by laws Russian Federation and... and support of the electronic document management system (EDF) with lessees and is... which is issued by any accredited EDF operator. – There are many operators on the market... a simple procedure. Typically, the EDF operator provides access to Personal Area... In 2018, EDF operator specialists predict an increase in the flow of legally significant...

- Responsibility for late submission of a tax return

Conclude with the electronic document management (EDF) operator an agreement on the provision of services for... providing EDI with the tax authority; or provide... powers for EDF with the Federal Tax Service to an authorized representative (intermediary...) who has an agreement with the EDF operator and a qualified verification key certificate...

- Features of choosing an electronic reporting system

EDI reporting systems are offered by several developers. Every software... ? EDI reporting systems are offered by several developers. Each software... service is offered by more than a hundred EDF operators. Each of them has the status of... solutions focused on different EDI tasks. Regarding the choice of operator...

- What you need to know about electronic signatures before implementing it

On the platform of the electronic document management (EDF) operator, and all actions to use... exchange documents, and which EDF operator is used by most partners in order to maximize... * the number of documents transmitted through the EDF operator to external counterparties. What changes await...

At the end of May 2011, the Ministry of Finance took another step towards the implementation of electronic document management - an order was issued that approved the procedure for issuing and receiving electronic invoices. But in order to get a real economic effect from using paperless technologies, it is important to convert all document flow* into electronic form. The 1C company is ready to provide its users with such opportunities.

Tax Code of the Russian Federation

Art. 169 of the Tax Code of the Russian Federation as amended. Federal Law of July 27, 2010 No. 229-FZ).

Federal Law No. 63-FZ of January 10, 2002 No. 1-FZ

dated 04/25/2011 No. 50n

We are moving towards the exchange of electronic documents with counterparties

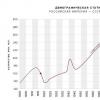

The need to switch to paperless technologies has been brewing in the economy for a long time. The introduction of electronic document exchange with counterparties has a positive economic effect: reducing the costs of organizations for consumables, postal services, maintaining an archive of documents on paper (costs of paper, personnel, renting space for the archive, etc.), reducing time for data processing and exchange, reducing the number of errors, the ability to quickly search the required document in the electronic archive.

Now the state is doing a lot in this direction. In 2002, the Law “On Electronic Digital Signature” was adopted, which established the legal significance of electronic documents signed with an electronic signature. Unfortunately, the provisions of this law did not apply to invoices, about which there was a special provision in the Tax Code of the Russian Federation. This restriction has now been lifted.

Last summer, changes were made to the Tax Code of the Russian Federation providing for the possibility of drawing up and issuing invoices in electronic form with the mutual consent of the parties to the transaction and the availability of technical means and capabilities for receiving and processing such invoices (Article 169 of the Tax Code of the Russian Federation as amended by the Federal Law of July 27, 2010 No. 229-FZ).

On April 6, 2011, the President of the Russian Federation signed Federal Law No. 63-FZ “On Electronic Signatures”. The new law is aimed at eliminating the shortcomings of the current Federal Law of January 10, 2002 No. 1-FZ “On Electronic Digital Signatures,” as well as expanding the scope of use of electronic signatures.

And finally, on May 25, 2011, the order of the Ministry of Finance of Russia dated April 25, 2011 No. 50n “On approval of the Procedure for issuing and receiving invoices in electronic form via telecommunication channels using an electronic digital signature” was registered with the Ministry of Justice of Russia (registration number 20860) .

The Russian Ministry of Justice has registered the procedure for issuing and receiving electronic invoices

The procedure establishes that the issuance and receipt of invoices in electronic form is carried out through one or more electronic document management operators with compatible technical means. Please note that the use of electronic invoices is permitted only by mutual agreement of the parties to the transaction. Thus, the use of electronic documents is a right, not an obligation, of counterparties. The Procedure specifies which day is considered the date of issuance and the date of receipt of electronic invoices, and regulates the procedure for making corrections to them.

The procedure comes into force from the moment of its official publication (clause 2 of the order of the Ministry of Finance of Russia dated April 25, 2011 No. 50n). In fact, it can be used after the appearance of accredited electronic document management operators* and the approval by the Federal Tax Service of Russia of the formats of invoices, a log of received and issued invoices, a purchase book and a sales book in electronic form (paragraph 2 of clause 9 of article 169 of the Tax Code of the Russian Federation) .

