How to become a virtual operator. Now every Russian can create his own telecom operator. MVNO - virtual telecom operators in Russia

Virtual operators (Mobile Virtual Network Operators) are actively developing despite the fact that they do not have their own infrastructure. They buy network minutes and gigabytes of traffic from real (basic) operators mobile communications(MNO) and resell them to clients - both private and corporate. What is this - a promising direction, or banal mediation? Let's figure it out together.

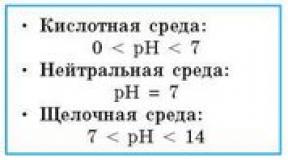

Based on the level of development of their own services, they distinguish between a lightweight (Light MVNO) and a full virtualization model (Full MVNO). The former rent, among other things, traffic routing services, while the latter physically control everything except base stations. There are also intermediate forms of subsidiaries in the form of service providers and resellers. For greater clarity, we presented these differences in the table.

WhyMNOCan’t they themselves sell services to clients directly?

They can and do sell, but MNO always has a reserve of numbering capacity and throughput. Most of the time it remains unclaimed, and when everyone starts congratulating each other at the same time (for example, Happy New Year), the reserve is still not enough. It only helps in situations where there is a small and short-term increase in user activity. The larger the operator, the greater the reserve he has, and it would be nice to transfer this ballast to at least self-sufficiency. Large MNOs (like T-Mobile and Verizon) have been doing this for a long time. They enter into contracts with virtual operators and dynamically offload unused capacity to them at minimum “wholesale” prices.

How can a virtual operator keep tariffs lower than those of a real one?

The virtual operator does not have capital costs for installing base stations, and bureaucratic costs are kept to a minimum. It can use the towers of several operators at once, expanding the coverage area and reducing the cost of forwarding. In addition, it provides subscribers with a favorable offer by simply playing on the difference in tariffs. A virtual operator always buys the services of real ones at several times cheaper than they go to end consumers. MVNOs mainly promote roaming-free tariff plans and the Multi-IMSI function (multiple numbers on one SIM card). Thanks to it, while traveling you can use the Internet and make calls at the rates of your home region.

Aren't base operators afraid of competition?

Abroad, competition is encouraged by the antimonopoly service, as it improves the market. If a backbone provider leases its capacity to virtual operators, then there will be much fewer claims against it from regulatory authorities. At the same time, the emergence of MVNOs in Russia was held back for a long time precisely because of concerns about domestic competition. It can really arise if a virtual operator guessed right with some specific market niche and began to actually take away potential profit from the base one. In such cases, the infrastructure owner may change his mind about reselling traffic and spin off a subsidiary company with similar functions from his structure. However, a subsidiary requires investment. It independently manages the part of the infrastructure and assets allocated to it, issues licenses for the provision of telematics services, radio frequency broadcasting and other permitting documents. Therefore, it is often more profitable to leave everything as is and simply buy an emerging competitor while it is young.

For example, the VEON holding has established several subsidiaries, including Vympel-Communications, which promotes communication services under the Beeline brand. In turn, Beeline provided its capacity to the virtual operator Sim Telecom, which since 2014 has been known under the Sim Sim brand. It has gained popularity among migrant workers thanks to its extensive sales network (about 4,000 points near train stations, markets and other crowded places), low rates for calls to CIS countries and support from call center operators in different languages(including Uzbek and Tajik). Previously, Beeline underestimated this segment, but in 2016 it saw its scale and bought a controlling stake in Sim Telecom. This is exactly the case when a virtual operator helped a real operator develop a new market niche.

How common are virtual operators?

In November 2017, Virgin Mobile launched an MVNO service in Russia. Now the brainchild of Richard Branson is represented in 67 regions, but so far Virgin mobile services are available only to those subscribers who have already connected their home Internet and digital television. The company's main focus is on business clients, including Sberbank, Alfa Bank and M.Video.

On June 1, a new virtual operator began operating in Russia - Easy4. This is the brand of the international company EasyCall, in which private investment funds invested about one billion rubles. The interests of EasyCall in Russia will be represented by Sonet LLC, which already has agreements with MTS and Tele2. The company is also focused primarily on corporate clients. It also has special tariffs for travelers and servicing IoT devices (for example, trackers, mobile terminals and cash registers).

