American stock exchange amex. US Stock Exchange - AMEX. American Stock Exchange Milestones

The title of one of the largest regional exchanges in the United States has been held for several years by the American Stock Exchange (AMEX). The exchange has a history of more than 100 years, the year of official creation is 1911. Geographically, AMEX is based in the Big Apple - New York. It all started with the unification of small street vendors into an association called “New York Curb Market”. The name by which we know the American Stock Exchange today was adopted in late 1953.

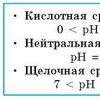

AMEX, after the market crash in 1987, set out to improve itself and changed its trading rules. The most important changes are:

1. Raising the level of exchange margin (exchange margin is the security of the currency that the investor contributes as security for the position).

2. Introduction of a permissible maximum possible when the stock price falls. After reaching given parameter, trading on AMEX will cease automatically. AMEX gained worldwide fame in the mid-nineties of the last century. It was then that an electronic trading system using a “wireless terminal” was introduced. Fundamental changes befell the American Stock Exchange in 1998 - the site was absorbed by the NASDAQ exchange. However, investors made every effort to return the site - after 6 years, in 2004, trading was resumed on AMEX. American Stock Exchange bought out.

AMEX Index

The exchange used the Amex Composite index (after the merger - XAX) reflecting the state of shares and depositary receipts traded on the exchange. There were also Amex Oil Index and Amex Gold BUGS Index, which united, respectively, the securities of oil companies and gold mining corporations.

After the emergence of NASDAQ, the American Stock Exchange is experiencing a crisis - there is a strong outflow of companies. There were difficult times for AMEX for 10 years, after which the site switched to trading derivatives, government bonds and options (as additional areas). According to statistics, up to 10% of securities traded in the United States were traded on the American Stock Exchange. The exchange worked from 9.30 am to 16.00 local time. According to Moscow time, regular trading began at 17.30 and ended exactly at midnight.

After the emergence of NASDAQ, the American Stock Exchange is experiencing a crisis - there is a strong outflow of companies. There were difficult times for AMEX for 10 years, after which the site switched to trading derivatives, government bonds and options (as additional areas). According to statistics, up to 10% of securities traded in the United States were traded on the American Stock Exchange. The exchange worked from 9.30 am to 16.00 local time. According to Moscow time, regular trading began at 17.30 and ended exactly at midnight.

In 2008, the American Stock Exchange experienced a second takeover - the site was purchased by NYSE-Euronext. The corporation paid the shareholders of the American Stock Exchange with its shares (total amount - $260 million). Amex's headquarters, which occupies an entire skyscraper in New York, has been sold. The deal of the century ended the standoff between the Amex and NYSE exchanges.

Why was AMEX sold?

The reason for the merger is very simple - Amex's weakening position. Thus, if earlier shares of world-famous corporations rotated on this platform, then during 2007, mainly securities of medium and small companies were traded here. The sale of the American Stock Exchange to NYSE-Euronext Corporation was approved by the Securities and Exchange Commission, the US Department of Justice, and the shareholders of the American Stock Exchange. On May 10, 2012, the American Stock Exchange finally ceased to exist under its original name, being renamed NYSE MKT LLC.

Stay up to date with all the important events of United Traders - subscribe to our

Which has recently lost its independence and became part of the NYSE Euronext holding. The AMEX stock exchange is located in New York City and, prior to the merger, was on par with the NYSE in terms of the total number of shares in circulation. AMEX carried out the listing of shares of the largest mining, oil and biomedical companies on the trading platform.

Currently, the section, which has now been renamed NYSE MKT LLC, is a platform for the listing and trading of small-cap companies.

History of the AMEX Exchange

Like other exchange platforms, AMEX was initially localized right in the middle of the street, near Exchange Place and Broad Street, which was the financial center of New York. The forefathers of modern stock exchanges did not then have the opportunity to organize an office and therefore gathered on the boulevard and resold shares of oil, metallurgical, mining and railway companies. Subsequently, sellers of processed products, such as kerosene, also joined street trading. To implement their trades, the organizers and participants posted advertisements on concrete pedestals, which later became the basis for the specific name of the exchange.

all US securities traded on AMEX

listed companies

largest US stock exchange

The AMEX was officially founded by Carl Forzheimer and Emmanuel Mendels at the dawn of the Great American Panic of 1907. From that moment on, street vendors received the “rules of the game” and began regulated activities. The organized exchange, in honor of the discoverers, received the name New York Curb Market Agency (Curb by curbstone, which translated from English is a concrete pedestal).