Note:

* The procedure for accreditation of companies as electronic document management operators must be approved by the Federal Tax Service of Russia. After accreditation of operators, the corresponding exchange mechanism will be agreed upon with them and then supported in the economic programs of the 1C company.

In the economic programs of the 1C company, the possibility of drawing up and issuing invoices in electronic form will be implemented after the approval of the above documents and formats.

The introduction of electronic invoices served as an incentive for the widest possible use of other accounting, tax and financial accounting documents in electronic form.

Exchange of electronic documents with counterparties in "1C:Enterprise 8"

Already now, the 1C: Trade Management 8 program has implemented the ability to exchange documents, the exchange procedure for which is not regulated by law (for example, invoices, invoices, product catalogs, price lists, orders, including documents in free form). Direct exchange “Seller - Buyer” is possible from the program (via e-mail or a shared file directory on the server).

When developing a mechanism for exchanging electronic documents in 1C:Enterprise 8, the task was to implement a simple setup and exchange mechanism with the most convenient interface. Documents are digitally signed and sent to the recipient with the click of a button. If the participants in the exchange agree among themselves that not all sent documents must be legally significant, then for certain types of documents it is possible not to use an electronic signature.

For ease of use, the system has a built-in hint system (step by step), which informs the user about the following necessary action when working with an electronic document.

For the convenience of users, the program also implements:

- flexible configuration of steps in working with electronic documents in user mode;

- generation of an electronic document in several generally accepted formats specified by the user;

- linking the signature certificate to certain types of signed electronic documents, as well as checking the correctness of the signature certificate when sending or receiving;

- automatic tracking of the current version of the electronic document according to the accounting system document;

- viewing the list of all electronic documents with their brief characteristics in connection with the accounting system document;

- maintaining a detailed log of events on actions with electronic documents;

- viewing the contents of an electronic document on the screen in a printed form familiar to the user, installing a digital signature or sending it to the author of the document for revision, as well as the ability to upload an electronic document with installed digital signatures to a directory on disk;

- comparison of 2 versions of electronic documents.

- a separate ergonomic form for processing electronic documents prepared for signature, broken down by signature certificates of responsible employees of the organization;

- automatic generation of an accounting system document based on the contents of the received electronic document.

In the future, the exchange of electronic documents with counterparties will be implemented in other solutions on the 1C:Enterprise 8 platform.

In conclusion, we note once again that with the introduction of electronic document exchange with counterparties, it becomes possible to improve the level of quality of processing and exchange up-to-date information, reduce the number of errors encountered during “manual” input, as well as reduce the labor intensity and time of document processing.

If a few years ago it could be said that the electronic form of information exchange is of interest to advanced entrepreneurs, today we can confidently say that electronic document flow between organizations is global in nature, and today is the fastest and most productive way of exchanging information.

What is and how does electronic document flow between organizations work?

Electronic document management (EDF) is a way of interaction between counterparties using electronic means of communication, legally established and technically supported modern technologies.

The document flow system between counterparties has gone through many stages, but this format of information transfer began to be actively implemented when extra-budgetary funds and tax authorities set requirements for the generation and provision of reports not only on paper, but also in electronic form.

Over time, the advantages of the electronic method of processing and transmitting information to counterparties were appreciated by users, and document flow in electronic format became comprehensive.

Electronic document flow between organizations: pros and cons

The business world has appreciated the benefits of electronic document management, and today it is used not only to interact with regulatory authorities, but also as a way to exchange business information with business partners, as well as to transfer information within the company.

The advantages of this type of information exchange with counterparties include:

increasing the speed of resolving issues and settlement transactions;

efficiency, ability to control and analyze;

optimization of staff working time;

reduction of costs for document processing work.

However, some disadvantages of EDI cannot be ignored. Basically, they relate to the system - a software product that provides information cycles, which also has its disadvantages. In total, the disadvantages include:

impossibility of making adjustments and additions after sending the document. To correct errors, the user will have to use a more complex procedure - send the corresponding cover letter of notification and a new, corrected document to the counterparty;

The software is not updated automatically - you must purchase additional system updates as they become available.

How the system works

Let's define what electronic document flow between organizations is, how it works and what is necessary for its effective operation.

Currently, electronic document management is a system for working with documents in a “paperless” technology mode, on the basis of which originals are generated directly in electronic form, in a special optional field.