All virtual operators in Russia have difficulties implementing the provisions of the laws from the Yarovaya package. In terms of data storage, it came into force on July 1, 2018. Now operators are required to store recordings of voice calls, text messages and Internet traffic of all users for six months. To fulfill these requirements, backbone providers purchased expensive and specific equipment at their own expense. Does renting infrastructure imply access to it for virtual operators? If so, these are huge security risks. If not, you will have to incur capital costs and lose the benefits of a virtual operator. Should the virtual operator independently provide law enforcement agencies with access to the accumulated data, or can he forward the request to the real operator? There are no clear answers to these questions yet.

conclusions

Virtual operators are gradually increasing their share throughout the world. They are of interest primarily to those subscribers whose needs are very different from the needs of the majority. For example, you often make calls to neighboring countries, use mobile sales equipment, or want to organize your corporate communications. In the USA and Europe, this is a long-tested system for providing communication services. In Russia it also finds its fans, but in general it develops more slowly. This is due to the peculiarities of local laws and reluctance " Big three"(now four) to re-divide the market.

There are a number of trends that could potentially increase demand for MVNOs. This is the development of IoT, corporate networks and mobile payment systems. They generate not so much a lot of traffic (the lion's share of it always comes from video content), but a large number of small transactions. Polls of sensors via the Internet and remote commands, checking versions of files with shared access, regular and push notifications, GPS tracking logs, SMS with confirmation codes - all this is more profitable to transmit according to a specific tariff plan through a virtual network that unites strengths different backbone providers.

How do virtual telecom operators work? Who can make money from new technology? And what risks do classic operators see in creating MVNOs? Pavel Malygin, an expert at Peter-Service, talks about the present and future of MVNO projects around the world.

In 1999, the British regulator OFTEL (The Office of Telecommunications) first proposed using the term MVNO (Mobile Virtual Network Operator). At that time, a virtual operator was understood as a company that offered mobile communications services, but did not have the necessary radio frequency resources. Since then, companies around the world, from banks to logistics corporations, have been creating their own virtual telecom operators.

According to GSMA Intelligence data for 2015, MVNO operators are mainly developed in Europe, Asia and North America.

The global MVNO market will reach more than $75 billion in 2023, according to a new report from Transparency Market Research. The average annual growth rate is estimated at 7.4% during this period from 2015 to 2023. Market growth through 2022, according to Global Market Insights, is also impressive.

Virtual telecom operators - how does it work?

MVNO technology is an easy opportunity for third-party companies to enter the cellular communications market. Banks, industrial corporations, retail, transport and logistics sectors - medium and large businesses have long realized the prospects of MVNO projects.

To create their own virtual operator, companies do not need to obtain communications licenses and build base stations. They rent all the necessary infrastructure in whole or in part from the parent operator - MNO (Mobile Network Operator). MVNOs operate under their own brand and exist only in conjunction with MNOs.

The synergy of the core business with telecom services opens up new business opportunities for companies, reduces communication costs, and ensures customer loyalty. For a parent operator, creating an MVNO allows you to expand your penetration, increase your customer base, obtain additional sources of income from renting infrastructure, promote new services, and much more.

Depending on the volume of infrastructure owned or borrowed from the operator, MVNOs are divided into types. The more infrastructure an MVNO has, the greater the range of services it can provide to its mobile customers.

Reseller MVNO (Reseller)

The simplest MVNO option. Specializes only in sales and marketing of basic operator services under its own brand.

Service Provider MVNO (Service provider)

In addition to sales and marketing, she performs customer service and billing.

Enhanced Service Provider MVNO (Service provider with enhanced capabilities)

Offers additional services, issues its own SIM cards and tariff plans.

Full MVNO

MVNO with maximum infrastructure. In addition to everything, it maintains the network using its own switching center and concludes its own national and international roaming and interoperator agreements.

Typically, MVNO projects are launched by companies that decide to make money in the mobile communications market, or large corporations interested in moving from the client level to the service provider level. MVNOs are also launched by operators expanding their service package with additional mobile offers.

Despite its apparent simplicity, at the stage of creating a virtual operator, companies may encounter a number of problems. Deploying your own MVNO infrastructure requires a high level of technical competence. Poor expertise in the telecommunications field is becoming a problem for many companies. The ideal solution for virtual operators is to use ready-made boxed solutions.

In this situation, the development of independent MVNOs is facilitated by the so-called Mobile Virtual Network Enablers and MVNA aggregators (Mobile Virtual Network Aggregator).