After the end of the First World War, the exchange gained great popularity, and the emerging economic growth contributed to the influx of capital to the exchange platform. In 1921, the organized stock exchange opened its own office, located in Lower Manhattan on Greenwich Street. In 1929 stock Exchange was renamed the New York Curb Exchange (NYCE), which symbolized the abandonment of the marketing agency and a focus exclusively on exchange trading.

At the end of World War II, the economy of the United States experienced a recession for some time, which also affected the activities of the exchange. In 1953, the NYCE exchange was once again restructured and accordingly changed its name to the American Stock Exchange (AMEX), which remained with it for the next 50-plus years.

Over the next few decades, AMEX was successful and the exchange did its business well. Also during this period, there were several high-profile scandals related to trading in unregistered shares, but management managed to avoid significant losses against this background and continue to work. Until 1972, AMEX's business was in full swing and, according to the listing list, the exchange platform was equal to the NYSE.

In 1977, NYSE management proposed buying out the AMEX exchange, but Paul Colton, the head of the American Stock Exchange at that time, opposed such a deal. The management considered its positions to be very stable in the financial market, and the situation with the New York Stock Exchange at that time was not yet so successful. However, the rapid development of the NASDAQ exchange led to a significant outflow of companies and exchange players from AMEX, and over the next 10 years the exchange experienced significant difficulties.

Do you want to make money on shares of super companies such as Google, Apple, MicroSoft, FaceBook? Invest in them with the most reliable stock broker – .

The salvation for AMEX during this difficult period was the introduction of new trading instruments - government bonds and derivatives, as well as admission of foreign companies to listing on the stock exchange. The significant collapse of the stock markets in 1987 led to the fact that AMEX was one of the first to introduce amendments to the functioning of the exchange, which were subsequently adopted by other stock exchanges. The exchange established limits on the maximum increase and maximum decrease in price for one trading section. This made it possible to stabilize the stock market and prevent significant losses for investors. If the critical level was reached, trading was stopped. AMEX also raised the margin level to reduce the burden on the portfolios of investors who purchased shares with all available funds and could lose their entire deposit as a result of another large price fluctuation.

With the advent of computerized technology, AMEX became the first stock exchange to introduce electronic trading systems based on wireless terminals.

However, the thriving NASDAQ exchange was significantly superior to the American Stock Exchange and in the late 90s the NASDAQ exchange bought out AMEX. But a little later, in 2004, AMEX management bought the exchange back and continued working.

At the dawn of the next crisis in 2008, AMEX was unable to stay afloat as an independent exchange platform and therefore was forced to join the New York Stock Exchange NYSE. NYSE Euronext holding completely bought out the American Stock Exchange for 260 million. dollars and renamed the exchange NYSE MKT LLC, but most still call it AMEX.

Current AMEX - NYSE MKT LLC

In 2008, NYSE employees transported all the equipment from the office previously located under the AMEX exchange and installed it at a new address on 11 Wall Street. The modern exchange does not have the significant capitalization it had at the time it was one of the top three (until 2008) and is used only for listing small companies. Subsequently, after the IPO, many companies, taking into account development and expansion, move to the NYSE exchange, so MKT is considered a springboard for the acceleration of small companies. Despite this, very popular indices remained behind AMEX, which are calculated and traded to this day.

AMEX Indices

The main one is AMEX Major Market Index which includes 20 of the largest companies in America. The index was compiled in 1983 and, like Dow Jones, it has a small listing, but the companies included in the index are real monsters of the American economic system: Walt Disney, Boeing, IBM, Du Pont, JPMorgan Chase, Microsoft, Dow Chemical, Hewlett Packard, 3M, Wal-Mart, General Electric, Merck&Co, Coca-Cola, ExxonMobil, Wells Fargo, Chevron, J&J, McDonalds, American Express, Procter&Gamble.

Second popular index AMEX Composite is the weighted average of the sum of the prices of all companies in the listing. The index was renamed NYSE MKT Composite.

In addition, based on AMEX developments, new indices were also formed taking into account the technologies of the new concern:

- Financial Subsector– financial section, which includes such corporations as Tompkins Financial Corporation and SeaBord Corporation.