The main element of the system is an electronic document.

To ensure effective system functionality and ensure its viability:

the potential counterparty must also be connected to the electronic document management system;

between the interacting parties, technical readiness must be ensured for the exchange of documents in electronic form;

the parties' actions must be coordinated and interconnected.

For a document created electronically to acquire legal significance, it must:

conform to a specific format;

be certified by the signature of an official or responsible person.

What documents are involved in EDF?

Three types of documents are subject to electronic exchange:

formalized documentation - drawn up in standardized forms regulated by the legislation of the Russian Federation (for example - UPD, invoice, certificate of completion, etc.);

informal documents signed with one signature - the sending counterparty (business correspondence, notifications, cover letters, etc.);

informal documents signed simultaneously by several participants in the system.

How to organize electronic document flow between organizations

To organize the work of EDI and ensure its effectiveness, it is necessary to develop and register all technical nuances in a local regulatory act - a special EDI Regulation.

The EDI system may involve administrative and accounting documents of varying degrees of importance and confidentiality. Taking this into account, in the Regulations, listing the list of documents subject to the electronic circulation system, it is necessary to indicate which of them are certified by a simple and which by an enhanced electronic signature of an official. Also, the Regulations must contain a list of persons authorized to sign documents generated electronically.

After coordination and approval of the Regulations, users of the document management system will need to resolve a number of organizational issues:

select an EDF operator and enter into an agreement with him;

organize an electronic archive - for subsequent storage of received and copies of sent electronic documents;

enter information about the transition to electronic document management in the local normative act– The accounting policies of the enterprise, having issued them as an addition to the document;

provide technical equipment for the operation of the system;

resolve other organizational issues.

What is needed for electronic document flow between organizations

In order to log in as a participant in the EDF system, users must:

connect to the EDF operator;

purchase (or register an existing one in the system) an electronic signature certificate, as well as a cryptographic protection tool;

together with the operator, connect your potential counterparties to your own service;

inform your counterparties about connecting as a participant in the EDI system;

conclude agreements with counterparties on the exchange of documents and information electronically through the EDI system.

Deputy General Director of Taxkom LLC

The vast majority of accountants use specialized computer programs and submit electronic reports to the tax office and funds. So why not communicate “electronically” with your counterparties? Why print out stacks of paper when you can create and store electronic documents? We were told how to do this by a company that provides electronic document management services.

Igor Vladimirovich, please tell us what electronic document management is?

I.V. Murashkintsev: Electronic document management is a way of organizing work with documents, when the bulk of their originals are generated in electronic form, without the use of paper media. Please note that with such document flow, originals are created in electronic form, and not just electronic copies of paper documents. Electronic documents in approved formats can be compiled in most accounting programs. But in order for an electronic document to be legally significant, it must not only comply with approved formats and have mandatory details, but also be signed with an electronic signature.

Having created a document, you can immediately sign it with an electronic signature in many, although not all, accounting programs.

If an electronic document is sent to a counterparty, it must be sent in compliance with the procedure for exchanging electronic documents.

What kind of procedure is this for exchanging electronic documents? Which type of electronic signature should an electronic document be signed?

We thank the chief accountant of LLC “Firm “ANIS-98”” for the proposed topic of interview Olga Vladimirovna Saltykova, Moscow city.

I.V. Murashkintsev: This order will be different for different documents. Electronic invoices have special, more stringent requirements. They must be signed with an enhanced qualified electronic signature and sent through an electronic document management operator Order, approved. By Order of the Ministry of Finance dated April 25, 2011 No. 50n.

An enhanced qualified electronic signature is an analogue of an organization’s seal along with the signature of the responsible person. It is accompanied by a qualified verification key certificate. Only accredited certification centers can issue such electronic signatures Law of April 6, 2011 No. 63-FZ. Documents that were signed with an electronic digital signature under the old EDS Law, which will no longer be valid from July 1 Law of January 10, 2002 No. 1-FZ, are considered to be signed with an enhanced qualified electronic signature.

In certain industries, for example in jewelry production, it is advisable to transfer through an operator not only external, but also some internal documents of the organization. Internal documents usually do not need to be signed with an enhanced qualified signature. At the discretion of the organization itself, a strengthened unqualified or even a simple electronic signature may be sufficient.