MVNE- These are intermediaries between regular and virtual operators. Enablers take care of all technical issues of the MVNO, and also help reduce the time and costs of putting the MVNO project into operation. MVNEs provide MVNOs with ready-made technical solutions and relieve them of the problems associated with solving non-core problems.

Working together with MVNE helps the virtual operator to focus only on marketing and sales, and outsource the entire technical part to the enabler.

MNO operators are interested in working only with large MVNOs with a large subscriber base. It is very difficult for small MVNOs to enter the cellular services market. In this case, small players are helped by MVNA. They aggregate several small virtual operators and interact with the MNO as one large MVNO.

The general scheme of interaction between MNO and MVNO, MVNE and MVNA may look like this:

MVNO - virtual telecom operators in Europe

There are more than 100 million subscribers of virtual operators in Europe. The popularity of MVNOs in this region is due to the actions of regulators and mobile operators. Regulators are seeking to increase competition and reduce prices for mobile communications, and operators are interested in the efficient use of their radio frequencies.

A quarter of MVNOs in Europe operate as a discounter, providing services on a low-cost model

According to Pyramid Research forecasts for 2015–2020, in Europe the most promising segments for MVNOs will be data-MVNOs, M2M, and ethnic MVNOs. This almost coincides with forecasts for Russia from J’son & Partners Consulting analysts. The most successful will be data-MVNOs ( international roaming), telecom, ethnic, large corporate and M2M/IoT.

MVNO - virtual telecom operators in Russia

According to TMT Consulting, the number of MVNO subscribers in 2015 more than doubled compared to the previous year and amounted to 2.5 million subscribers. J'son & Partners Consulting predicts that the subscriber base will grow to 5 million users by 2020.

Other companies and telecom operators also operate in the Russian virtual operator market.

Since 2014, Gazprom Telecom LLC, together with Peter-Service, has been implementing a project to create a virtual telecom operator. Rostelecom is testing an MVNO operator on the Tele2 network in several regions of Russia - subscribers can already buy SIM cards from the new operator. Sberbank is also working together with Tele-2 on a new MVNO project for its clients. PJSC MegaFon and Mail.Ru Group began a project to create a mobile operator VKMobile in 2016 and plan to launch it by the end of the year.

However, these are isolated projects, and in general the MVNO market in Russia is poorly developed. The model of low-cost operators, popular in Europe, has not taken root. For example, MTS and the Auchan hypermarket chain unsuccessfully tried to develop the A-Mobile project for supermarket customers. The retailer Svyaznoy suspended the virtual operator Svyaznoy Mobile, launched in 2013 on the basis of MTS. And the MVNO project “Alle” from X5 Retail Group closed in 2012, having worked for only two years. Telecom operators themselves have occupied the niche of budget tariffs (Tele2).

According to experts at J`son & Partners Consulting, the main limiting factors for the development of MVNOs in Russia are mobile operators who do not want increased competition and the lack of pressure from regulators.

It is very difficult for independent MVNOs to negotiate with operators on the rental of cellular infrastructure, and for Full MVNOs this also means high capital costs for additional infrastructure.

Height Russian market MVNO is directly related to the development of MVNE based on large cellular operators. Independent MVNEs do not yet exist, just like MVNAs, due to the unresolved conditions of their activities at the legislative level.

Despite the existing problems, virtual operators in Russia have a future. Projects created on the basis of well-known mass market brands with a large customer base will be successful. These are well-known banks, payment systems, providers and large companies. An important factor will be the presence of their own distributed sales network, as well as a developed loyalty program.

Stay in touch!

Because of their smaller size, MVNOs are quicker to adapt to actual customer requirements than their larger telecom infrastructure partners. Virtual operators fill gaps in all market segments, sometimes providing unique services.

In the highly competitive telecom market (there are more than 500 operators in Europe alone) it is not easy to stand out, so there are MVNOs all over the world that are trying to win over customers with unusual promotions. Today we will talk about the most original offers from operators.

Sub-brands

Red Bull Mobile logo

In one of the most unusual technology partnerships, Red Bull has teamed up with Vodafone to launch its own virtual mobile operator. Yes, this is the Red Bull that makes the energy drink of the same name.