- Technology Subsector– index of information technology companies (includes Document Security System, eMagin Corporation and others).

- Natural Resources Subsector– an index of companies engaged in the extraction and processing of natural resources, such as the Canadian Bellatrix Exploration LTD or the Canadian subsidiary of ExxonMobile – Imperial Oil Limited.

- Healthcare Subsector– sector of medical device and pharmaceutical manufacturing companies (Protalix Bio Therapeutics and National HealthCare Corporation).

- Industrial Subsector– heavy industry sector (NEWGOLDINC, Grupo Simec, S.A. de C.V, etc.)

Trading on the exchange is conducted through the standardized platforms of NYSE Euronext, at the same time as trading on the New York Stock Exchange - from 9-30 to 16-00 North American time, on weekdays. The average capitalization of AMEX on the NYSE is $1 trillion.

Most of the assets of the AMEX exchange are still functioning today in a new composition. For example, the system for selling futures and options received the new name NYSE Arca.

It is the largest regional exchange in the United States. It is located in New York, and its first appearance dates back to 1911. The creation occurred when street vendors in the Big Apple decided to create a new association and gave it the name "New York Curb Market". She found her real name only in 1953.

When the major market crash occurred in 1987, the AMEX stock exchange sharply tightened its general trading rules. The first change concerned the provisioning tool. This led to a significant increase in the level of exchange margins. In addition, a maximum was established that was allowed. If the limit of this parameter was reached, trading stopped automatically.

AMEX exchange and its worldwide fame

In the 90s, the exchange gained particular popularity. This was due to the fact that then, for the first time in the entire history of the market, “wireless terminals” were introduced. This original system for trading securities electronically became a key aspect.

In 1998, the largest and known as the top three stock market NASDAQ bought AMEX. True, the shareholders of the American stock market AMEX could not just give away the “tidbit.” They fought and gave their best. As it turned out, everything was not in vain, and therefore already in 2004 they resumed trading in securities under their original name. The platform functioned independently until the moment when a historical event occurred - a merger with the NYSE, which is still the best largest American exchange in the entire “great triangle”!

American Stock Exchange today

The current status of all securities, namely shares, on the AMEX exchange is displayed as the Composite Index. Everything related to depositary receipts companies, as well as the current state of shares traded on the stock exchange, are reliably displayed on the charts. Other important indices on the AMEX exchange are the Gold BUGS Index (responsible for companies that trade gold) and the Oil Index (shares of oil companies).

In the 50s, the exchange unwittingly became the main participant in a large number of scandals related to finance. Problems arose when shares of unregistered (“leftist”) companies began to be traded on the stock exchange at non-fixed prices. True, a little later the situation improved and by 1972 AMEX's listing was equal to the New York Stock Exchange - NYSE.

AMEX Stock Exchange – how to trade stocks?

Today, the AMEX exchange is one of the most successful exchange platforms with solid turnover. In order to be able to buy shares on the American site, traders need to contact SDG-Trade. After a significant improvement in the position of the exchange, when shares of foreign companies were allowed to be listed on it, it is easy to make a profit on this trading platform.

To trade shares, register on the SDG-Trade website, after which you will have the opportunity to open a real trading account and trade with the help of specialists. If you are a novice trader, you will be offered to take effective training courses for free, and then practice on a demo account trading platform without financial losses. We wish you success!

The American Stock Exchange is one of the largest regional exchanges operating in the United States of America. Its headquarters are located in New York. Based on the total volume of shares traded and when taking into account their dollar equivalent, AMEX is the second largest stock exchange in the United States.

The American Stock Exchange was founded in 1911. Its organizers were street vendors in New York who decided to unite and create their own association. At different times this exchange had different names. Including, it was called the New York Over-the-Counter Agency (until 1911), the New York Over-the-Counter Market Association (1911-1921), the New York Over-the-Counter Market (1921-1929), the New York Semi-Official Exchange (1929-1953) . In 1953, the New York Stock Exchange received its current name.

In the 1980s, when it was not the best time for any exchange to operate, AMEX moved to increase its exchange margin levels to provide a new guarantee mechanism. In addition, a new maximum limit on the permissible fall in stock prices before stock trading closes was adopted. This step was made in order to save companies from bankruptcy and prevent panic in the market.