Enhanced unqualified signatures are also issued by certification centers, and they can be cheaper than qualified ones. A simple signature is a cipher or password that allows you to identify the creator of the document. You can add such a signature using computer program, and it will require less expense than purchasing an enhanced signature.

External documents, except invoices, can be sent to counterparties by simple email. By agreement of the parties, they can be signed either with an enhanced qualified or enhanced unqualified electronic signature. But using a special electronic document management system is more convenient, as it allows you to instantly receive notification that your partner has received the document. He, in turn, can immediately sign it and send it to you.

What is the best way to start implementing electronic document management?

I.V. Murashkintsev: Typically, companies that have many counterparties and a large volume of external document flow decide to switch to using electronic documents. Since the exchange of electronic documents, in particular invoices, is possible only by mutual agreement of the parties clause 1 art. 169 Tax Code of the Russian Federation, then first you need to discuss the possibility of switching to electronic document management with your regular counterparties. Then you must select an electronic document management operator and enter into an agreement with him. The list of electronic document management operators included in the Trust Network of the Federal Tax Service is posted on Federal Tax Service website .

What criteria should you look for when choosing an operator?

I.V. Murashkintsev: As a rule, electronic document management operators provide the opportunity to exchange electronic documents with several counterparties in test mode. During such “trial operation” you will be able to understand which interface is more convenient for you and whether it will be easy to combine your accounting program with the operator’s document management system.

The more difficult it is to combine an accounting program with an electronic document management system, the higher the cost of implementing the system will be. Please also pay attention to the price of sending electronic documents. Usually shipping costs are the same as in mobile communications: The “caller”, that is, the sender of the electronic document, pays. Electronic documents often need to be sent as a set. In this case, there may be a charge for sending a package of documents, for example an invoice and a certificate of completion of work or an invoice.

Is it necessary to simultaneously enter into an agreement with a certification center - an organization that issues electronic signatures?

I.V. Murashkintsev: This is mandatory for external document flow. The certification center must provide all participants in the document flow with electronic signatures. Companies that submit reports electronically have already concluded such agreements. If you use only internal document flow, then it depends on your desire. Internal documents can be signed with a simple electronic signature, and in this case there is no need to enter into an agreement with a certification authority.

Can counterparties use different electronic document management systems? Or is it possible to receive documents only if your partner sent them through the same operator?

I.V. Murashkintsev: Currently, unfortunately, there is no internal roaming between operators. Therefore, in order to receive documents, you need to connect to the same operator as the company that sends the documents. So if your counterparties work through different operators, in order to exchange documents with counterparties, you will have to enter into an agreement with each of the operators.

We hope that roaming will work within this year and then it will be possible to accept documents sent through other operators.

Is it necessary to separately stipulate the use of an electronic document management system in contracts with counterparties?

I.V. Murashkintsev: No, you don't have to do this. It is enough to exchange regular emails (they do not need to be certified with electronic signatures) or paper letters by fax, where agreement to use electronic documents is confirmed Letter of the Ministry of Finance dated 01.08.2011 No. 03-07-09/26. Or, for example, one of the counterparties can invite another through its operator, as happens when inviting “friends” in in social networks, and the other is to accept this invitation. However, if your counterparty does not want to receive documents electronically, you will have to continue sending them paper documents.

Well, we agreed with our partners, chose an operator or even several operators. What to do next?

I.V. Murashkintsev: Now we need to adapt the company’s business processes to the implementation of electronic document management when working with contractors:

develop and approve a procedure for electronic document management;

appoint those responsible for its maintenance;

organize an electronic archive of received and sent documents;

prescribe in the accounting policy the rules for creating, receiving and storing electronic documents, appoint those responsible for the generation and signing of electronic documents.Each employee who is authorized to sign electronic documents must be provided with an electronic signature, because you cannot transfer your signature to other persons.

Do I need to print and store electronic documents in paper form?

I.V. Murashkintsev: No, it’s not necessary, although many continue to do it the old fashioned way. All sent and received electronic documents are stored in an electronic archive. And your electronic archive should be organized in such a way that, if necessary, for example, at the request of the tax inspectorate, you can quickly find the requested documents and send them to the inspectorate electronically, the same way electronic reporting is now transmitted.

And if the tax office or auditor requests a paper copy of an electronic document, will it be clear that this is a copy of the electronic document and that the electronic document is signed by the parties?