Red Bull MOBILE is fully integrated into the parent company's marketing strategy, including the following services: Red Bull branded phones, competitive rates, unlimited access to Red Bull TV and World Red Bull video content, as well as exclusive offers and discounts at all Red Bull events.

Other well-known brands also have experience of similar cooperation. For example, Virgin Group is an international conglomerate of companies founded by billionaire Richard Branson. The Virgin Group is best known for its activities in the field of recording and air travel. At the same time, Virgin Mobile became the world's first virtual mobile cellular operator, which began operating in 1999. It uses the cellular networks of existing operators around the world: in the UK - T-Mobile, in the USA - the CDMA network of Sprint, in Australia it works on the networks of Optus, in Canada - Bell Mobility, in France - Orange, in South Africa - Cell C.

In the US, Virgin Mobile made the unusual decision to become an MVNO aimed only at iPhone users. Virgin has just one plan for this: you get unlimited talk, text and Mobile Internet for 50 dollars a month. However, Virgin is "optimizing" streaming media to make better use of the channel: video resolution is limited to 480p, and any games are limited to 2Mbps.

Free communication

()

When using Karma or Zero Mobile, you still need to make at least one payment to purchase a hotspot. However, there is an operator in the world that actually offers a completely free service - FreedomPop.

FreedomPop gives you 500MB of data, 200 minutes of talk time, and 500 text messages (via Wi-Fi) for free every month. The Overdrive Pro access point supports up to eight devices simultaneously and has an LCD display that provides real-time traffic information. The battery lasts for four hours of operation without a network.

The company provides Internet access at speeds of up to 6 Mbit/s (4G). Data plans above the free limit depend on whether you use one of the FreedomPop phones or connect your own GSM device.

Seamless networks

Google Project Fi logo

Many Wi-Fi hotspot manufacturers promise seamless switching between hotspots, but few can provide a smooth transition between Wi-Fi and GSM. Google's Project Fi virtual carrier combines the connectivity of Wi-Fi networks and the infrastructure of large carriers without dropping your connection as you move from one network to another, even during a call. But that's not the only thing that makes it unique.

At Google Fi, each plan starts at $20 and includes unlimited minutes and text messages. For an additional fee, you will have access to 4G and/or Wi-Fi networks in more than 135 countries around the world. Project Fi also offers group plans that allow you to add other users to your subscription for an additional $15 per month.

But Project Fi has a significant drawback: you can only connect to the carrier with certain phone models - Google Pixel 2, Pixel 2 XL, Moto X4, Google Pixel, Pixel XL, Nexus 5X, Nexus 6P and Nexus 6.

Niche product

With the help of MVNO, any companies and communities have the opportunity to create niche products for a narrow segment of the audience. For example, the Brazilian evangelical church Igreja Sara Nossa Terra created a virtual cellular operator, Mais Parceiros de Deus, for its 1.3 million parishioners. You can connect immediately in the temple.

In Brazil, this is the second operator created by an official religious organization. In 2015, the Worldwide Fellowship of the Assemblies of God launched the operator Mais AD. President Mais AD said that thanks to religious adherence, the operator's customer base has higher average revenue per user and lower churn than the market average.

Rapid Mobil application interface

Satisfying the needs of a narrow market segment is the strategy of many MVNOs. Moreover, the audience can be anyone. Mobile operator Ventocom in Austria has launched a joint project with the Rapid football club. As a result, a virtual operator was created, focused on serving 900 thousand fans. Ventocom offered new customers discounts on season tickets, tickets to matches of their favorite team, as well as roaming packages for away matches.

High competition requires new approaches from business. Eighty percent of ambitious startups in the MVNO market in Europe fail due to a number of factors: insufficient understanding of telecom economics, insufficient number of subscribers, unstable partnerships, lack of planning and management. However, twenty percent of companies are truly leveraging the full potential of this highly adaptable telecommunications model. The most successful MVNO business models combine a well-thought-out management approach, a strategic plan for partnerships with other operators, and precise targeting of the target audience.

", From 2015 to 2017, the number of MVNO subscribers more than doubled: from 2.5 million to 5.8 million customers and amounted to just over 2% of the total subscriber base. And according to forecasts, by the end of 2018, MVNOs will have 7 million connections.

According to experts, this growth is primarily due to the fact that MVNO operators are focusing on overcoming consumer dissatisfaction. This is often the focus of mid-sized and small companies that are flexible enough to provide targeted and relevant offerings to address specific customer needs. This can be not only a competitive price and simplicity of the offer, but also comprehensive customer service for all necessary services.