At the very beginning of the 1990s, the American Stock Exchange was the first in the world to organize an electronic trading system that involved the use of wireless terminals. This is considered a truly historic event and an invaluable contribution to the exchange industry as a whole, since as a result, the approach to conducting a wide variety of exchange transactions has changed for many years.

In 1998 AMEX was bought out by NASDAQ. However, in 2004, members of the American Stock Exchange bought their platform back, and to this day they remain its shareholders.

The American Stock Exchange trades primarily in the securities of small and medium-sized enterprises, while stocks large companies traded on the New York Stock Exchange. For example, securities of most gas and oil companies are traded on AMEX. It also trades options based on shares traded on the New York Stock Exchange. Some OTC stocks may also be traded on the American Stock Exchange. Within a few recent years AMEX began to actively carry out transactions with a large number of derivative financial instruments, called in general terms derivatives. The American Stock Exchange has more shares of foreign companies traded than any other stock exchange operating in the United States. Trading on AMEX is conducted in a mode similar to NYCE.

Today, the American Stock Exchange is considered one of the most popular in the world, as about 10 percent of all global stock transactions are carried out through it. AMEX listing conditions are quite flexible in comparison with NYCE, which makes it possible for developing companies to actively place their securities on it.

The exchange is open 5 days a week except Saturday and Sunday, from 9:30 to 16:00. Geographically, it is located in the lower part of Manhattan, at 86 Trinity Place.

Official site: www.amex.com

Official website integrated: www.nyse.com/attachment/amex_landing.htm

American Stock Exchange (AMEX) this is one of the largest and most influential exchanges in the United States of America. It was founded in 1911 and is headquartered in New York City.

The main index is: XAX (Amex Composite). It clearly shows the state of shares and other securities that are traded on the stock exchange.

There are also other indices, for example, such as: Amex Gold BUGS Index, which combines shares of gold mining organizations and Amex Oil Index, which includes companies involved in oil production.

The American Stock Exchange ranks second in the United States in terms of the total number of shares traded. The development of the exchange began with street vendors who operated on the streets of New York and later decided to unite and create an organization called “New York Curb Market”. Although the exchange at different periods of its existence always bore different names. And only in 1953 they began to call it exactly the same as to this day.

In the 80s, or more precisely in 1987, there was a collapse financial market and they came very Hard times for the operation of almost all American exchanges. At this time, Amex decided to take a very responsible and serious action. The management decided to change and improve the trading mechanism. Many changes were aimed at ensuring that most companies stood more firmly on their feet, in addition, it was necessary to somehow renew the periodic panic moods of the market.

If we talk in more detail about the changes, they were as follows:

- The level of exchange margin has changed in a positive direction

- We introduced a permissible maximum that is possible when stock prices decline. A certain level was set, upon reaching which, trading stopped automatically

Closer to 1990, a historical event happened on the stock exchange. All exchange trading is now carried out using wireless and electronic terminals. This event brought the exchange to a completely different level and significantly facilitated the process of carrying out transactions.

Closer to 1990, a historical event happened on the stock exchange. All exchange trading is now carried out using wireless and electronic terminals. This event brought the exchange to a completely different level and significantly facilitated the process of carrying out transactions.

It is worth noting that for a long time the exchange was marking time, as most companies began to pull back their assets and leave. One of the main reasons was that already at that time the NASDAQ exchange was gaining momentum in the United States.

It was she who bought AMEX in 1998. But the majority of shareholders of the American stock exchange did not put up with such circumstances and began to take certain actions to correct the situation. Such intervention on the part of shareholders was far from in vain. In 2004, the exchange resumed trading in securities under its original name. It functioned in this way for a relatively short time.

In 2008, another event occurred in the history of the exchange, when it was absorbed for the second time, and this time by the NYSE-Euronext organization, which is considered not only the largest financial platform in the United States, but throughout the world. On May 10, 2012, AMEX was finally renamed NYSE MKT LLC.

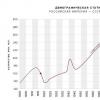

Let's give some more statistics that reflect the operation of the exchange. At the time of 2005, the trading volume on the market was about $600 billion, capitalization in 2006 was about $83 billion, profit in 2004 was $89 billion.

Date of last update of the material: May, 2016

Read also...

- Tasks for children to find an extra object

- Population of the USSR by year: population censuses and demographic processes All-Union Population Census 1939

- Speech material for automating the sound P in sound combinations -DR-, -TR- in syllables, words, sentences and verses

- The following word games Exercise the fourth extra goal