I.V. Murashkintsev: You can print the electronic document and receive a paper copy. This copy will automatically be printed that it is a paper copy of an electronic document and the original was signed electronically by the parties. A paper copy, if it is properly executed, that is, certified by the signature and seal of the organization or notarized, can be used in the same way as a copy of the original paper document.

Can all documents be created electronically?

I.V. Murashkintsev: Documents can be created both in paper and electronic form. If an electronic document is signed with a qualified electronic signature, it is equivalent to a paper document signed by hand clause 5 art. 9 of the Law of December 6, 2011 No. 402-FZ; clause 1 art. 6 of the Law of 04/06/2011 No. 63-FZ. There are electronic formats approved by the Federal Tax Service for the invoice, consignment note TORG-12 and the certificate of completion of work. Other documents can be created in any format, such as text or pdf.

But there is a document that must be drawn up on paper. This is a consignment note. It is not yet possible to provide the ability to read it electronically while traveling.

In addition, documents regulating the relationship between employer and employee, for example, a job application, an employment contract, must also be drawn up in paper form.

What are the requirements for equipment and computers connected to the electronic document management system?

I.V. Murashkintsev: The same as for computers from which electronic reporting is sent to the tax office and other regulatory authorities. Each workplace connected to the electronic document management system must have a stable Internet channel and the Crypto-Pro program or another similar program for working with electronic keys must be installed.

What dangers may arise when creating and sending electronic documents and how to avoid them?

I.V. Murashkintsev: In my opinion, there are no serious dangers. The only thing is that you need to be very careful, do everything on time and not make mistakes in electronic documents, especially invoices. The regulations for issuing and sending invoices are very strict. And to correct the error in the submitted invoice, you must resend the corrected invoice.

But you cannot post a new invoice using a date that has already passed.

Continuous numbering of invoices occurs in the accounting program. It doesn't matter whether you send paper or electronic invoices and whether you use one or more carriers.

What is the approximate cost of sending and receiving an electronic document?

I.V. Murashkintsev: A stable price on the market for these services is only just emerging. Today it can range from 1 to 5 rubles. for sending one electronic document. Some operators additionally charge a subscription fee. Receiving electronic documents is usually free.

In any case, it is cheaper than sending documents by regular mail, especially over long distances. Plus, reducing the cost of printing and storing paper documents.

According to reviews from companies that have begun implementing electronic document management, savings when switching to exchanging documents with counterparties electronically can amount to about 2% of the company’s gross turnover.

If a company is planning to switch to electronic document management, our recommendations will help you create an action plan. They will tell you how to negotiate with contractors, choose a provider and prepare staff for changes in work.

If a company is going to switch to electronic document management (EDF) with counterparties, evaluate in advance what part of the documents will be able to be transmitted electronically. The scale of the project, the work plan for it, labor costs and expenses of the company depend on this.

How to draw up a work plan for the transition to electronic document management with contractors

Divide the work on the company's transition to electronic document management into blocks:

- organizational matters;

- counterparties;

- document flow;

- staff;

- provider;

- budget.

List the tasks to be completed within each block (see.

). Adjust the list if necessary. Let's assume that a company may not need automation: it is convenient to track the status of document registration through the company's accounting system, but if the volume of document flow is not large, then the costs of automation will not pay off.

Decide for yourself in what order to perform the above steps. Some work can be performed simultaneously, for example, developing presentation materials for staff and negotiating with contractors.

How to negotiate with counterparties on the transition to electronic document management

Divide the company's counterparties into four groups. Each group will have to take a special approach in order to agree on the transition to electronic document management. It is possible that not all counterparties will agree, you will have to continue to exchange paper documents with them or terminate cooperation.

Significant counterparties who use electronic document management. Such companies already work with their providers, perhaps not with the organizations with which your company intends to cooperate. You can deal with counterparties from this group as follows:

1. Consider whether it is advisable to enter into an agreement with the provider with whom the buyer (supplier) cooperates.

2. Find out whether there is roaming between your company’s intended provider and the counterparty’s provider.

3. Invite the counterparty to enter into an agreement with the provider chosen by your company.

Significant counterparties who do not use electronic document management. If the buyer (supplier) refuses to use electronic document management, and it is unprofitable for the company to stop cooperating with him, proceed according to one of the scenarios:

1. Use with such a counterparty .

2. Make an appointment and try to convince them to use electronic document management.

Promise that you will be tolerant of possible shortcomings and will help establish electronic document flow in working with your company.