Thus, MVNOs work with narrow customer niches that are not very interesting to basic mobile operators due to the high cost of acquisition.

In addition, experts note projects when an MVNO is initially created to support a specific business or financial endeavor, be it the banking sector, such as Let's Talk (operator of Sberbank) and Tinkoff Mobile. In this case, MVNO becomes another way to strengthen loyalty and at the same time an additional factor in monetizing the customer base.

Analysts point to ensuring convergence of services as another factor expanding MVNO growth reserves, as the boundaries between fixed-line, broadband and mobile communications become increasingly blurred.

| As we see it, the success of a virtual operator in Russia occurs in at least three cases. The first is when, in the process of developing a business strategy, high hopes are placed on MVNO brand awareness. In Russia, this category includes Sberbank Telecom (the Let's Talk brand) and Tinkoff Mobile. The second is a niche virtual operator aimed at a specific segment, for example, ethnic. And finally, virtual operators relying on VAS services. I’m almost sure that our success as an MVNO is due to the availability of additional services, that is, the creation of actual added value for the subscriber. The combination of fixed, mobile and corporate communications based on the Virtual PBX was implemented as a response to the consumer request of subscribers. For our clients, such synergy translates into convenience and budget savings on telecommunications. |

Market drivers

According to experts, the potential of the MVNO market is high. According to forecasts, by 2022 the share of MVNOs in Russia will increase 7 times – to 14–15%. Despite this, many companies still show restraint in developing this direction, carefully analyzing both the positive experience and unsuccessful experiments of other operators. In addition, factors that can affect the state of the market are studied.

| If we talk about the drivers of the MVNO market, then they include social, political, economic and legal factors. Any changes in legislation in the telecom industry can either “explode” the virtual operator market or lead to its fall. In fact, the existing accelerator of the emergence of virtual mobile operators in our country and the expected market growth with it is the decision of Tele 2 to become an MVNO Factory. The Big Four representative leases its own radio network to more than 15 Russian telecom operators to provide mobile communications services. |

2017: The Ministry of Telecom and Mass Communications optimizes the work of virtual telecom operators

In particular, when connecting virtual communication networks to the communication networks of other operators, the draft order allows the use of elements of communication networks that form connection points of mobile operators. Previously, virtual operators had to build such interconnection points. According to the document, virtual networks can also be organized on professional digital radio networks of the TETRA standard.

According to the department, as of August 2017, Roskomnadzor issued 85 licenses for the provision of communication services under the MVNO model.

The draft order also assumes that orders of the Ministry of Telecom and Mass Communications dated December 29, 2008 No. 116 “On approval of the Requirements for the provision of mobile radiotelephone communication services when using the business model of virtual networks of mobile radiotelephone communications” and dated August 30, 2011 No. 215 “On measures for further implementation business models of virtual networks of mobile radiotelephone communications, in terms of the use of numbering resources,” will be declared invalid.

2015

Despite the rather long period of legalization of the Russian virtual operator market (MVNO), since 2009 it has been characterized by a very weak level of development compared to developed countries, low growth rates and instability, which intensifies during periods of economic instability. Based on the results of the analysis of more than 50 projects (more than 20 operating and in a high degree of readiness for launch), the following trends can be identified:

- the largest and most dynamic projects are developed within one group of companies, which includes the host operator (Yota - MegaFon, MGTS - MTS, etc.);

- a significant part of the MVNO market in terms of subscriber base is accounted for by Yota, this is the fastest growing virtual operator project based on the results of 2015;

- there are a large number of resellers on the market operating under an agency scheme - they do not require a license or numbering capacity;

- from 2013 to January 2016, there was a reduction in the number of MVNO licensees.

The main prospects for the development of the MVNO market in Russia are associated with the development of projects in the field of B2B and B2G, as well as with such areas as M2M and the Internet of Things (IoT). In particular, there is a trend of increasing activity on the part of telecom operators subordinate to large holdings (Gazprom, Transneft) towards launching their own full-cycle MVNOs with the prospect of servicing company employees and members of their families, as well as for use in industry technological processes within the framework of the concept M2M/IoT (data from J'son & Partners Consulting).

According to J"son & Partners Consulting, by the end of 2015 there were about 2.2 million MVNO subscribers in Russia, which is no more than 1% of the number of active mobile SIM cards. This figure approximately corresponds to the level of developing countries in Latin America and of Eastern Europe and indicates that the MVNO market in Russia is still in its most early stage of its development. According to J’son & Partners Consulting forecasts (base scenario), the share of MVNOs will be about 2% (5 million) by 2020.

The main limiting factors for the development of the MVNO market are associated with the disinterest of large cellular operators (the Big Three) in increasing competition in the virtual absence of regulatory pressure. As a result, it is difficult and most often simply impossible for potential independent MVNOs in Russia to come to an agreement with cellular operators on the provision of cellular infrastructure for rent. Another obstacle is the unpreparedness of the regulatory framework. In particular, the legislation does not define the conditions for the activities of MVNAs - aggregators that could act as intermediaries for small virtual operators in commercial agreements with mobile operators in order to obtain more favorable conditions due to economies of scale. For large Full MVNOs, development is constrained by the need for high capital costs and the complexity of implementing an infrastructure sharing model.

An analysis of existing MVNO projects in Russia at different stages of implementation, planned, closed and “frozen” projects showed that the most “viable” MVNOs are projects launched by telecommunications companies within groups of companies (MTS, MegaFon).

The largest MVNO in Russia is Yota with a subscriber base of about 1.7 million at the end of 2015 and a market share of 78% in terms of the number of subscribers. To others large projects include Allo Incognito, MGTS, SIM-SIM, Matrix Mobile and Aiva Mobile:

A characteristic feature of the Russian MVNO market from the point of view of the target audience is the absence of discount operators (the niche is occupied by Tele2) and niche MVNOs targeted at various social and age groups (the niche is occupied by cellular operators).

2014

Mikhail Bykovsky, Deputy Director of the Department for Regulation of Radio Frequencies and Communication Networks of the Ministry of Telecom and Mass Communications, explained in May 2014 that virtual operators, depending on the scale and class of tasks assigned, implement different business models on the market. If a company itself organizes marketing and sales, carries out billing and tariffication, direct service and support for subscribers, independently provides them with services, is responsible for inter-operator interaction and traffic management, but does not have its own cellular network (base stations and corresponding frequency resource), then this company is a full-fledged virtual operator, and its business model is called Full MVNO. If traffic management and inter-operator interaction are excluded from the listed set of functions, then this is already a lightweight virtual operator business model, or Light MVNO. Two other models, where the operator functionality is even less, are called Second Brand and Branded Reseller.

2013

“Even taking into account MVNOs affiliated with host operators and sub-brands of mobile operators, the subscriber base of virtual operators in Russia does not exceed 1% of the number of active SIM cards. The MVNO market in Russia is still in the very early stages of its development,” said Evgeniy Vasiliev, CEO of the company “

The article will discuss virtual cellular operators that have become popular in the territory Russian Federation. There are quite a few of them; only the most famous and beneficial for subscribers are described here. Most of them have appeared in this area recently, but have already managed to gather their users. Each operator is trying to reduce prices to optimal levels in order to reduce the outflow of consumers.

"Er Telecom"

Since recently (2016), Dom.ru can already be considered a virtual operator. At the moment, it is allowed to purchase SIM cards under the Er Telecom brand. In March, communication was available only to those living in Kirov. By the end of the year, the service was activated throughout Russia. Works on the basis of the Tele2 operator.

For now, purchasing a SIM card is only possible on top of other services provided. We are talking about the Internet, telephony and television. The cost of using the card is 250 rubles/month. There will also be a monthly fee for basic package: 300 min. online, 6 GB of Internet and 300 messages. Local calls cost 0.9 rubles. per minute, to other regions of the Russian Federation - 8 rubles, SMS will cost 2.5 rubles. If the entire available limit on the network has been exhausted, then the communication user will pay 2 rubles for each minute.

By the end of the year, Er Telecom had implemented the network throughout the country. The operator’s goal is to protect itself as much as possible from user churn by providing the entire communications package at a low cost.

If we take into account the minimum prices in the tariffs of this operator, then we can safely say that the offer is “average”. For example, similar services are provided by MegaFon and Beeline, where they cost much less.