Smallcounterparties who use electronic document management. The same options can be applied to this group of buyers and suppliers as in relation to significant counterparties. But it is advisable to conduct negotiations in the form of correspondence so as not to waste extra time. If an agreement cannot be reached, it may be easier to refuse cooperation.

Smallcounterparties who do not use electronic document management. If the buyer (supplier) is not one of the company’s key partners, try to motivate him to use electronic document management with a provider convenient for you. Options:

1. Announce that, for example, from the beginning of the new quarter, your company accepts and sends documents only in electronic form.

2. Take a commission if the counterparty loses and sent duplicates; fine if he submitted original documents after the deadline. Apply such measures in relation to buyers (suppliers) who do not hand over papers on time.

For small companies that exchange paper documents, it is worth preparing a clear presentation. If counterparties understand the nuances of electronic document management, it will be easier to convince them to change their work procedure. It is hardly possible to meet all the company’s small buyers and suppliers, so the presentation will convince.

How to choose an electronic document management provider

If a company has many counterparties, then most likely it will have to work with several providers. Try to minimize the number of the latter.

Choose providers:

- with whom the company’s counterparties are already working and to whom you can transfer a significant volume of transactions;

- which have maximum roaming;

- which can use the company's signature certificates (if any).

The price factor does not need to be taken into account. If the provider does not have roaming with the providers of your counterparties, it is not suitable, even if its services are cheaper.

How to formalize the company's document flow

Before switching to electronic document management, you need to formalize the movement of company documents. Compose or adjust if necessary:

1. List of documents that the company uses when working with counterparties.

2. Current list of officials involved in document flow. Please indicate who:

- creates a document – uploads it to the provider’s personal account;

- signs the document. These employees will need a login and password to enter their personal account and electronic signature certificates;

- controls the signing of the document by the counterparty;

- prints the document and files it in a folder or saves it on the company server.

This list must be constantly updated. As soon as an employee leaves, his electronic signature must be canceled and issued to the newly appointed person.

Prepare and document in the internal regulations a schedule for the movement of documents from the moment of creation to sending to the archive (see. ).

How to prepare company personnel for the transition to electronic document management

How quickly and successfully the company will switch to , depends on the employees. To prevent them from sabotaging the project, it is important not to force, but to convince them of the benefits of innovation.

A significant cost item when implementing electronic document management is payment for employees’ working time, which they will spend on training to work in new system and resolution of emergency situations. Conduct centralized outreach and training efforts to reduce these costs.

Start explaining and training in advance - when management decided to switch to electronic document management. Organize a presentation explaining the principles of work for all company personnel, including employees who do not participate in electronic document management.

Pay special attention to training signatories. Create clear and detailed instructions for them, preferably with screenshots: which site to go to, what information to enter and where, what buttons to press and at what moment, how to work with the signing certificate.

The following arguments will help convince employees to support the project of introducing electronic document management:

- In terms of the level of responsibility of an official, an electronic signature is no different from a physical one;

- Electronic document management allows you to quickly create and process documents. You don’t have to call and find out when the counterparty will sign and send the required document;

- documents will not be lost. It will be easier to find them.

How to plan the costs of implementing electronic document management

consists of the following parts:

1. The cost of the provider’s services is 10,000–20,000 rubles. per year, depends on tariff plan. Find out the prices and budget for them.

2. The cost of an electronic signature certificate is 1000–2000 rubles. per year, depends on the tariff plan of the certificate manufacturer.

3. Employee salaries - additional payment or cost of the time that staff will spend not on their direct duties. Costs depend on the duration of tasks and the cost of one hour of employee work.

The following types of work will be labor-intensive: meetings and telephone conversations with contractors, preparing presentations and instructions for contractors and employees of your company, training employees, resolving emergency situations (see. ). Plan how long it will take.

Budget not only employee salaries, but also social contributions from them.

4. The cost of automation - depends on the tasks that the company wants to solve, the complexity of their implementation, and the cost of an hour of developer work.

Prepared from materials

Read also...

- Tasks for children to find an extra object

- Population of the USSR by year: population censuses and demographic processes All-Union Population Census 1939

- Speech material for automating the sound P in sound combinations -DR-, -TR- in syllables, words, sentences and verses

- The following word games Exercise the fourth extra goal