Rostelecom

As you know, until 2014, Rostelecom provided mobile communication services to residents of Russia. In the third quarter of 2016, the company entered into an agreement with Tele2. After that, at the federal level, she began working with the services of a virtual mobile operator. During the planning of the operating system, a representative of Rostelecom said that the emphasis would be on 4Play, or more precisely on the tariffs that work within its framework.

The total amount of the contract is 330.4 million rubles. This cost is calculated including VAT. What calculations will be made depends on the volume of use of the full range of services. The contract is valid for one year or until the entire funds limit is exhausted.

Those areas served by Tele2 will also be able to use the services of MVNO Rostelecom. But there is a possibility that some special agreements will be added. A little earlier, before the launch of the main network, the company conducted a trial project of a virtual operator in the Urals. Representatives of Rostelecom are completely satisfied with the results that the pilot program offers. Before the launch of the virtual operator, the company said that all services would be connected to 4Play in some way. Rostelecom is not going to promote other MVNO communication options.

The announcement of the completed project between the two companies took place in 2015. Even then, work on the technical and commercial parts of the project was almost completed.

It should be noted that the alliance between Rostelecom and Tele2 is not the first. In 2014, the described representative, based on the second one, provided various mobile network services that operated in the Urals and Perm region. They could only be used

"Matrix"

Based on Megafon, Matrix Telecom launched a virtual network in Russia in 2003.

The representative was founded in 1998. Even then it provided international and long-distance communications. In 2000, signal technologies were updated, and three years later the company signed an agreement with Sonic Duo, better known as MegaFon. As a result of this agreement, the brand provided its first proprietary “Unlimited” tariff. This was the beginning of working as a virtual operator. As of 2008, the network was used by about 155 thousand people. The most active of them are 75 thousand residents.

The Matrix Telecom company is expanding the area of providing its services. She is constantly working to integrate options beyond the nation's capital. To achieve this, she fruitfully cooperates with the North-West branch of her partner. This makes it possible to believe that soon a connection will appear there too.

"Skylink"

Skylink (Moscow) was created in 2003 in order to strengthen the work of regional network operators operating on NMT-450 technology. Thanks to the introduction of the special EV-DO standard in 2005, operators providing services based on the company were able to improve the speed of the Internet provided.

Skylink makes it possible to communicate with various 30 regions of the state. In addition, there are services that allow you to interact with subscribers located in Latvia, Belarus and Transnistria.

"Central Telegram"

The virtual mobile operator “Central Telegram” operates on the basis of the Skylink company (Moscow). He started his activities in 2013. Coverage is available only in the Moscow region. There is quite a lot of competition in this area, so the operator has taken care of the quality of its services and also reduced prices to optimal levels. Representatives have repeatedly stated that they want to make the options universal so that the user can use them as conveniently as possible. We are talking about, for example, forwarding calls to a specific number, creating a single and main account.

"Plus one"

In 2011, the virtual operator “Plus One” was launched on the basis of Skylink. Its peculiarity lies in the fact that this is one of the projects of the already well-known Rostelecom.

Services are broadband. The emphasis is on Internet access. The company gives preference to the combination of 3G coverage in Moscow and the region, remote work with various applications and information resources.

The main users of virtual operator services are private and legal entities, who need a cheap and reliable base for the use of office and home networks while traveling. Moreover, this company may be of interest to those people who are not satisfied with the options provided by other coverages, or to those who do not have terrestrial communications in their area.

"Hello Incognito"

Another network operating on the basis of Skylink. It also uses MegaFon and Beeline as its basis, like many other virtual cellular operators. She started her work in 2001. Currently, it provides some communication services using its own networks. This virtual operator is considered one of the oldest in Russia. Coverage covers Moscow and its region, St. Petersburg and all other areas located in the North-West region.

The first basic operator was MegaFon, the contract was concluded in 2003. The second was Skylink, with which the company began cooperating in 2008. The last was Beeline. The contract was concluded in 2011.

"People's mobile phone"

This virtual cellular operator received a license back in 2009. But services are still not provided. There is no information why this happened. Let's look at what operating principles the company set for itself.

Initially it was planned that the operator would operate in Moscow, St. Petersburg, Nizhny Novgorod, Samara, Kemerovo and Rostov. Operation is provided by Tele2.

The main feature of the company is the refusal to use towers that would guarantee coverage. They receive all this for work from basic telecom operators. The company managed to conduct network quality testing, the results of which it was pleased with. It is unknown when exactly the connection will be available to residents of Russia.

"Atlas"

Atlas is a virtual operator operating on the basis of the Beeline company. The activity began in the late summer of 2016. Available in Moscow and the region. The operator is free and is a project from the Russian Ventures organization. Its goal is considered to be the task of “covering” with communications not only the Russian Federation, but also other countries of the Commonwealth of States over the next three years.

If a person constantly uses the services of this operator, then every month the company provides him with one of the free tariff plans. There are only five of them, designed for communication, visiting Internet resources, watching movies, and so on. The size of the gift depends on the frequency of use of the application. If you wish, you can purchase any tariff yourself. The operator emphasizes that it does not matter to him whether the user pays. If you don’t have enough traffic, you can always buy more for it. It is earned within the application. The utility allows you to quickly and instantly find and purchase some equipment or other goods. For this, the user will receive virtual money.

The main tariff, which is responsible for conversations on the network, is made in such a way that a person does not pay money for the connection. There is no subscription fee. Moreover, there are no randomly connected services or similar tricks that many mobile network operators resort to. A consumer who uses Atlas for communication will never be able to “go into the red.” This is impossible.

Unfortunately, the Atlas virtual cellular operator does not provide an international connection. According to a statement from the representative, it will appear as soon as the company can make the service as inexpensive and high-quality as possible. Communications throughout Russia are charged the same, so you can safely call to the other side of the state.

SIM cards are issued in limited quantities. They provide the opportunity to take advantage of good and high-quality operator services.

"Quince-mobil"

Another virtual operator is Aiva-Mobile, operating on the Tele2 basis. MTS is also the backbone network. In Russia, this company is considered a leader. The launch took place in 2014.

The operator guarantees its users the most convenient and favorable conditions for cooperation. He focuses on residents of former countries Soviet Union, especially paying attention to Central Asia. The Russian Federation was not deprived, so coverage is present here too. The first country where communications from this operator appeared was Tajikistan.

Representatives of the company insist that by cooperating with them, the subscriber will receive high-quality, profitable and complete options for using mobile network. The advantages include two numbers associated with one SIM card, each of which is constantly active, the possibility of forwarding, and cheap roaming. Users often connect to this operator.

"Smarts"

Virtual cellular operators operate on the basis of this company. Let's take a quick look at each:

- "Yo". Operates since 2008. Serves seven regions of the Russian Federation. We are talking about Mordovia, Bashkortostan, Tatarstan, Chuvashia, Saratov, Ulyanovsk, Astrakhan. It differs in that it has low prices. If subscribers are on the same tariff, then they can communicate with each other for free. Almost the only operator that operates with a large number of users and is developing.

- "Fly". Operates since 2012. Serves only Tatarstan. Over the course of a year, it acquired about 1 thousand users. Now the operator has been bought out by SMARTS-Kazan, but continues to provide mobile communication services.

- "Euroset". It has been operating since 2007. It functioned only until 2009. This is due to the fact that the operator did not gain success among the residents of Russia. The underlying company stopped servicing after part of the shares were purchased by Vympel.

- "NMT". It has already been discussed earlier. The Roskomnadzor license was issued quite a long time ago. The work never started. The Company makes no guarantee that plans will be carried out or coverage will be provided. Interest from potential users has long faded, so it is unlikely that even after launch the network will achieve commercial success.

MTS

Virtual cellular operators operate on the basis of MTS; it would be useful to briefly consider them:

- "Hello". Work began in 2010. It is a joint product from the chain of stores “Perekrestok”, “Karusel” and so on and the MTS company. It operates with only one tariff, like many other MVNO operators. It allows subscribers to use mobile services for a small fee, moreover, you are allowed to accumulate points and make purchases in the above stores. The project was closed in 2012. Those people who were served in it were transferred to MTS. The tariff and its plan have been preserved.

- "A-Mobile". Operating since 2008. Also a co-product. This time the merger took place with the Auchan hypermarket. Tariffs can only be purchased there. The basic plan is that the subscriber is given 15 minutes a day to talk with an interlocutor using the same services. If the second user is connected to a different tariff, then the cost is generally average for Moscow and the region.

- "Svyaznoy Mobile". Before launching the virtual mobile operator project, a line of tariff plans was released jointly with MTS. In the fall of 2013, coverage was provided in Moscow and the region. A little later, the network became available to all MTS users.